Buying a Singapore Condominium for Sale

Your guide to buying a Singapore condominium for sale. Learn to navigate the market, secure financing, evaluate properties, and close your dream home deal.

So, you're looking for a Singapore condominium for sale. It’s an exciting journey, but it’s also a market with its own unique personality. What you'll find is a landscape shaped by strong local demand and a surprisingly tight supply of unsold homes. This creates a clear split between the bustling suburban neighborhoods and the famously stable prime central districts—a dynamic that offers something for both discerning homeowners and savvy investors.

Getting a Feel for the Singapore Condo Market

Before you even start scrolling through listings, it's wise to get a sense of the bigger picture. The private property scene here isn't one giant, uniform market. Think of it as a collection of micro-markets, each with its own tempo and character. Getting a handle on these nuances is your first real step toward a smart purchase, whether you have your heart set on a luxury gem like UPPERHOUSE at Orchard Boulevard or a family-friendly spot in a quieter neighborhood.

Right now, the market is telling a tale of two very different areas: the prime Core Central Region (CCR) and the rapidly expanding suburban zones. While the CCR—home to prestigious addresses in Orchard and Newton—holds its ground, much of the recent price action has actually been happening in new projects on the city fringe and in the suburbs. This points to a shift in buyer priorities, where value and space are becoming just as important as a prime postcode.

What's Driving Prices?

A few key factors keep the Singapore condo market so consistently strong. For one, there’s a very low level of unsold inventory. Developers here are careful not to overbuild, which naturally supports property values. On top of that, there's a steady stream of local buyers, especially those upgrading from public HDB flats, who keep demand healthy.

These ingredients create a remarkably resilient environment, even when the global economy feels a bit shaky. The numbers back this up. According to the Urban Redevelopment Authority's latest data, private home prices saw a 3.33% year-on-year increase in the first quarter. Interestingly, most of that push came from new condo launches outside the prime districts. You can dig into the historical data yourself and explore detailed Singapore property price history to see these patterns over time.

To give you a clearer snapshot of where things stand, here's a quick look at recent price movements.

Key Singapore Property Market Indicators

This table summarizes the latest shifts in Singapore's private residential market, offering a glimpse into current trends.

| Property Type | Quarter-on-Quarter Change | Year-on-Year Change |

|---|---|---|

| Non-Landed Private Residential | +0.95% | +4.74% |

| Overall Private Residential | +1.05% | +3.33% |

As you can see, while the quarter-on-quarter growth has moderated, the annual gains show that buyer confidence remains solid.

The market's resilience is the real story here. The pace of price growth for non-landed condos has cooled to a 0.95% quarterly increase, but the year-on-year gain is still a very healthy 4.74%. This signals sustained confidence from buyers.

Cracking the Code: CCR, RCR, and OCR

To navigate the market like a local, you need to know the lingo. Real estate in Singapore is broken down into three main regions, and they are worlds apart in terms of character and cost:

- Core Central Region (CCR): This is the crème de la crème. We're talking Districts 9, 10, 11, the Downtown Core, and Sentosa. It’s the epicentre of luxury living, defined by world-class amenities and a global vibe.

- Rest of Central Region (RCR): Think of this as the city fringe, the belt surrounding the CCR. These areas offer fantastic connectivity and a more approachable price point than the prime districts, making them a huge hit with young professionals and families.

- Outside Central Region (OCR): This covers the suburban heartlands where most Singaporeans live. It’s also where some of the most exciting growth has been happening lately, with new launches offering modern living at competitive prices.

Understanding this regional split is crucial when you're searching for a Singapore condominium for sale. A budget that gets you a spacious family home in the OCR might only stretch to a compact one-bedder in the CCR. For a closer look at what's available, you might find our guide on finding the right apartment for sale in Singapore helpful.

This is why you'll hear market analysts forecasting a modest 3-4% price increase for private homes overall. The growth isn't spread evenly; it's concentrated in those well-located suburban projects that really hit the mark for today’s buyers. Keeping this in mind will help you set realistic expectations and focus your search on the areas that truly fit your budget and life.

