Condominiums For Sale Singapore Your Ultimate Guide

Discover condominiums for sale Singapore with our ultimate guide. Get market insights, buying steps, and explore luxury options to find your perfect home.

When you start searching for condominiums for sale Singapore, you're not just looking for a property. You're exploring a lifestyle built around modern comforts, exclusive communities, and smart investment opportunities. Whether this is your first foray into the market or you're a seasoned investor, your path will lead you to a primary choice: buying a brand-new unit straight from the developer or purchasing a pre-loved home in a resale transaction.

Finding Your Place in the Singapore Condo Market

Diving into Singapore's condominium market feels a bit like exploring a vibrant, sophisticated new city. The appeal is easy to understand. Condo living offers a unique blend of convenience, security, and access to top-tier facilities like swimming pools, state-of-the-art gyms, and beautifully landscaped gardens. It’s a sought-after choice for locals and expatriates alike, providing a private retreat within a lively community, all set in one of Asia's most dynamic hubs.

Your journey starts with one big question that will define the rest of your home-buying experience: Do you want a pristine, untouched unit, or a home that already has a story to tell?

The Two Main Paths to Condo Ownership

Think of it like choosing a car. You could go for a model that’s fresh off the factory line, or you could opt for a beautifully maintained classic. A new launch condo is bought directly from the developer, sometimes even before the first brick is laid. This route gives you the thrill of being the very first owner, the benefit of the latest architectural designs, and often, the chance to secure attractive early-bird pricing.

Then there's the resale condo, which you buy from a previous owner. This option lets you see exactly what you’re getting upfront and move in much faster. Plus, you’ll often find that older developments offer more generous living spaces. Each path has its own distinct set of pros and cons.

The decision between a new launch and a resale property isn't just about the unit itself. It's a strategic choice that impacts your timeline, finances, and long-term investment goals. Getting this first step right is crucial.

To figure out what’s best for you, it’s important to get a handle on the key differences. Here are the main things you’ll want to weigh up as you start your search:

- Move-In Timeline: New launches mean waiting a few years for construction to finish. With a resale, you can pretty much move in right after the sale is complete.

- Condition and Customisation: A new launch is a blank canvas in perfect condition. A resale might need some renovations, which adds to the initial cost but also gives you the chance to make it your own.

- Pricing and Payments: New launches typically use a progressive payment scheme, spreading out the cost over the construction period. Resale deals require a more traditional, upfront payment structure.

- Location and Space: You'll often find older resale condos in established, mature estates with larger floor plans. New launches tend to be in up-and-coming areas with modern, often more compact, layouts.

This guide is your map. We'll break down the market's complexities, step by step, so you can confidently find a home that fits both your lifestyle and your financial game plan.

Understanding Singapore's Current Condo Market

Diving into Singapore's property market without a clear picture is like trying to navigate the city without a map. Before you even think about putting down an offer, you need to get a feel for the landscape—what's happening with prices, how many properties are changing hands, and what the general buyer sentiment is. This insight is what separates a hopeful homebuyer from a savvy, strategic investor.

The Singapore property scene is famously resilient, shaped by careful government oversight and the ebb and flow of the global economy. The first quarter of 2025, for instance, showed a market that's settling into a more sustainable rhythm. According to the Urban Redevelopment Authority (URA), the overall Property Price Index for private homes saw a modest 0.81% rise from the previous quarter. This isn't the breakneck speed we've seen in the past, but it points to a healthy, self-correcting market finding its footing.

Singapore Property Market Snapshot (Q1 2025)

To give you a clearer idea, here's a quick look at how the different segments of the private residential market performed. This table breaks down the recent performance, showing that growth, while moderate, is happening across the board.

| Metric | Quarter-on-Quarter Change | Year-on-Year Change |

|---|---|---|

| Overall Private Property Index | +0.81% | +4.2% |

| Landed Property Prices | +1.2% | +5.8% |

| Non-Landed Property Prices | +0.6% | +3.7% |

As you can see, the market is demonstrating steady, albeit cautious, appreciation. This is a sign of a maturing cycle, where sustainable growth is valued over speculative spikes.

