Buying an Apartment in Singapore for Sale

Your guide to finding the perfect apartment in Singapore for sale. We break down the market, legal steps, and financing to help you make a smart investment.

Finding the right apartment in Singapore for sale is about more than just scrolling through listings—it's about understanding the unique rhythm of the market. Singapore's property landscape is always moving, with clear cycles of intense buyer activity followed by moments of caution. This guide will give you the foundational knowledge you need to navigate it like a pro.

Decoding the Singapore Property Market

Before you even think about scheduling viewings, it's crucial to get a feel for the private real estate market here. Think of it like learning to read the weather before you set sail; knowing the conditions is the first step to making a smart decision. This means looking beyond the dramatic headlines and focusing on what actually drives value and creates opportunity.

The Singapore property market ebbs and flows in cycles, swayed by everything from the local economy and government cooling measures to major global events. Buyer sentiment can turn on a dime, which you'll see reflected in the sales numbers. A great way to get a real-time pulse of the market is by keeping an eye on the data from Singapore's Urban Redevelopment Authority (URA).

New private home sales can swing wildly from one month to the next. A big jump in sales usually signals a return of confidence, while a dip might mean buyers are taking a wait-and-see approach. You can dig deeper into these trends and what's behind them through detailed market analyses.

Key Market Terminology

To talk the talk when you're on the hunt for an apartment, you need to know the lingo. Here are three terms you’ll hear all the time:

New Launch: This is a brand-new condo project being sold straight from the developer. You’re essentially buying a unit off-plan or while it's being built, which often comes with early-bird pricing and the undeniable appeal of being the very first owner.

Resale: A resale property is simply a home that's had a previous owner. These apartments are what you see on the open market. The big plus here is that they're typically ready to move into, and you know exactly what you’re getting—no surprises.

Sub-sale: This one's a bit less common. It happens when someone who bought a new launch unit decides to sell it to another person before the project is even finished and the legal title has been handed over.

Navigating the Singapore property market is all about recognizing patterns. Once you understand the difference between a developer's launch and the resale market, you can tailor your buying strategy to fit your budget, timeline, and long-term goals.

Freehold vs. Leasehold Properties

This is one of the most fundamental concepts to grasp, as it directly impacts your property's long-term value and what you actually own.

With a freehold property, you own the apartment and a share of the land it's built on forever. There's no expiry date. For families looking to build generational wealth, this is a huge draw. As you can imagine, freehold properties are a rare find, especially in prime central districts, and they almost always come with a higher price tag.

On the other hand, a leasehold property gives you ownership for a fixed period, which in Singapore is typically 99 years. When the lease runs out, the land and everything on it goes back to the state. While that might sound like a downside, leasehold properties are more common, more affordable, and can often generate better rental returns, making them a fantastic choice for many homeowners and investors. The truth is, the vast majority of apartments in Singapore, even at the most prestigious addresses, are leasehold.

