Condos for Sale in Singapore Your Complete Guide

Discover everything about condos for sale in Singapore. Our guide covers eligibility, financing, top neighborhoods, and the buying process for your dream home.

When you start looking at condos for sale in Singapore, you're tapping into a market famous for its stability, luxury, and solid investment potential. It’s a place where sleek, modern high-rises are set against incredibly lush greenery, offering a premium lifestyle right in the heart of a global financial hub. This guide is your first step to making sense of it all.

Why Is Singapore Such a Hot Market for Condos?

Picture a city that runs with Swiss-watch precision, where world-class infrastructure and serene nature don't just coexist—they complement each other. That unique fusion is the very essence of Singapore, and it’s what makes its condominium market a powerful magnet for both discerning homebuyers and savvy international investors.

A condo here isn't just four walls and a roof; it's a ticket to a sought-after way of life. It’s a very different choice from the public HDB housing most locals live in, or the sprawling landed properties that are much rarer. This guide will be your roadmap, walking you through everything that matters: from who is eligible to buy and how to finance your purchase, to comparing neighborhoods and navigating the step-by-step process.

A Market That’s Both Stable and Growing

If there's one word to describe Singapore's real estate market, it's resilient. It has a long history of steady growth, offering a secure environment for your money, all backed by strong governance and a powerhouse economy. That stability is a huge part of the appeal.

The numbers tell the story. The Singapore real estate market is valued at roughly $46.58 billion in 2025, and the condo segment is a big piece of that pie. It's projected to grow at a Compound Annual Growth Rate (CAGR) of 6.57% between 2019 and 2033. This isn’t just a fluke; it's driven by Singapore's standing as a global business center, strong local demand for private homes, and a tightly regulated system that keeps things in check. You can dig deeper into the Singapore real estate market data to see the trends for yourself.

The Undeniable Allure of the Condo Lifestyle

So, what’s the big deal about living in a condo? It's the perfect blend of convenience, community, and top-notch amenities, all rolled into one. Unlike other types of homes, a condominium offers a complete package designed for a modern, fast-paced life.

Owning a condominium in Singapore is like having your own private sanctuary with resort-style facilities. It’s about lazy weekends at the infinity pool, hitting the state-of-the-art gym before work, and knowing you have 24/7 security. It’s a self-contained world of comfort.

This exclusive access to facilities is what really sets condos apart. As a resident, you get to enjoy:

- Recreational Facilities: Think swimming pools, tennis courts, and fully equipped fitness centers right on your doorstep.

- Social Spaces: BBQ pits, clubhouses, and function rooms perfect for hosting friends and family.

- Peace of Mind: Gated access and round-the-clock surveillance are standard.

- Effortless Living: The landscaping and common areas are always impeccably maintained for you.

At the end of the day, choosing a condo is an investment in a lifestyle that values comfort, security, and convenience above all else. Let's get you started on this exciting journey.

So, Who Can Actually Buy a Condo in Singapore?

Before you even start scrolling through listings, let's get one of the biggest questions out of the way: are you eligible? Navigating Singapore's property rules can feel complex, but it really boils down to your residency status.

The great news? Unlike landed houses, which are mostly reserved for citizens, the condominium market is open to everyone. Singapore Citizens (SCs), Permanent Residents (PRs), and foreigners can all own a slice of the city's skyline.

The main difference lies in the taxes you’ll pay, specifically a levy known as the Additional Buyer's Stamp Duty (ABSD). This is the government’s tool for keeping the market stable for locals while still welcoming global buyers. Think of it as a tiered entry fee that changes based on who you are and how many properties you already own.

The Smoothest Path: Singapore Citizens

For Singapore Citizens, buying a condo is as straightforward as it gets. You face the fewest hurdles and the lightest tax load.

If this is your first home, you’re in the clear—you pay 0% in ABSD. It’s a huge financial head-start and a clear signal of the government's focus on helping citizens get on the property ladder.

Things change once you start building a property portfolio, though. For your second property, you’ll be looking at an ABSD of 20%. If you decide to buy a third or any more after that, the rate climbs to 30%.

The Route for Permanent Residents

Permanent Residents also have a well-trodden path to condo ownership, just with a few more financial signposts along the way.