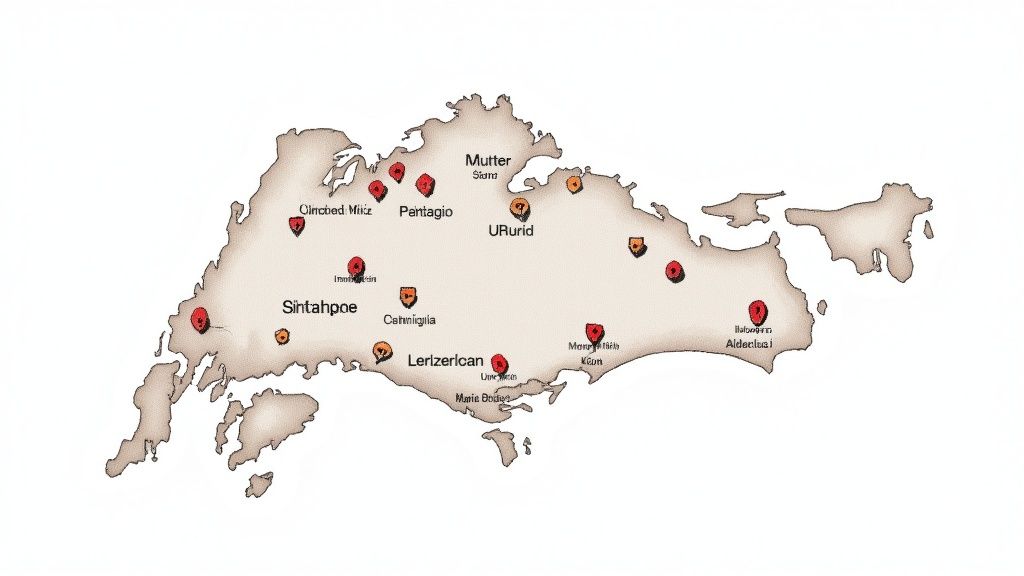

Decoding Singapore's Property Regions

To really make sense of the market, you can't just look at Singapore as a whole. It’s a mosaic of distinct regions, each with its own personality, price tag, and investment potential. Getting to know them is the first step in zeroing in on the right property for you.

You’ll hear these three acronyms all the time:

- Core Central Region (CCR): This is the crème de la crème. Think of prime districts like Orchard, Newton, and Sentosa. Properties here are considered blue-chip assets, prized for their prestige and long-term value.

- Rest of Central Region (RCR): This is the city fringe, where accessibility meets lifestyle. Areas like Queenstown, Bishan, and Paya Lebar offer fantastic connectivity to the city center without the CCR's eye-watering prices. It's a sweet spot for professionals and young families.

- Outside Central Region (OCR): These are the suburban heartlands—places like Tampines, Jurong, and Woodlands. The OCR is all about value, offering larger living spaces and family-friendly amenities, making it a go-to for those upgrading from HDB flats.

Your choice between CCR, RCR, and OCR is more than just about a postcode; it's a strategic decision. Are you looking for a prestigious address to preserve capital (CCR)? A blend of growth and convenience (RCR)? Or a value-focused home in a vibrant community (OCR)?

Knowing where different https://upperhouse.luxurycondo.sg/blog/singapore-condominiums-for-sale are located helps you align your search with what you truly want. An investor targeting expatriate tenants might focus on the RCR, while a family planning for the long haul will likely find their perfect fit in the OCR.

The Forces Shaping Today's Market

A few key factors are always at play in Singapore's property market, acting like the winds and currents that steer the ship. Every buyer needs to keep an eye on them. First up are government cooling measures, like the Additional Buyer's Stamp Duty (ABSD), which are designed to keep the market stable and curb speculation, especially from foreign buyers and investors with multiple properties.

Interest rates are another huge piece of the puzzle. When borrowing costs are low, buyers feel more confident, and you'll see more activity in the market. But when rates start to climb, people tend to become more cautious. It’s useful to look at broader trends in homeownership and rental affordability to get the bigger economic picture.

Finally, there's the supply of new homes. A steady stream of new launches can keep prices in check and give buyers more options, but it also means more competition for sellers and landlords. Getting a handle on these dynamics is crucial for making a well-timed and intelligent purchase.

New Launch vs. Resale Condo: Which Path is Right for You?

When you start looking at condos for sale in Singapore, one of the first major forks in the road you'll encounter is the choice between a brand-new unit and a resale property. It’s a bit like choosing between a car fresh off the assembly line, complete with that new-car smell and the latest tech, versus a tried-and-true model with a history and established character. Neither is inherently better; the right choice really boils down to your personal timeline, financial situation, and what you want out of your home.