Getting Your Finances in Order for the Big Purchase

It’s easy to get swept up in the excitement of finding the perfect condo in Singapore. The stunning views, the five-star amenities… but before you let your heart lead the way, it’s time for a frank conversation with your finances.

Putting your financial house in order isn't just a box-ticking exercise; it’s what turns a dream property into a tangible reality. It gives you a rock-solid foundation, so you can move with confidence and purpose.

Let's break down exactly what you need to do, starting with the rules that govern every property loan in Singapore.

Know Your Limits: TDSR and MSR Explained

Before you even start browsing listings, you need to understand two critical lending frameworks in Singapore: the Total Debt Servicing Ratio (TDSR) and the Mortgage Servicing Ratio (MSR). These aren't just banking jargon—they are hard-and-fast rules that determine how much you can actually borrow.

The TDSR is the big one for private property buyers. It’s a straightforward rule from the Monetary Authority of Singapore that says your total monthly debt payments cannot be more than 55% of your gross monthly income. This includes everything: your new mortgage, car loans, personal loans, and even your credit card balances.

If you’re also looking at HDB flats or Executive Condominiums (ECs), there's another layer: the Mortgage Servicing Ratio (MSR). This caps your home loan repayment at 30% of your monthly income. It doesn’t apply to private condos like UPPERHOUSE, but it’s an important distinction to be aware of.

Your TDSR calculation is the absolute starting point. It's the number that tells you—and the banks—your maximum borrowing power. Nail this down first, and you’ll know exactly what price bracket you can shop in.

The Smartest First Step: Get an In-Principle Approval (IPA)

Once you have a rough idea of your borrowing limit, it's time to make it official. Go to a bank and get an In-Principle Approval (IPA), sometimes called an Approval-in-Principle (AIP).

Think of an IPA as your financial passport for property hunting. It’s a bank's formal commitment, in writing, of how much they’re prepared to lend you for a property purchase.

Walking into a viewing with an IPA in hand immediately sets you apart. It shows sellers you are a serious, pre-qualified buyer, which gives you incredible leverage, especially when a unit is in high demand.

- You look like a serious buyer. An IPA proves you’re ready to transact.

- You get a rock-solid budget. No more guesswork. You know your exact limit.

- You can act fast. When you find the one, you can make a confident offer on the spot.

Budgeting for the Real Cost of Buying

The purchase price is just one piece of the puzzle. A significant chunk of your initial cash outlay will be for taxes and other professional fees. Getting caught off guard by these costs can derail your purchase.

The two big ones are Buyer’s Stamp Duty (BSD) and Additional Buyer’s Stamp Duty (ABSD). The BSD is a tax on all property purchases, calculated on the purchase price or market value, whichever is higher.

The ABSD is where the costs can really add up. The amount you pay hinges on your residency status and how many properties you already own. Singapore Citizens buying their first home are exempt, but for everyone else—PRs, foreigners, or citizens buying a second property—it’s a hefty tax. We break down the exact rates and scenarios in our detailed guide on the complexities of Additional Buyer's Stamp Duty (ABSD).

Don't forget to factor these other expenses into your cash planning:

- Legal Fees: For the conveyancing lawyer who handles all the legal documentation.

- Valuation Fees: Required by the bank to confirm the property's market value.

- Option Fee: This is your initial deposit, typically 1% of the purchase price, paid in cash to secure the Option to Purchase (OTP) from the seller.

By getting a handle on your borrowing limits, securing an IPA, and mapping out all the associated costs, you'll be in a powerful position. You can hunt for your ideal Singapore condo with the clarity and confidence of a seasoned buyer.

How to Spot Value in New Launch Condos

There’s nothing quite like the feeling of being the first owner of a brand-new condo. You get that pristine, untouched space, straight from the developer. But once you look past the glossy brochures and stunning showflats, the real challenge is figuring out if a project has genuine, long-term value. It’s an art, really—learning to see beyond the initial hype.