When buying your very first residential property here, you'll pay an ABSD of 5%. It's a key reason why many PRs who have put down roots in Singapore see owning a private home as a very real possibility.

This initial rate strikes a balance, acknowledging long-term residents' goals without overheating the market. But be prepared for a steep jump if you plan to invest further. The ABSD for a second property skyrockets to 30% for PRs, and 35% for a third and beyond. For a broader look at available properties, our guide on condominiums for sale in Singapore offers more context.

The Rules of the Game for Foreign Buyers

Singapore has always been a magnet for international investors, and foreigners are absolutely welcome to buy condominiums. The key difference is that they face the highest ABSD rate right from the get-go.

A foreigner buying any residential property in Singapore is subject to an ABSD of 60%.

This is a hefty figure, and it’s a deliberate "cooling measure" designed to manage foreign demand and keep the market in check. While it's a significant cost to factor into your budget, the long-term stability and growth potential of Singapore real estate means it continues to be a top choice for global investors.

To simplify all this information, here's a quick comparison of the rules and rates.

Buyer Eligibility and ABSD Rates at a Glance

This table lays out the essential property ownership rules and tax rates for each buyer category, making it easy to see where you stand.

| Buyer Profile | Eligibility for New/Resale Condos | ABSD Rate (First Property) | ABSD Rate (Second Property) |

|---|---|---|---|

| Singapore Citizen | No restrictions | 0% | 20% |

| Permanent Resident | No restrictions | 5% | 30% |

| Foreigner | No restrictions | 60% | 60% |

Getting a firm grip on these regulations is the first real step in your property journey. It clears up any confusion, helps you calculate your total budget with confidence, and lets you focus on finding the right home.