Let's break down the pros and cons of both new launch and resale condos to give you a clearer picture. Think of this as your guide to navigating that critical first decision.

The Allure of a New Launch Condo

A new launch is exactly what it sounds like: a property you buy directly from the developer, often before the first brick is even laid. This option has some powerful draws, attracting everyone from savvy investors to families planning for the future.

The most obvious perk? You’re the very first owner. Everything is pristine and untouched, from the appliances to the swimming pool. This means you don't have to worry about immediate repairs, and developers typically offer a one-year defects liability period to fix any issues that pop up. Plus, developers often dangle early-bird pricing to get sales moving, which can be a great opportunity to lock in a price below its eventual market value.

Another huge benefit is the Progressive Payment Scheme (PPS). Instead of a massive upfront mortgage, your payments are tied to construction milestones. This makes the initial financial commitment much more manageable, as your monthly payments are significantly lower while the property is being built.

- Pristine Condition: You get a flawless unit backed by the developer's one-year warranty for defects.

- Modern Amenities: New projects almost always feature the latest smart home systems, eco-friendly designs, and cutting-edge facilities.

- Potential for Capital Appreciation: Getting in on the ground floor can lead to solid capital gains by the time the project is finished and the neighborhood matures around it.

A new launch is essentially an investment in the future. You're buying a vision, which requires patience but comes with the potential for higher returns and a brand-new asset.

The Practicality of a Resale Condo

A resale condo, on the other hand, is a property you buy from its current owner. This route offers a completely different set of advantages, centered around certainty, speed, and often, space.

The biggest win here is immediacy. Once the deal is done, you can move in, usually within about three months. There's no waiting for construction to finish.

What you see is exactly what you get. You can walk through the actual unit, check out the view from the balcony, see the condition of the gym, and get a real sense of the community before you sign anything. This eliminates the guesswork and uncertainty that can come with buying off-plan.

Interestingly, older resale condos often have larger floor plans than their newer counterparts. A three-bedroom unit from a decade ago might offer a lot more living space than a brand-new equivalent, which can be a game-changer for families. The neighborhood is also fully developed, with established schools, markets, and transport links right at your doorstep.

Of course, you’ll need to budget for potential renovations, as a resale unit will have some wear and tear. It's also wise to keep an eye on the supply of new properties coming onto the market. For instance, the government's land sales program for the first half of 2025 is expected to release around 8,505 private residential units. This influx of new homes can create more competition and potentially soften prices in the resale market. Understanding how supply affects the resale market in Singapore for 2025 can help you make a smarter move.