Getting a great unit in a hot new launch isn't about luck. It’s all about doing your homework and knowing the subtle signs of a future winner. This means you need to be looking long before the official launch announcements start hitting the news.

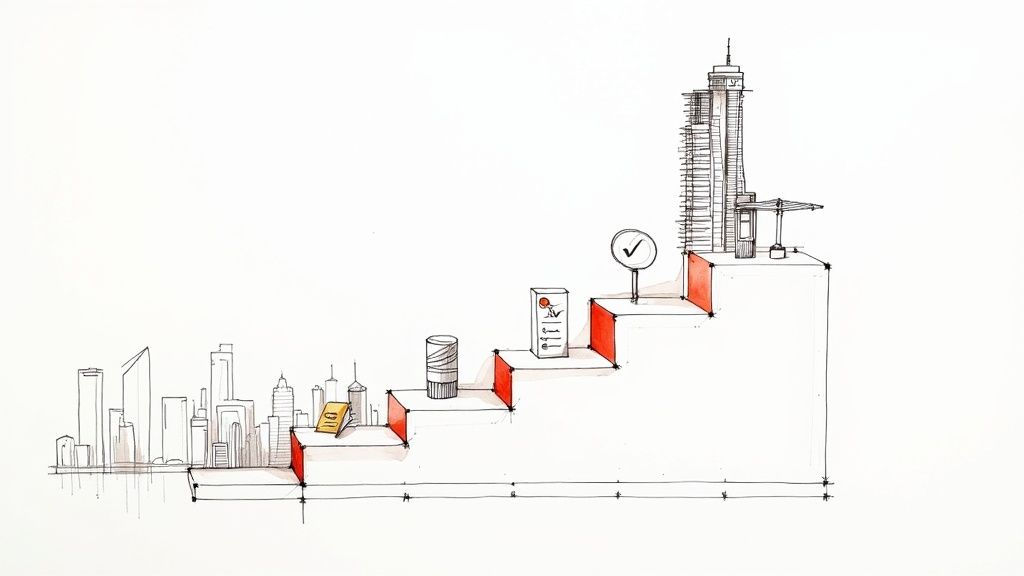

Tracking Future Opportunities

The smartest buyers I know are always watching the Government Land Sales (GLS) program. When a well-known developer snags a plot of land in a prime spot, that’s your first big clue. It tells you a new project is coming down the pipeline, usually within 12-18 months. Following the developers themselves is an even more direct way to stay in the loop.

Getting this head start is a game-changer. It gives you plenty of time to research the location, understand its growth potential, and line up your finances. You’ll be ready to move while everyone else is just hearing about it for the first time.

The Real Advantages of Buying at Launch

Jumping in early on a new launch comes with some very real perks that can make a huge difference to your bottom line. The most talked-about benefit is early-bird pricing. Developers nearly always offer the first batch of units at a discount to get the ball rolling and build momentum. As sales pick up, you can bet the prices for later phases will climb.

But it’s not just about the price. Early buyers get the pick of the litter. You can snag that premium unit with the perfect facing, the most efficient layout, or the highest floor. These are the details that drive higher resale values and attract the best tenants down the road. They're the units everyone wishes they had, but only the first-movers get.

Picking the right unit isn't just a lifestyle decision; it's a financial strategy. A condo with an unblocked view or a prime position facing the pool can easily command a 5-10% premium on the resale market compared to a less desirable unit in the very same building.

Decoding a Successful Project

So, what separates a sell-out success from an average development? From my experience, it boils down to a few key fundamentals that sharp-eyed buyers learn to spot.

- Connectivity is King: I can't stress this enough. A condo's walking distance to an MRT station is probably the most critical factor for its long-term health. If you can walk to the station in 5-7 minutes, you’ll always have strong demand from tenants and future buyers.