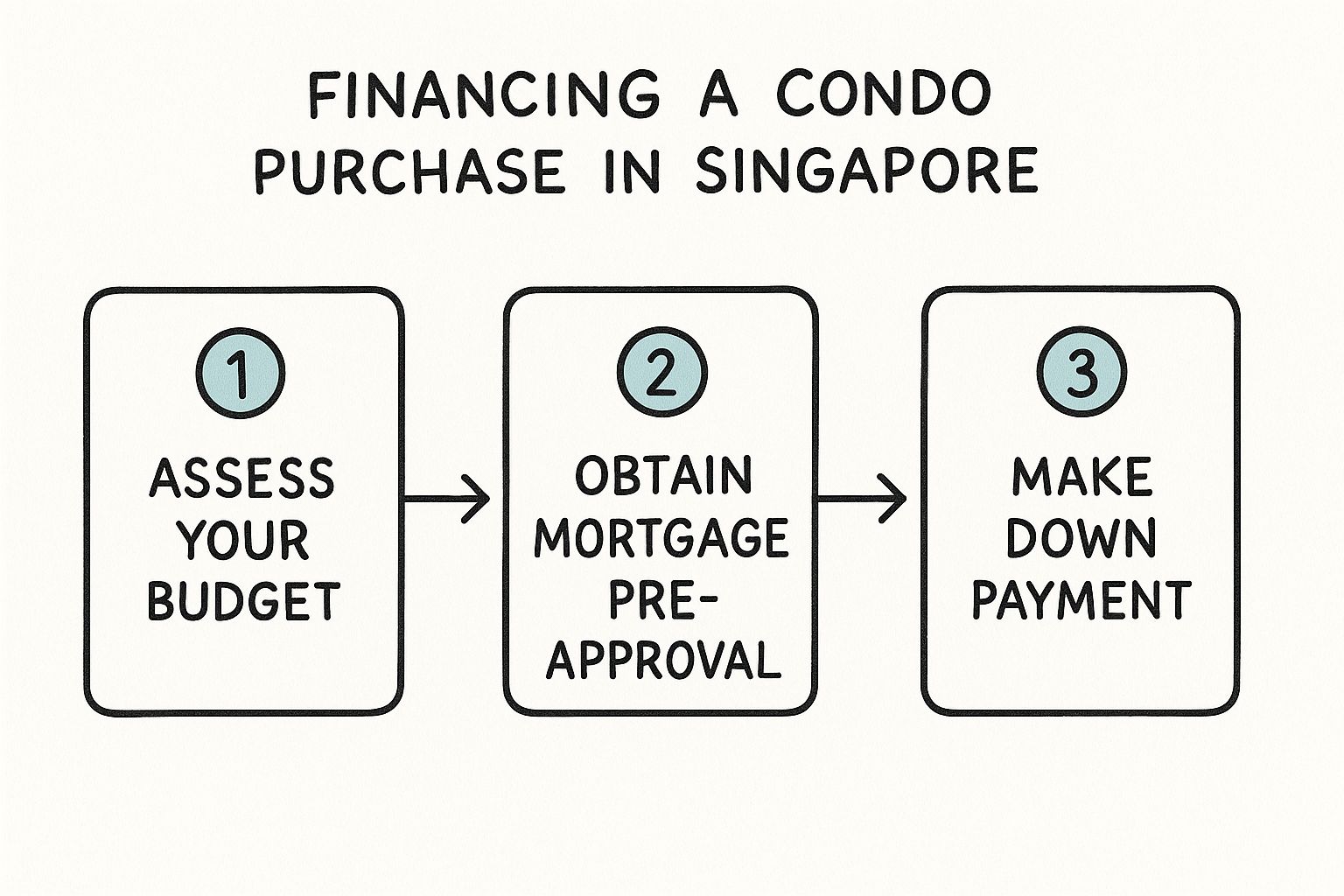

How to Finance Your Condo Purchase

Figuring out the money side of buying a condo can feel like the biggest hurdle, but it's more straightforward than you might think. Let's break down the world of Singapore mortgages and savings into simple, practical steps you can use to approach your purchase with confidence.

The entire system is built on two core pillars established by the Monetary Authority of Singapore (MAS). These aren't just rules for the sake of it; they’re designed to keep the property market stable and prevent buyers from getting in over their heads.

Decoding Key Financial Limits

Before you even start talking to banks, you need to understand your borrowing boundaries. The first one to know is the Loan-to-Value (LTV) ratio. This simply dictates the maximum percentage of the property's price that a bank can lend you.

For your first home loan, the LTV is capped at 75%. That means the bank will finance up to 75% of the condo's value, and you'll need to cover the remaining 25% as a down payment. Out of that down payment, at least 5% must be in cash. The other 20% can be a mix of cash or funds from your CPF savings.

The second crucial limit is the Total Debt Servicing Ratio (TDSR). This one is all about making sure your monthly loan payments don't stretch you too thin. Under this rule, your total monthly debt obligations—your new mortgage, car loan, credit cards, everything—cannot exceed 55% of your gross monthly income.

Think of your monthly income as a pie. The TDSR rule says that all your debt repayments combined can't take up more than 55% of that pie. This ensures you still have a healthy slice left over for living expenses, savings, and everything else life throws your way.

Leveraging Your Central Provident Fund

If you're a Singapore Citizen or Permanent Resident, your Central Provident Fund (CPF) is an incredibly useful asset when buying property. The savings in your CPF Ordinary Account (OA) can be a game-changer.

Here's how you can use your CPF OA funds:

- The Down Payment: Once you've paid the mandatory 5% in cash, you can use your OA savings to cover the next 20%.

- Stamp Duties: This includes the Buyer’s Stamp Duty (BSD) and, if it applies to you, the Additional Buyer’s Stamp Duty (ABSD). You can learn more about the Additional Buyer's Stamp Duty in our detailed guide.

- Monthly Mortgage Payments: You can arrange for your monthly loan installments to be paid directly from your CPF OA, which frees up a significant amount of your take-home cash each month.

Putting your CPF to work can make the financial side of owning a luxury condo much more manageable.

The Loan Application Process

With a firm grasp of your finances, it's time to get your loan in order. The smart move is to start this process well before you even make an offer on a property.

The very first step is to secure an Approval-in-Principle (AIP), sometimes called an In-Principle Approval (IPA), from a bank. An AIP is essentially a bank's conditional promise to lend you a specific amount, based on an initial check of your financial standing.

Getting an AIP is a non-negotiable step for a serious buyer. Here's why:

- It sets your budget. You’ll know exactly what you can afford, which focuses your property search immensely.

- It shows you mean business. Sellers and their agents will see you as a credible, prepared buyer.

- It streamlines everything. When you do find the right place, the formal loan application moves much faster.