Your Step-by-Step Guide to Buying a Condo

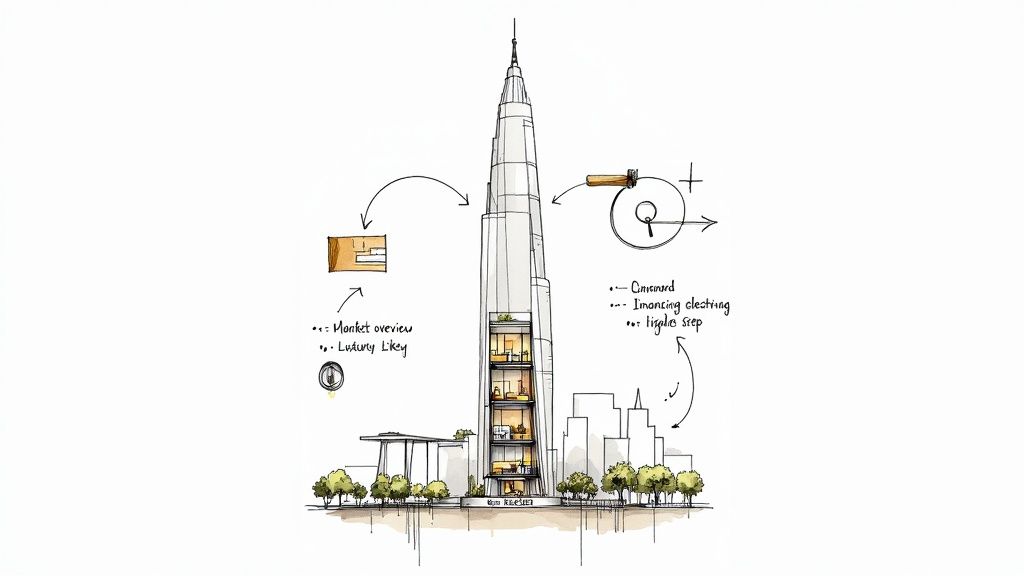

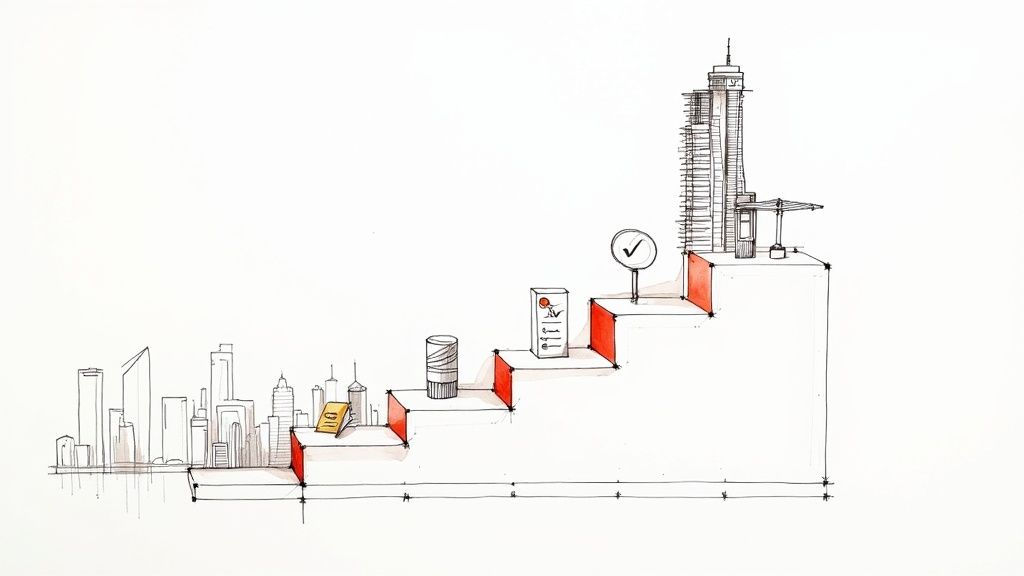

The path to owning a luxury condominium in Singapore might seem like a maze of financial jargon and legal paperwork. But it doesn't have to be. When you break it down into a clear, step-by-step roadmap, the entire journey becomes much more manageable. Think of this as your personal checklist, taking you from the first financial checks right up to that thrilling moment you get the keys.

This visual guide breaks down the main stages of buying a condo in Singapore.

As you can see, the process flows logically from discovery and financial groundwork to the final legal steps. It’s a structured approach that ensures you can move forward with confidence.

Step 1: Secure Your Financing First

Before you even start dreaming about infinity pools and skyline views, your very first move should be to sort out your finances. It's like getting your passport sorted before you book an international flight—it dictates exactly where you can go.

The best place to start is by getting an Approval-in-Principle (AIP) from a bank. An AIP is essentially a bank's formal commitment, telling you the maximum loan amount they’re prepared to offer based on your income, credit score, and other financial obligations.

Getting an AIP gives you two powerful advantages:

- A Solid Budget: You’ll know precisely what you can afford, which saves you from wasting time looking at properties that are out of reach.

- Serious Buyer Status: An AIP proves to sellers and agents that you're a pre-qualified and serious buyer, giving your offer more weight.

Step 2: The Search and the Offer

With your budget firmly in hand, the fun part begins: the hunt for your ideal home. This is when you'll start exploring different apartment in Singapore for sale, scheduling viewings, and zeroing in on the properties that feel right.

Once you find a condo you can't live without, it's time to make your move. If the seller accepts your offer, you'll need to lock it down by signing an Option to Purchase (OTP). This is a crucial legal document that gives you the exclusive right to purchase the property for a set period, typically 14 days.

To get the OTP, you'll pay an option fee, which is almost always 1% of the purchase price. This is paid in cash and is non-refundable if you back out, so be sure of your decision!

The Option to Purchase is a serious commitment. It takes the property off the market, giving you a window to get your financing and legal affairs in order. This is the point where your property hunt turns into a real transaction.

During this two-week option period, you'll need to appoint a conveyancing lawyer to manage the legal side of things. Your lawyer will do the necessary due diligence, like checking the property title for any issues. This is also when you'll formally accept the home loan offer from your bank.

Step 3: Exercising the Option and Finalising the Deal

To move forward, you have to "exercise" the OTP before it expires. This involves signing the document and paying the next part of the down payment—usually 4% of the purchase price, often called the Option Exercise Fee.