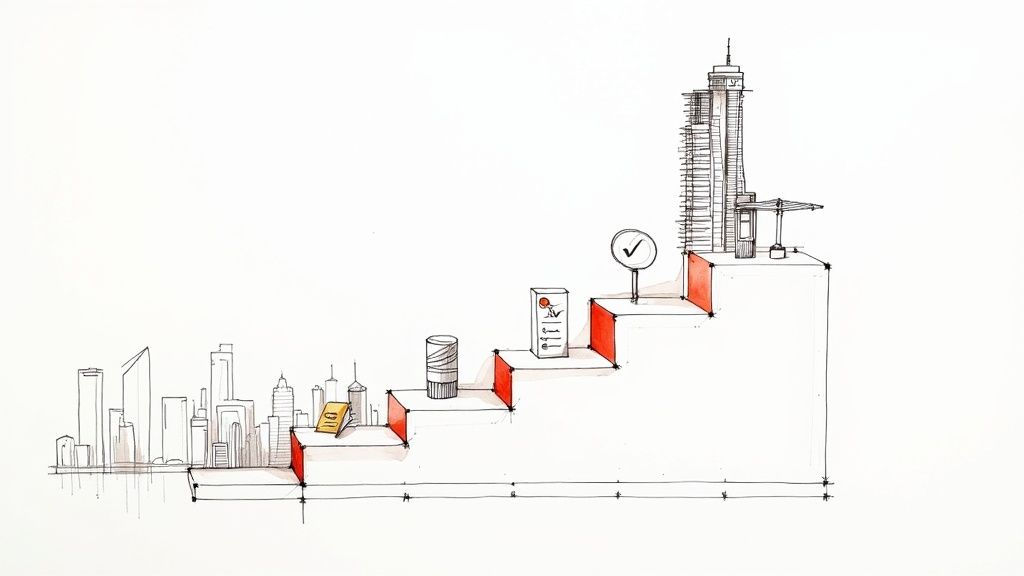

Your Step-by-Step Guide to the Legal Process

Diving into the legal side of buying an apartment in Singapore can feel a bit overwhelming at first. But don't worry—the system here is incredibly well-structured, designed from the ground up to protect everyone involved. Think of it as a carefully planned sequence of events where each step logically follows the last, ensuring everything goes smoothly.

Your journey starts the moment you find "the one" and decide to make an offer. From there, it's a matter of following the roadmap, from signing key documents to getting the keys in your hand. Let's walk through it.

Assembling Your Professional Team

Before you even think about putting an offer on the table, the very first thing you should do is get your team in place. You'll need two key players on your side: a great property agent and a sharp conveyancing lawyer.

- Property Agent: This is your on-the-ground expert. They’ll help you hunt down the right places, set up viewings, and, most importantly, handle the negotiations for you.

- Conveyancing Lawyer: Your lawyer is the one who handles all the critical paperwork. They'll run legal checks on the property, manage the money, and make sure the title deed is properly transferred into your name.

I can't stress this enough: get your lawyer involved early. You'll want them to look over the Option to Purchase (OTP) before you sign anything. It’s a simple move that can save you from major headaches later on.