- The Transformation Story: Look for areas where the government is investing heavily. The URA Master Plan is your roadmap here. It shows you where new transport lines, business hubs, and amenities are planned, all of which will lift the entire area's appeal and value.

- School Proximity: For anyone with a family, being within the 1km radius of a top primary school isn't just a bonus—it's often a deal-breaker. This single factor provides incredible support for property values.

Beyond the Glossy Floor Plan

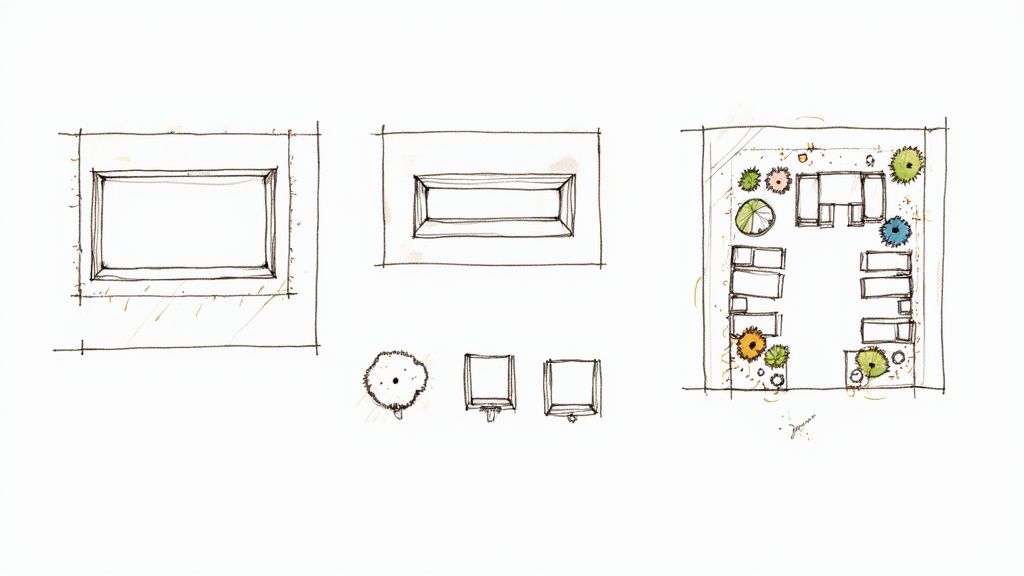

A floor plan is more than just lines on paper; it's the blueprint for how you'll actually live in the space. What you're looking for is efficiency—layouts that don't waste precious square footage on long hallways or awkward, unusable corners. The flow should feel natural.

Also, pay close attention to the unit’s orientation. A north-south facing unit is the gold standard in Singapore because it avoids the harsh, direct heat of the afternoon sun. This makes the home more comfortable to live in and can even lower your air-conditioning bills.

To really get a feel for what makes a property a solid investment, it helps to understand the bigger picture. We put together an analysis of current luxury real estate market trends that can give you that broader perspective. By combining a sharp eye for on-the-ground details with a grasp of market-wide movements, you can confidently find a new launch that’s not just a beautiful home, but a fantastic investment for your future.