Once exercised, the OTP transforms into a binding Sale and Purchase Agreement (S&P). From here, your lawyer takes the lead, coordinating with the bank and handling the payment of stamp duties. These are significant costs to factor in:

- Buyer's Stamp Duty (BSD): A tax that applies to all property purchases in Singapore.

- Additional Buyer's Stamp Duty (ABSD): Another tax that applies to Singapore Permanent Residents, foreigners, and citizens purchasing their second or subsequent property.

The whole process, from exercising the OTP to the final handover, typically takes between 8 to 12 weeks. On the completion date, your lawyer will finalise the payment, and you'll officially become the owner of your new condominium. Congratulations, you've got the keys

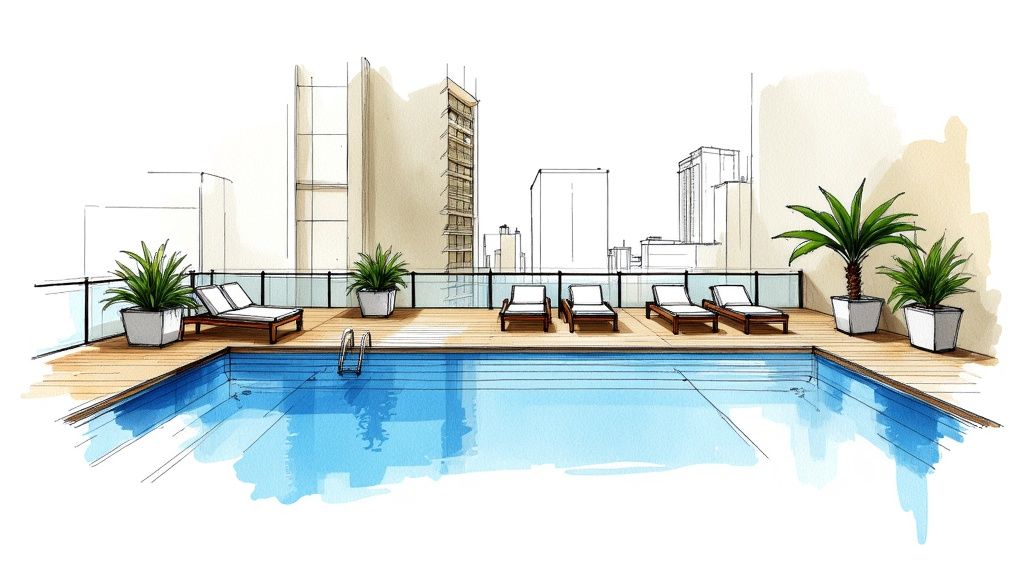

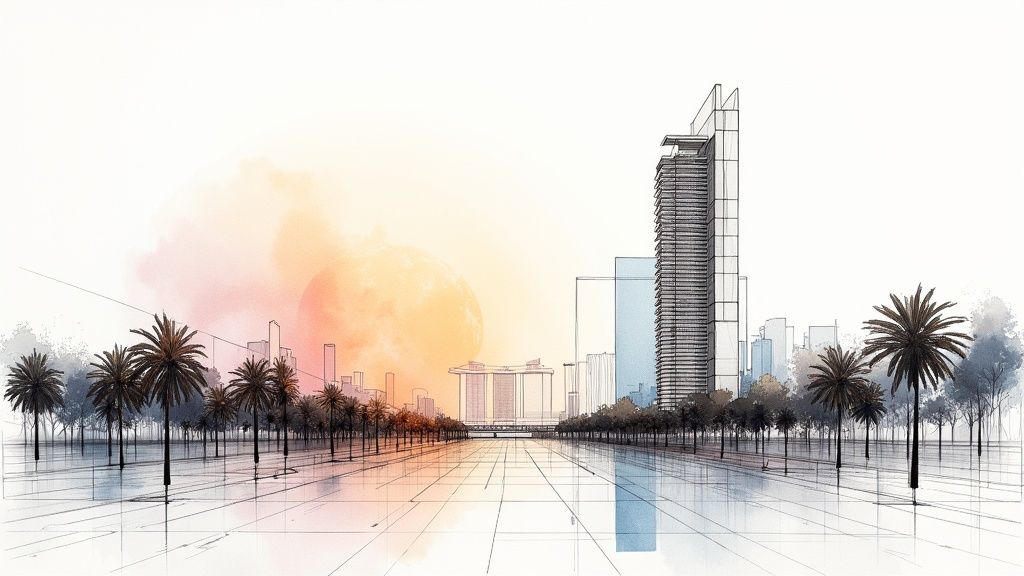

Spotlight on Ultra-Luxury Living at UPPERHOUSE

To really get a feel for the pinnacle of Singapore’s property market, you have to look past the usual listings and step into the world of ultra-luxury. This isn't about chasing square footage; it's about a highly curated lifestyle defined by prestige, privacy, and an uncompromising standard of quality. There’s no better example of this than UPPERHOUSE, an exclusive freehold development nestled at 30 Orchard Boulevard—arguably the city’s most sought-after address.

This isn’t just another one of the many condominiums for sale singapore has to offer. It's an entirely different class of real estate altogether. Properties in this tier are as much works of art as they are homes, blending iconic architecture, bespoke services, and a location that offers both quiet refuge and instant access to the city’s pulse. For the right buyer, these are legacy assets—an investment in a life less ordinary.

What Defines the Ultra-Luxury Segment

The ultra-luxury market plays by its own rules. It’s a space where exclusivity is the most valuable amenity and every single detail has been thought through. A few key pillars hold up this rarefied standard.

First up, it’s all about the prime location. UPPERHOUSE, for instance, sits in District 10, a short stroll from the Orchard Road shopping belt and the serene Singapore Botanic Gardens. Finding that perfect blend of urban energy and natural tranquility is incredibly rare, and that’s what makes it so desirable.

Next is architectural significance. These developments are often the masterpieces of world-renowned architects. UPPERHOUSE carries the signature of the acclaimed WOHA architects, famous for their groundbreaking, sustainable designs that feel like a natural extension of their environment.

Finally, there’s the non-negotiable need for ultimate privacy and exclusivity. With just 30 residences, UPPERHOUSE creates an intimate, tight-knit community. That’s a level of privacy that larger developments can't even begin to approach. This scarcity is a true hallmark of luxury; it feels less like buying a property and more like joining a very exclusive club.