Once you have that AIP in your pocket, you can start your property search with real confidence. After you’ve found the perfect condo and signed the Option to Purchase (OTP), you’ll go back to the bank to formally accept their Letter of Offer. That’s the final step to locking in your financing and getting one step closer to collecting your keys.

Finding the Perfect Neighborhood for Your Lifestyle

When you’re buying a condo in Singapore, you're not just buying a property; you're choosing a lifestyle. The neighborhood you pick shapes everything from your daily commute to your weekend plans. It’s the difference between having a Michelin-starred restaurant just a short stroll away or starting your morning with a quiet cycle through a sprawling nature park.

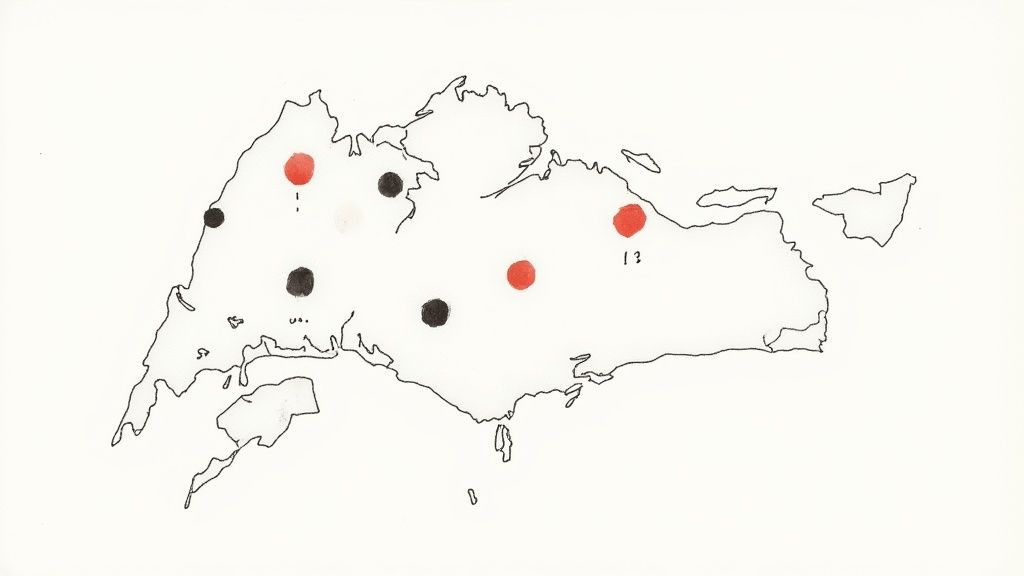

To make sense of the market for condos for sale in Singapore, it helps to think of the island in three main zones. Each one offers a completely different living experience. Figuring out which one fits you best is the first real step to finding a place that truly feels like home.

Core Central Region (CCR): The Heart of Prestige

The Core Central Region, or CCR, is the glittering, beating heart of Singapore. This is where you’ll find the city’s most prestigious addresses, from the upscale districts of Orchard and Tanglin to the iconic skyline of Marina Bay. Think of it as the city’s luxury showcase, lined with designer flagships, exclusive private clubs, and prime real estate.

Living in the CCR is all about having unparalleled convenience and a prestigious postcode. Residents are just moments away from world-class shopping, fine dining, and the Central Business District. Condos here often boast breathtaking city views, dedicated concierge services, and private lift access, all designed for a discerning buyer who wants the absolute best.

The CCR is the pinnacle of Singapore's urban living. It's an address that speaks volumes and offers a lifestyle where the city's finest attractions aren't just nearby—they're practically your backyard.

Naturally, this level of exclusivity comes with the city’s highest price tag. The CCR is home to Singapore’s most coveted properties, attracting high-net-worth individuals and savvy international investors. To get a better feel for these prime locations, take a look at our detailed guide to the best neighbourhoods in Singapore.

Rest of Central Region (RCR): The Sweet Spot

Just beyond the prime central districts, you'll find the Rest of Central Region (RCR). This is the vibrant city-fringe zone that offers a fantastic blend of easy access to the core and a charming community feel. We're talking about popular spots like Queenstown, the hip Tiong Bahru enclave, and the bustling hub of Paya Lebar.