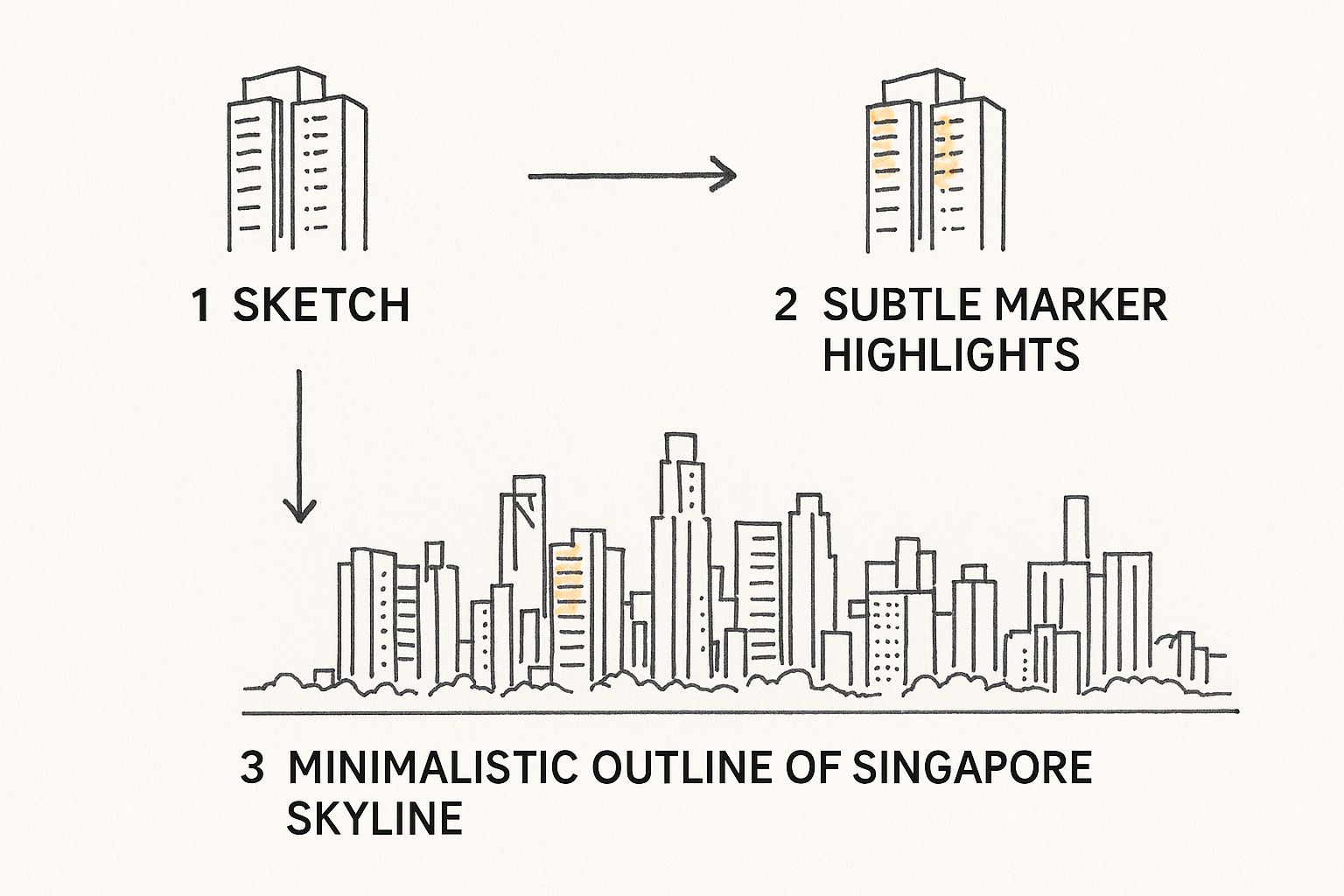

The whole process has a clear, predictable flow.

This timeline really helps visualize the journey, showing how you move from securing the property with an OTP all the way to completion day.

Securing the Option to Purchase

So, you've found the perfect apartment, and you've shaken hands on a price. What's next? The first official step is securing the Option to Purchase (OTP). This is a crucial legal document that kicks off the whole buying process.

Essentially, the OTP is like putting a "reserved" sign on the property. To get it, you'll pay an option fee, which is almost always 1% of the purchase price. The seller then gives you the exclusive right to buy the apartment for a set period, usually 14 days.

During this option period, the seller is legally blocked from entertaining other offers. This gives you some much-needed breathing room to get your financing sorted and have your lawyer start their initial checks.

The Option to Purchase isn't just a simple reservation—it's your signal of serious intent. If you don't go through with the purchase within the timeframe, you'll lose that 1% option fee. So, make sure your ducks are in a row before you hand it over.

Exercising the Option and Due Diligence

To lock in the deal, you need to "exercise the option." This means you sign the OTP and pay the option exercise fee, which is typically 4% of the price. Your lawyer will handle this transfer for you. At this point, you've now paid a total deposit of 5%.

Once exercised, the OTP officially becomes a binding Sale and Purchase Agreement. Now, your lawyer really gets to work, conducting a series of detailed legal checks known as due diligence. This includes:

- Title Searches: Making absolutely sure the seller is the legal owner with the full right to sell.

- Property Encumbrances: Searching for any outstanding mortgages or legal claims tied to the apartment.

- Liaising with Authorities: Checking with agencies like the URA or BCA to ensure there are no unresolved issues or notices.

This is all the critical behind-the-scenes work that ensures you're getting a "clean" property. If you want to dive even deeper, our complete guide on finding an apartment for sale in Singapore explores these details further.

The final step is completion, which usually happens 8 to 12 weeks down the road. Your lawyer coordinates with the seller's lawyer and your bank to transfer the rest of the money and register you as the new owner. On completion day, you finally get the keys to your new home

Mastering Your Purchase Finances

Let's talk money. Getting the finances right is probably the single most important part of buying an apartment in Singapore. It can feel like a maze of acronyms and regulations, but once you break it down, it's actually quite straightforward. We'll walk through the rules, the loan process, and the "hidden" costs so you can build a budget with total confidence.