In the ultra-luxury market, a property is more than an address; it’s a statement. It reflects a commitment to exceptional quality, timeless design, and a life lived without compromise. This is what attracts a very specific, discerning clientele.

A Glimpse into the UPPERHOUSE Lifestyle

Living at UPPERHOUSE is an experience crafted for the highest standards. The entire development is conceived as an urban sanctuary, offering residents a peaceful escape from the bustling city just below. From the moment you arrive, the focus is on creating a seamless, elevated way of life.

The lifestyle here revolves around:

- Bespoke Services: Think personalized services that anticipate your every need, much like living in a five-star hotel.

- World-Class Amenities: The facilities are designed for both unwinding and entertaining, from breathtaking city views on the sky terrace to private wellness suites.

- Thoughtful Design: Each residence is a study in precision, featuring high-end finishes, generous layouts, and a design that floods the space with natural light while framing panoramic views.

Even with some economic headwinds, Singapore's ultra-luxury condominium market saw a strong resurgence in the first quarter of 2025. The latest data showed that 17 ultra-luxury condo units were sold in just the first three months of the year, a clear sign of renewed buyer confidence at the top end. As this recent analysis of Singapore's ultra-luxury condo sales shows, these properties—typically in prime Core Central Region locations with exceptional views and facilities—continue to be a major draw for affluent local and international buyers.

This kind of resilience really underscores the lasting appeal of top-tier properties. For both investors and homeowners, developments like UPPERHOUSE represent more than just a home; they are stable, high-value assets in a world-class city. They offer a rare opportunity to own a piece of Singapore's most prestigious real estate, promising a lifestyle of comfort, convenience, and quiet sophistication.

Getting the Finances and Legal Details Right

When you're buying a luxury condo, sorting out the financing and legal paperwork is like laying the foundation for your dream home. Get it right, and everything else falls into place. This is where the real groundwork happens, ensuring your purchase is built on a solid, secure base. Let’s walk through the financial and legal essentials you need to know when looking at condominiums for sale in Singapore.

Making Sense of Mortgages

A home loan is a huge commitment, so it pays to get comfortable with the terminology. Lenders in Singapore operate under strict rules from the Monetary Authority of Singapore (MAS), which are designed to protect both you and the financial system.