Imagine being close enough for a quick commute into the city, yet far enough to enjoy a more relaxed, unique neighborhood character. The RCR is known for its eclectic mix of trendy cafes, beautifully restored heritage shophouses, and modern malls, all coming together to create a lively, engaging atmosphere.

Condos in the RCR are a top choice for young professionals and families who want to be near the action without the CCR's premium price. You’ll find everything from sleek new developments to well-established condominiums with generous layouts, all in areas that feel connected but still have a strong local identity.

Outside Central Region (OCR): Expansive and Family-Focused

The Outside Central Region (OCR) covers Singapore's well-developed suburban towns, like Tampines, Woodlands, and Jurong. This is where the majority of Singaporeans live, in areas designed around a family-focused lifestyle with plenty of space, greenery, and fantastic local amenities.

Life in the OCR is about tranquility and community. These are self-contained towns built for comfortable living, each with its own large regional malls, reputable schools, community centres, and sprawling park networks. It's an environment where families have room to grow and can enjoy a slightly slower pace of life.

Condominiums in the OCR typically offer the best value for money in terms of price per square foot. They’re known for larger units and incredible, resort-style facilities that cater to everyone. Mega-developments like Treasure at Tampines are a perfect example of this region’s appeal, offering a complete lifestyle package at a more accessible price. And while the commute to the CBD is a bit longer, the ever-expanding MRT network makes these suburbs more connected than ever.

Ultimately, whether you're drawn to the prestige of the CCR, the vibrant energy of the RCR, or the peaceful, spacious living of the OCR, the best neighborhood is simply the one that aligns with what matters most to you.

Your Step-by-Step Condo Buying Timeline

From the moment you find your dream condo to the day you’re holding the keys, the purchase process in Singapore is a series of well-defined legal steps. It might seem daunting at first, but it’s actually a well-oiled machine designed to protect everyone involved. Think of it as a clear roadmap that takes you from offer to ownership.

Knowing what’s coming next removes the anxiety and lets you focus on the excitement of it all. So, let’s walk through each stage of the transaction, cutting through the jargon to highlight the key milestones you'll hit when buying a condo in Singapore.

Stage 1: The Option to Purchase

You've found the one. Your financing is sorted (or at least pre-approved). The first real move you'll make is securing an Option to Purchase (OTP). This is a legally binding document that gives you the exclusive right to buy the property at a set price within a fixed period.

To get the OTP, you'll put down a non-refundable option fee, almost always 1% of the purchase price. So for a S$2 million condo, that’s S$20,000. This payment effectively takes the unit off the market—usually for 14 days—giving you time to get your ducks in a row without worrying about another buyer swooping in.

Think of the OTP as your "reservation ticket." It locks in both the price and the property, giving you the breathing room to get your lawyer and bank to finalize everything.

During this option period, you need to engage a conveyancing lawyer to handle the legal work. They'll run checks on the property's title to make sure everything is clean. This is also when you'll give the OTP to your bank to get the formal Letter of Offer for your home loan.

Stage 2: Exercising the Option

To move forward, you have to "exercise" the OTP before it expires. This just means signing the acceptance form and paying the rest of the deposit, known as the exercise fee. This is typically 4% of the purchase price.

Together with the initial 1% option fee, you've now paid the first 5% of the condo's price, which must be in cash. The moment you exercise the option, the deal is sealed—it becomes a confirmed sale, and both you and the seller are legally bound to see it through. If you back out now, you'll unfortunately forfeit your entire 5% deposit.

With the option exercised, your lawyer takes over. They will lodge a "caveat" on the property with the Singapore Land Authority. This is simply a public notice of your legal interest in the condo, which is crucial because it prevents the seller from trying to sell it to anyone else.