Think of Singapore's property financing rules like guardrails on a winding road—they're there to keep everyone safe, both you and the financial system. The two big ones you absolutely need to know are the Loan-to-Value (LTV) limit and the Total Debt Servicing Ratio (TDSR).

These two rules pretty much dictate how much you can borrow, so getting your head around them from the get-go is essential.

How Much Can You Actually Borrow?

First up is the Loan-to-Value (LTV) limit. This simply sets the maximum amount a bank can lend you, as a percentage of the property's price. For your first home loan, the LTV is capped at 75%.

So, for a S$2 million apartment, the bank will lend you a maximum of S$1.5 million. You need to cover the remaining 25% yourself.

Of that 25% downpayment, at least 5% has to be in cold, hard cash. The other 20% can come from either cash or the savings in your CPF Ordinary Account.

Next, there's the Total Debt Servicing Ratio (TDSR). This rule is all about making sure you aren't stretched too thin. It limits your total monthly debt payments—your new mortgage, plus any car loans, credit card balances, or student loans—to 55% of your gross monthly income.

Think of it this way: Your monthly income is a pie. The TDSR rule says that all your debt slices combined can't be more than 55% of the whole pie. This makes sure you still have plenty left over for living expenses, savings, and everything else life throws at you.

Your First Financial Move: Get an IPA

Before you even start scrolling through property listings, your very first step should be to get an In-Principle Approval (IPA) from a bank. Sometimes called an Approval-in-Principle (AIP), this is basically a bank’s promise—in writing—of how much they're willing to lend you after a quick check of your finances.

Getting an IPA is a game-changer for a few reasons:

- It sets your budget in stone. No more guesswork. You'll know exactly what you can afford and can focus your search on the right properties.

- It makes you a serious buyer. Showing up with an IPA tells sellers and their agents you mean business.

- It makes everything faster. Once you find your dream home and sign the Option to Purchase, your formal loan application will fly through because the groundwork is already done.

An IPA is usually good for about 30 days and gives you the power to negotiate with confidence.

The "Other" Costs You Can't Ignore

The price on the listing is just the starting point. To avoid any nasty surprises, you have to factor in several other costs, mainly the stamp duties.

Buyer's Stamp Duty (BSD) is a tax everyone pays when buying a property in Singapore. It’s calculated based on the purchase price or market value (whichever is higher), with the tax rate increasing for more expensive properties.

Then there's the big one for some buyers: Additional Buyer's Stamp Duty (ABSD). This is a hefty extra tax that applies depending on your residency status and how many properties you already own.

- Singapore Citizens: You only pay ABSD on your second (20%) or subsequent property.

- Permanent Residents (PRs): You'll pay 5% ABSD on your very first property.

- Foreigners: A 60% ABSD is applied to any residential property purchase.

To give you a clearer picture, here’s a breakdown of the typical upfront cash and CPF you might need for a S$2 million apartment as a first-time Singapore Citizen buyer.

Estimated Upfront Costs for a S$2 Million Apartment

| Cost Component | Estimated Amount (SGD) | Payable By |

|---|---|---|

| 5% Cash Downpayment | S$100,000 | Cash |

| 20% CPF/Cash Downpayment | S$400,000 | CPF or Cash |

| Buyer's Stamp Duty (BSD) | S$69,600 | CPF or Cash |

| Legal Fees (Estimate) | S$3,000 | Cash |

| Total Upfront Outlay | S$572,600 |

This table provides a solid estimate, but always remember to budget for a little extra for things like valuation fees and other small administrative charges. Factoring these in from the start is the key to a smooth and stress-free purchase.

Gauging Property Prices and Investment Potential

What's the real difference between a smart property investment and just a very expensive place to live? It all comes down to looking past the shiny brochure and understanding what truly drives a property's value. When you're eyeing an apartment in Singapore for sale, you need to have a clear picture of both its long-term growth prospects and its immediate power to generate income.