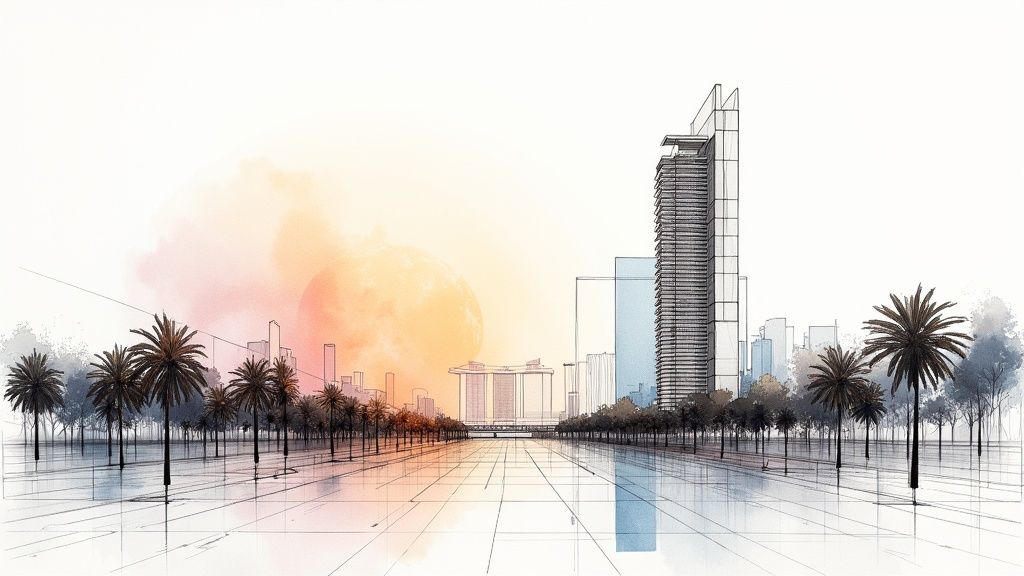

Uncovering Value in the Resale Market

New launches get all the buzz, but savvy buyers know that the resale market is where you can find immediate value and established communities. It’s a different ballgame entirely. Instead of poring over floor plans and artist impressions, you’re dealing with tangible properties—homes with a history. This requires a sharp eye, one that looks past a fresh coat of paint to see the solid fundamentals that make for a great long-term investment.

For anyone searching for a Singapore condominium for sale, the biggest advantage of the resale market is certainty. You get to walk through the exact unit you’ll be buying. You can feel the space, see how the afternoon sun hits the balcony, and get a real sense of the building's atmosphere. That kind of tangible experience is something you just can't get when buying off-plan.

Why Location Is Everything

In the world of resale properties, location isn't just a selling point; it's the absolute bedrock of your investment. A condo’s proximity to an MRT station, good schools, and essential amenities directly shapes its value, how easily you can rent it out, and its potential for appreciation down the road. It's simple, really: a property within a 10-minute walk of a major transport hub will always have a line of interested tenants and future buyers.