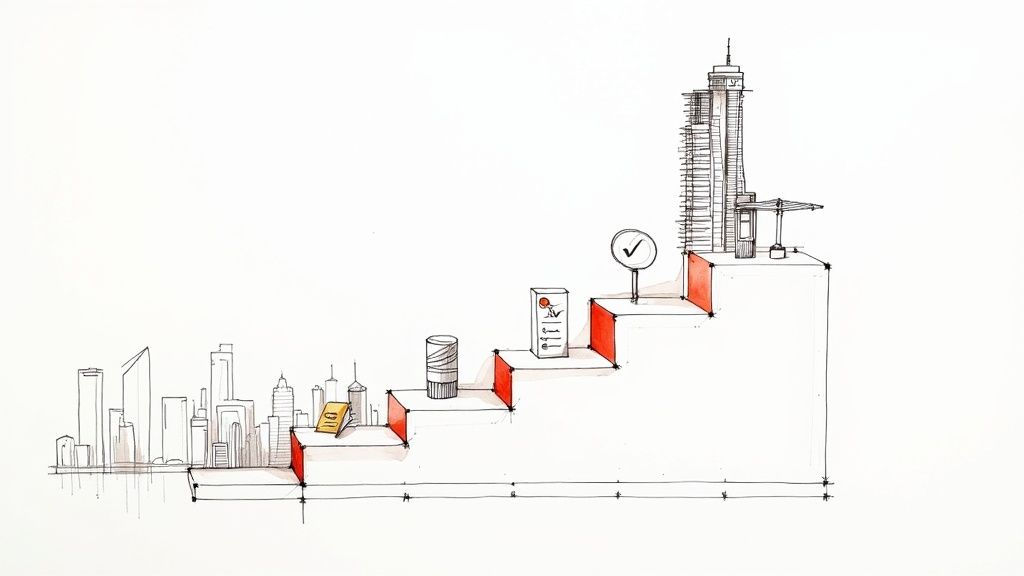

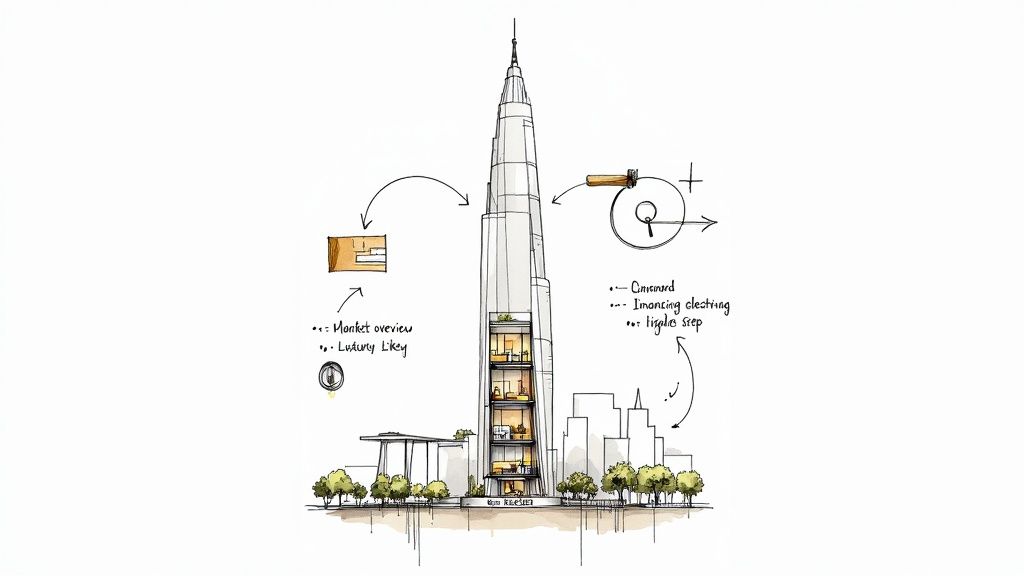

The image below gives you a bird's-eye view of the key financial steps that get you to this point.

As you can see, having your budget and financing pre-approved before you even sign an OTP is absolutely critical.

Stage 3: The Completion Phase

The home stretch is known as the completion phase. This usually takes about 8 to 12 weeks from the day you exercise the option. Behind the scenes, your lawyer and the seller's lawyer are working to get all the legal paperwork ready for the official transfer of ownership.

A few important financial steps happen during this period:

- Paying Stamp Duties: You have 14 days from exercising the OTP to pay the required stamp duties. This includes the Buyer's Stamp Duty (BSD) and, if it applies to you, the Additional Buyer's Stamp Duty (ABSD).

- Finalizing the Down Payment: You'll need to pay the rest of your down payment. If you're taking a 75% loan, this is the remaining 20%, which can come from cash or your CPF Ordinary Account savings.