You'll quickly come across two key concepts:

- Total Debt Servicing Ratio (TDSR): Think of this as a financial safety net. It ensures that your total monthly debt payments—your new mortgage plus any car loans, credit card bills, and other obligations—don't exceed 55% of your gross monthly income.

- Loan-to-Value (LTV) Limit: This dictates how much you can borrow. For your first property loan, the LTV is usually capped at 75% of the condo's purchase price. This means you’ll need to prepare the remaining 25% as a down payment, which can be paid using a mix of cash and your CPF funds.

You’ll also have to decide between a fixed-rate and a floating-rate loan. A fixed rate gives you peace of mind with predictable monthly payments for a set period. A floating rate, on the other hand, moves with the market, which could mean lower initial payments but less certainty down the road.

The Legal Side of Your Purchase

Your conveyancing lawyer is your guide and guardian through the legal maze. They do more than just push paper; they’re there to perform due diligence, making sure the property title is clear of any issues and that the entire transaction is above board. They’ll also manage the secure transfer of funds, which is a critical part of the process.

A big piece of the legal puzzle involves stamp duties. These are taxes on the legal documents of your property purchase and represent a significant upfront cost.

Stamp duties are a non-negotiable part of the property buying equation in Singapore. Budgeting for them accurately from the start is crucial to avoid any last-minute financial stress.

There are two main stamp duties to plan for:

- Buyer's Stamp Duty (BSD): Every property buyer pays this. It's calculated on a tiered scale, starting at 1% on the first $180,000 and climbing to 6% for property values above $3 million.

- Additional Buyer's Stamp Duty (ABSD): This one can be a real game-changer. The rate depends entirely on your residency status and how many properties you already own. For instance, a foreigner purchasing any residential property will face a steep 60% ABSD. We cover this complex topic in detail in our guide to the Additional Buyer's Stamp Duty.

Getting a firm handle on these financial and legal steps is essential for a stress-free purchase. And if you’re thinking about your condo as a long-term investment, it's also worth understanding the implications of renting out a condo once the deal is done.

Got Questions About Buying a Condo? We've Got Answers.

As you get closer to buying a condo in Singapore, a lot of questions are bound to pop up. It's completely normal. Let's tackle some of the most common ones head-on, so you can feel confident and clear about your next steps.

Can Foreigners Actually Buy a Condo in Singapore?

Absolutely. The condominium market in Singapore is open to buyers from all over the world, which isn't the case for most landed properties like bungalows or terrace houses.

The one big thing you need to know about is the Additional Buyer's Stamp Duty (ABSD). For any foreigner buying a residential property here, the current rate is a hefty 60% of the purchase price. So, while the process itself is straightforward, you must factor this tax into your budget right from the start.

What Costs Can I Expect After I Get the Keys?

The initial purchase price is just the beginning. Owning a condo means you're part of a community, and there are ongoing costs to keep everything running beautifully.

Think of it like a subscription for a premium lifestyle. Here's what you'll be paying for:

- Monthly Maintenance Fees: Everyone chips in for the upkeep of the pools, gym, gardens, and security. These fees (often called MCST fees) depend on how luxurious the development is and the size of your unit.

- Annual Property Tax: This is a tax on your property's potential rental value, known as its Annual Value (AV). It’s paid to the government every year.

- Home Insurance: The building's structure is insured by the management, but you'll need your own policy for everything inside your four walls—your furniture, valuables, and any renovations you've done.

Many owners also find that engaging professional condominium maintenance and care services helps protect their investment and keep their home in pristine condition over the long haul.

It's crucial to see these recurring costs as part of the total cost of ownership, not just afterthoughts. They're just as important as your mortgage and down payment.

Do I Really Need to Hire a Property Agent?

Technically, no—it's not legally required. But should you? For most people, especially first-time buyers or those new to the Singapore market, the answer is a resounding yes.

A great agent is more than just a door-opener. They're your negotiator, your paperwork guru, and your inside source for market intelligence you just can't find online. They guide you through the complexities, and here's the best part for buyers: their commission is typically paid by the seller. It’s like having an expert on your team at no direct cost.

Discover the pinnacle of luxury living in Singapore. For a private viewing or to learn more about our exclusive residences, explore UPPERHOUSE at Orchard Boulevard at https://upperhouse.luxurycondo.sg.

Related Articles

Interested in UPPERHOUSE?

Discover luxury living at UPPERHOUSE at Orchard Boulevard. Get exclusive updates and be the first to know about availability.