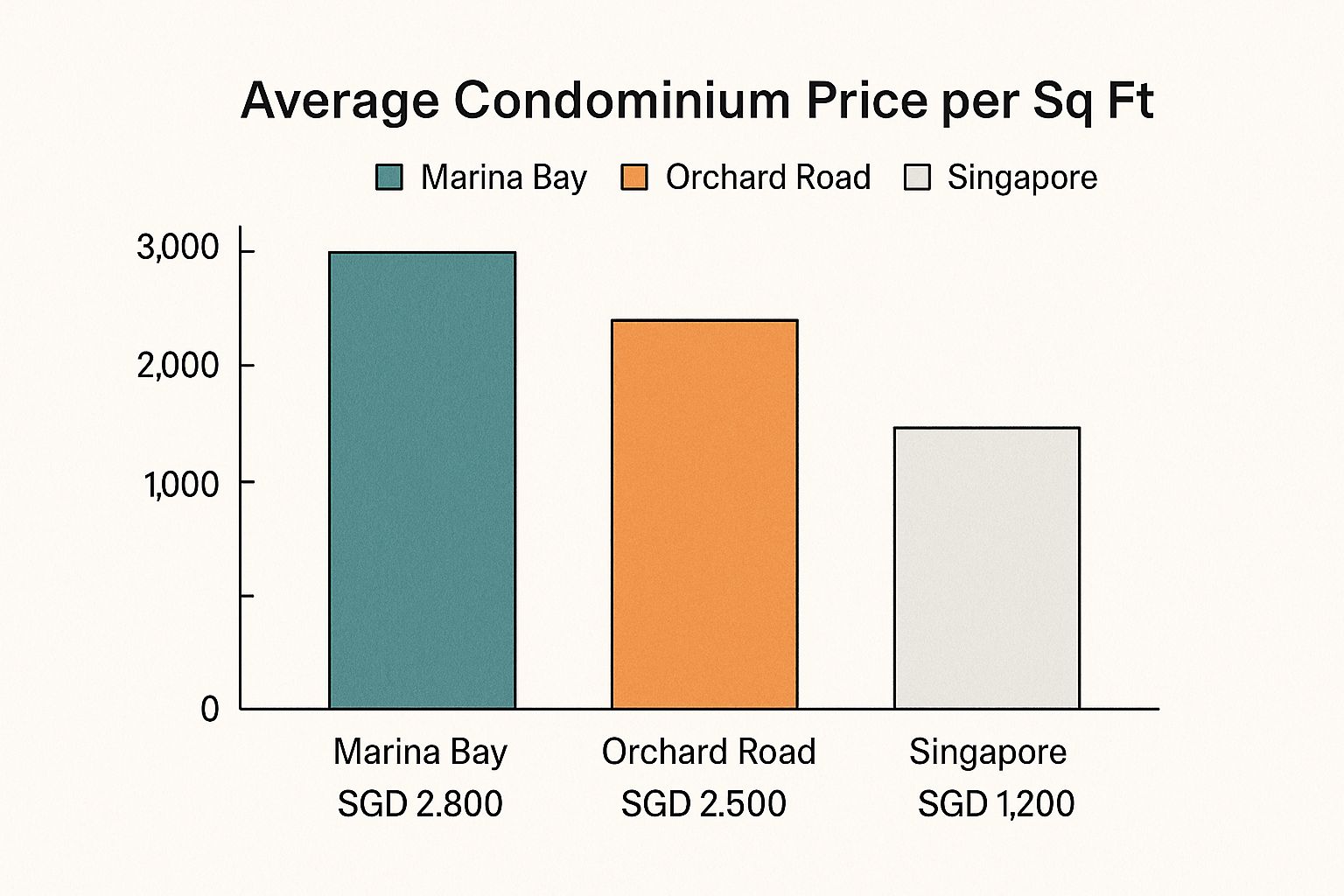

The data speaks for itself. Look at how dramatically property values can differ based on location, comparing prime districts like Orchard Road against the island-wide average.

This price gap isn’t just a number; it’s a clear indicator of the premium that a strategic address commands. A great location is your best defense against market volatility.

Reading the Supply and Demand Signals

The resale market doesn't exist in a vacuum; it’s directly influenced by the pipeline of new homes. Right now, Singapore's condo market is seeing a large influx of newly completed units. The government's plan to release around 8,505 private residential units is part of a total supply of about 57,200 units, which is starting to cool down the rental market from its recent highs.

But here’s the key takeaway: even with more supply, demand for well-located resale properties near MRT stations and international schools remains incredibly strong. These units continue to fetch premium rents. While some areas might feel the pressure, a condo in a prime spot will hold its value. To get a deeper understanding of these market forces, you can discover more insights about the Singapore resale condo market in 2025 and see how these trends might play out.

Spotting a real opportunity means finding a property in a high-demand pocket where supply is tight. I always advise my clients to look for older, well-maintained developments in mature estates where there are no new launches scheduled nearby. Those are the true hidden gems that offer both a good entry price and a strong rental yield.

What to Look for During a Viewing

When you walk into a resale condo for a viewing, your mission is to see beyond the staging. The seller has made it look perfect, but you need to focus on the things that are difficult and expensive to change.

Here’s a practical checklist to run through:

- Check the Building's Upkeep: Don’t just focus on the unit. Look at the condition of the common areas—the lobby, lifts, gym, and swimming pool. A well-cared-for building is a sign of a proactive Management Corporation Strata Title (MCST), which is vital for protecting your investment’s value.