- Bank Disburses the Loan: Just before the completion date, your bank will release the loan amount directly to the seller’s lawyer.

On the big day—the completion date—your lawyer transfers the final funds to the seller's side. In exchange, you get the keys to your new condo. Congratulations, you’re officially a property owner in Singapore

Reading the Singapore Property Market Trends

Trying to time your entry into the property market can feel overwhelming, but it's not about crystal balls or guesswork. It’s about learning to read the signs. Understanding the current market trends is the key to making a smart, strategic decision when you're looking at condos for sale in Singapore.

The goal is to analyze the right indicators—price movements, sales volume, and government policies—to get a clear picture of whether it’s a buyer’s or seller’s market. This isn’t just data; it’s the market intelligence that helps you spot a real opportunity when it appears.

Gauging the Current Market Climate

The most direct way to take the market's temperature is to look at recent price data. Right now, in 2025, Singapore's private residential market is on a steady upward climb, backed by strong economic fundamentals.

Data from the Urban Redevelopment Authority (URA) shows the Property Price Index for private homes rose by 3.33% year-on-year in Q1 2025. Non-landed properties, like condominiums, are a big part of that story, posting a 0.95% increase for the quarter. For a closer look at historical data, you can explore these detailed Singapore property price movements.

This consistent growth points to healthy buyer demand and solid investor confidence. While keeping an eye on the property market is crucial, it's also smart to stay informed about broader economic and financial market updates, as these wider trends often have a ripple effect on long-term property values.

Beyond just the price tags, two other factors are just as important:

- Transaction Volume: How many properties are actually changing hands? High sales volume usually signals a confident market, whereas a slowdown might mean buyers are getting more hesitant.

- Government "Cooling Measures": Keep an eye out for policies like the Additional Buyer's Stamp Duty (ABSD). The government uses these tools to keep the market stable, and any new announcement can immediately shift buyer sentiment and pricing.

Understanding these trends helps you position yourself for success. In a seller's market, you may need to act decisively. In a buyer's market, you might have more room to negotiate.

Ultimately, when you combine an understanding of price trends, sales activity, and regulatory shifts, you're no longer just watching from the sidelines. You become an informed player, ready to navigate the market with confidence and make a purchase that truly aligns with your financial goals.

Common Questions About Buying a Condo

Diving into the Singapore condo market always brings up a few key questions. Getting your head around these common queries will make your property search much smoother and help you make a more confident decision.

Freehold vs. Leasehold Properties

So, what's the real difference between a freehold condo and a 99-year leasehold?

Think of it this way: buying a freehold property is like owning a classic novel outright—it's yours forever, to pass down through generations. A 99-year leasehold, on the other hand, is like getting a long-term loan of that same book from a national library. After 99 years, the land title reverts to the state.

While the permanence of freehold is appealing and usually comes with a higher price tag, don't discount leaseholds. A well-located condo with a long remaining lease can be an excellent investment with serious growth potential.

Understanding Ongoing Costs

Does buying a condo come with recurring bills? Yes, it does.

First, you'll have monthly maintenance fees, often called MCST fees. These cover the upkeep of all the great facilities like the swimming pool, gym, landscaping, and 24/7 security. It's essentially your contribution to keeping the entire development in pristine condition.

On top of that, there's the annual property tax payable to the government. This is calculated based on your home’s estimated annual rental value, a figure known as its Annual Value (AV).

As you navigate the purchase, it's wise to be informed about various factors that can influence property value, including understanding how radon issues can impact real estate transactions.

Renting Out Your New Condo

Can I lease out my condo unit as soon as I get the keys? Absolutely. This is one of the biggest advantages of private property over HDB flats.

Once the purchase is legally complete, you're free to rent it out immediately. The only major rule to remember is that the tenancy agreement must be for a minimum of three consecutive months.

At UPPERHOUSE at Orchard Boulevard, we pride ourselves on providing clarity at every step of your luxury property journey. Discover a residence where every detail is considered. Explore your future home at UPPERHOUSE today.

Related Articles

Interested in UPPERHOUSE?

Discover luxury living at UPPERHOUSE at Orchard Boulevard. Get exclusive updates and be the first to know about availability.