Thinking like a seasoned investor means you're always balancing two critical goals: capital appreciation and rental yield. Each offers a distinct path to building wealth through your property.

Capital Appreciation vs. Rental Yield

Capital appreciation is the profit you pocket when your property's market value goes up over time. It’s a long-term play, a bit like planting a tree and waiting patiently for it to mature and bear fruit. This kind of growth is often supercharged by things happening outside the four walls of your apartment—think new MRT lines, government redevelopment plans, or a neighborhood suddenly becoming the "it" place to be.

On the flip side, rental yield is all about the immediate cash flow you get from renting the place out. It's a simple calculation: your annual rental income as a percentage of the property's price. A healthy rental yield provides a steady income stream, which is absolutely vital for investors who need their asset to start paying for itself right away.

So, what's your game plan? Are you looking for a stable, income-generating workhorse for your portfolio, or are you betting on a district's future boom to maximize your payout when you eventually sell? Your strategy will dictate which of these you focus on.

Using Data to Pinpoint Fair Value

So, how do you know if a listing price is realistic or just wishful thinking from the seller? The secret is to ground your assessment in hard data. The Urban Redevelopment Authority (URA) is your best friend here, offering a goldmine of information, most notably the official Property Price Index (PPI).

This index is the pulse of the market, tracking the price movements of private residential properties across the entire island. It gives you a powerful benchmark. By comparing a specific property’s price history against the broader market trend, you can quickly see if it's a star performer or a laggard.

The latest numbers show a market that is adjusting and finding its footing. For instance, private property prices in Singapore saw steady growth in early 2025. The overall PPI rose by 0.81% quarter-on-quarter and 3.33% year-on-year. Digging deeper, non-landed private condominiums—the heart of the apartment market—posted an even healthier annual jump of 4.74%, while landed property values dipped slightly, hinting at a shift in buyer demand.

What Really Drives Property Value?

A few core elements consistently prop up an apartment's long-term value. Before you get serious about any unit, run it through this mental checklist:

- Location and Accessibility: Being close to MRT stations, major expressways, and the CBD is non-negotiable. This is the bedrock of property value in Singapore.

- Amenities: Think like a future tenant or buyer. Are there top-tier schools, shopping malls, parks, and good healthcare nearby? These conveniences add a massive premium.

- The URA Master Plan: This is essentially the government's blueprint for Singapore's future. Pore over it to find planned upgrades like new transport hubs or commercial centers that could send property values in the area soaring.

- Property-Specific Perks: Little things make a big difference. Is it a freehold property? Is it on a high floor with an amazing view? Does the condo have unique, standout facilities? These features always command better prices.

Understanding the market also means knowing how properties are priced and sold. It's insightful to look into the tactics used to sell properties above asking price to get a complete picture of market dynamics.

By meshing solid data analysis with a sharp eye for these fundamental drivers, you can confidently assess the investment potential of any apartment in Singapore for sale. For more details on what to look for, our deep dive into Singapore condominiums for sale can guide you further. This methodical approach helps you cut through the emotional noise and make a decision rooted in sound financial logic.

Finding the Right Location and Property Type

In real estate, the old saying is true: location, location, location. When you're looking for an apartment in Singapore for sale, choosing the right neighbourhood is just as important as the apartment itself. This decision will define your daily life—from your morning commute to your weekend hangouts—and it will have a huge impact on your property's value down the road.

Singapore's property market is broadly split into three distinct regions, each with its own vibe, price tag, and lifestyle. Getting to know them is the first big step in zeroing in on your perfect spot.

Understanding Singapore’s Property Regions

Think of Singapore's residential map as a three-ring target. The bullseye is the most prestigious and pricey, and the value and character shift as you move outwards.

- Core Central Region (CCR): This is the heart of it all. We're talking prime districts like Orchard, Newton, and River Valley. The CCR is all about luxury, unmatched convenience, and being right next door to the Central Business District (CBD).