- Evaluate the Floor Plan: Is the layout practical? Look for efficient, "squarish" floor plans that maximize usable living space and don't waste square footage on long, awkward corridors. A good layout is a huge draw for both tenants and future buyers.

- Inspect for Wear and Tear: Look closely at the condition of the flooring, kitchen cabinetry, and bathroom fixtures. Keep an eye out for tell-tale signs of water damage, like stained ceilings or warped wood, which could signal costly underlying problems.

- Dig into the MCST's Financials: Never hesitate to ask for the minutes from the last Annual General Meeting (AGM). A healthy sinking fund and a well-managed MCST are green flags, indicating a stable and financially sound development.

By concentrating on these core fundamentals—location, building quality, layout, and management—you can confidently find a resale property that isn't just a place to live, but a solid, long-term asset. You’re buying a home with a visible past and a future you can rely on.

Navigating the Purchase from Offer to Keys

So, you’ve found it—the perfect Singapore condominium that ticks every single box. The search might be over, but a new, more structured part of the journey is just beginning. This is where things get real, moving from a verbal agreement to a legally binding commitment. It’s a process filled with precise steps, critical deadlines, and a fair bit of paperwork.

Knowing what to expect is the key to a smooth and stress-free closing. Let's walk through the milestones that will take you from making that initial offer to finally holding the keys to your new home.

Securing Your Unit with the Offer to Purchase

The first formal step you'll take is to make an offer and secure the property with an Offer to Purchase (OTP). Think of this as a legal document that, once the seller signs it, gives you the exclusive right to buy that specific unit within a set timeframe.

To get the OTP, you'll need to put down an option fee, which is almost always 1% of the agreed-upon price, paid in cash. This isn't just a symbolic gesture; it's a real financial commitment. Once the seller grants you the OTP, they're legally bound not to entertain other offers for the duration of the option period, which is typically 14 days.

Those two weeks are your window to get all your ducks in a row. It’s the time to finalise your home loan with the bank and appoint a conveyancing lawyer to handle the legal side of things.

A word of caution: the option fee is non-refundable. If you back out for any reason after the OTP is granted, you'll forfeit that 1%. This is precisely why having your In-Principle Approval (IPA) from a bank beforehand is so critical—it drastically reduces the risk of your financing falling through.

The Legal Framework of Your Purchase

With the OTP in hand, your very next call should be to a conveyancing lawyer. This professional is your navigator through the legal maze of a property transaction. They'll perform due diligence, run checks on the property title to ensure there are no hidden issues, and manage all the legal paperwork for a clean transfer of ownership.

Your lawyer also acts as the central coordinator, liaising directly with your bank to arrange the disbursement of the home loan. They ensure every legal and financial detail is handled with precision.

Once your financing is locked in and you're ready to commit, your lawyer will help you "exercise" the OTP. This involves two key actions:

- Signing the Acceptance: You formally accept the offer, usually well within the 14-day window.

- Paying the Option Exercise Fee: This is the next 4% of the purchase price, paid to your lawyer’s conveyancing account for safekeeping.

Together, the initial 1% option fee and this 4% exercise fee make up your 5% cash down payment.

From Agreement to Ownership

The moment you exercise the OTP, it transforms into a legally binding contract known as the Sale and Purchase Agreement (S&P). At this point, you are fully committed to buying the property. From here, the path diverges slightly depending on whether you're buying a brand-new launch or a resale condo.

For a new launch property, you'll follow a progressive payment schedule. This simply means you pay in instalments as the developer hits specific construction milestones.

New Launch Progressive Payment Schedule

| Construction Stage | Percentage of Purchase Price Due |

|---|---|

| Foundation Work | 10% |

| Reinforced Concrete Framework | 10% |

| Partition Walls | 5% |

| Roofing/Ceiling | 5% |

| Electrical Wiring & Plumbing | 5% |

| Car Park, Roads & Drains | 5% |

| Temporary Occupation Permit (TOP) | 25% |

| Certificate of Statutory Completion (CSC) | 15% |

In contrast, a resale property moves much faster. The entire process, from exercising the OTP to collecting the keys, usually wraps up in about 8 to 12 weeks. During this period, your lawyer and the seller’s lawyer are working behind the scenes to finalise the transaction.

The finish line is the completion date. On this day, your bank releases the loan amount, and you settle the remaining balance of the purchase price and any applicable stamp duties (BSD and ABSD). Once all payments are cleared, your lawyer will give you the good news.

And that's the moment you've been working towards—heading down to collect your keys. You are officially the owner of your new condominium.

Your Top Questions About Buying a Singapore Condo, Answered

When you start looking for a condominium in Singapore, a few key questions almost always come up. This is especially true if you're a first-time buyer or new to this incredibly dynamic market. Getting a handle on these fundamentals is the first step toward making a smart, confident decision.

Let's cut through the noise and tackle the most common queries I hear from clients, clarifying the core concepts that will define your property search.

Freehold vs. 99-Year Leasehold: What’s the Real Story?

At first glance, it seems simple, but the choice between freehold and leasehold has deep implications for your investment. Think of it as a question of legacy versus value.

A freehold property is yours forever, plain and simple. You own the apartment and a slice of the land it's built on, with no expiration date. It's an asset that can be passed down from one generation to the next.

On the other hand, a 99-year leasehold property gives you ownership for that specific period. After 99 years, the land goes back to the state. Don't let that scare you off, though. Leasehold condos are typically more affordable and often generate better rental yields, which is a huge plus for investors.

Ultimately, there’s no single right answer. While freehold gives you unparalleled peace of mind, a strategically chosen leasehold condo—especially one with over 70 years remaining on its lease—can deliver fantastic capital appreciation. It all comes down to your personal timeline and financial strategy.

What Taxes and Rules Should Foreigners Know About?

Singapore's property market is open to buyers from all over the world, but there are a few specific guardrails you need to be aware of. The big one is the Additional Buyer's Stamp Duty (ABSD). This is a significant tax applied to the purchase price, and it's a critical part of your budget calculation.

While you can own as many condominium units as you wish, buying landed property like a semi-detached house or a bungalow is a different story and requires special government approval, which is rarely granted.

A crucial tip: The ABSD is non-negotiable, so factor it into your financial planning from the very beginning. It's also worth noting that thanks to Free Trade Agreements, citizens from certain countries (like the USA and Switzerland) get the same treatment as Singapore Citizens and are exempt from ABSD on their first property purchase.

Decoding the Market: CCR, RCR, and OCR Explained

To truly understand property values in Singapore, you need to know the three geographic zones that classify the entire market. Each one has its own vibe, price range, and lifestyle.

CCR (Core Central Region): This is the crème de la crème of Singapore real estate. Think prime districts like Orchard, Newton, and Marina Bay. It’s where you’ll find the most luxurious properties, including exclusive addresses like UPPERHOUSE at Orchard Boulevard.

RCR (Rest of Central Region): Picture the vibrant city-fringe areas that ring the CCR. Places like Queenstown and Kallang offer an amazing lifestyle with fantastic connectivity, but at a more accessible price point than their CCR neighbors.

OCR (Outside Central Region): This is the suburban heartland of Singapore, covering areas like Tampines and Jurong. The OCR offers the most affordable private properties, often featuring larger, family-oriented layouts.

Getting familiar with these zones is non-negotiable. The same budget that could get you a spacious family condo in the OCR might only secure a one-bedroom unit in the CCR. Knowing this framework helps you zero in on the areas that make the most sense for you.

Ready to explore a premier address in the heart of the Core Central Region? Discover the refined living and unmatched connectivity offered by UPPERHOUSE at Orchard Boulevard. Visit our website to view floor plans and learn more about this exclusive opportunity.

Related Articles

Interested in UPPERHOUSE?

Discover luxury living at UPPERHOUSE at Orchard Boulevard. Get exclusive updates and be the first to know about availability.