- Rest of Central Region (RCR): Think of this as the city fringe. It wraps around the CCR and offers a fantastic balance of easy access to the city and more reasonable prices. Popular spots here include Queenstown, Bishan, and Kallang.

- Outside Central Region (OCR): This is Singapore's suburban heartland. Areas like Tampines, Jurong, and Woodlands offer more space for your money, often with a great community feel and fantastic local amenities.

Your choice between the CCR, RCR, and OCR really comes down to balancing your budget, lifestyle, and commute. A luxury apartment in the CCR offers prestige and proximity, while a family home in the OCR might give you more breathing room and a quieter environment.

To get a real feel for what makes each area special, you’ll find our deep dive into the different neighbourhoods in Singapore incredibly helpful. It's a great way to pinpoint the districts that genuinely fit your life.

New Launch vs. Resale Apartments

Once you’ve got a location in mind, the next big question pops up: do you buy a brand-new unit from a developer or a resale apartment that's been lived in before? Both have their own distinct appeal and things to consider.

A new launch condo has that irresistible "first owner" shine. You get the latest facilities, brand-new fittings, and sometimes you can snag a good deal with early-bird pricing. The trade-off? Patience. You’re often buying off-plan and will have to wait a few years for it to be built.

A resale apartment, on the other hand, is ready when you are. You can move in almost immediately, and what you see is what you get—you can check the unit's condition, the actual view from the window, and get a feel for the neighbours. Resale units also tend to be a bit more spacious than their modern counterparts, which is a major bonus for families.

Choosing the Right Unit Type

The final piece of the puzzle is picking an apartment with the right size and layout. A smart way to gauge demand is to look at what's happening in the rental market.

For example, recent trends in Singapore's private rental market have been quite telling. As of mid-2025, while the supply of larger apartments has softened rents, studio units have held their prices steady. This points to a strong, consistent demand for smaller, more affordable homes, likely from single professionals and young couples. You can find more details on these rental shifts and learn about Singapore's market rental trends on Relocity.com.

Here's a quick rundown of the usual options:

- Studio & 1-Bedroom: Perfect for singles, couples, or as a straightforward investment property. They're generally easier to rent out and have a lower barrier to entry.

- 2-Bedroom: The versatile sweet spot. It's a hit with small families, couples with future plans, and investors who want a good balance of rental income and a wide range of potential tenants.

- 3-Bedroom & Larger: This is the classic family home. You get the space you need for kids, and these units are often in neighbourhoods known for good schools and family-friendly perks.

At the end of the day, finding the right apartment is all about matching your budget with your priorities. By thinking carefully about the region, the age of the property, and the type of unit you need, you’ll be well on your way to finding a place that’s not just a great home for today, but a smart investment for the future.

A Prime Example: UPPERHOUSE at Orchard Boulevard

It’s one thing to talk about location and lifestyle in theory, but let's look at how it all comes together in practice. A perfect real-world example is UPPERHOUSE at Orchard Boulevard, a luxury development that ticks all the boxes for a premium apartment in Singapore for sale. It’s a fantastic case study in how an address can be much more than just a home—it's a serious asset.

Tucked away in the prestigious District 10, UPPERHOUSE is the very definition of a Core Central Region (CCR) property. Its biggest draw is obvious: you're just a stone's throw from the world-famous Orchard Road shopping belt. That's not just about having designer stores on your doorstep; it’s about securing an address with lasting appeal and strong investment potential. Properties here are constantly sought after by high-calibre tenants and buyers.

For families, the location is a game-changer. You're surrounded by some of the best international schools and respected local institutions, which is a major factor that keeps property values and rental demand consistently high in this neighbourhood.

A Fresh Take on Urban Luxury

Location aside, what makes UPPERHOUSE stand out is the lifestyle it promises. The entire development is designed as an exclusive urban retreat, masterfully blending the buzz of the city with the calm of nature. It’s hard to believe that the Singapore Botanic Gardens, a UNESCO World Heritage Site, is just a short walk away, offering a lush green escape whenever you need it.

This combination of city convenience and natural serenity is a rare gem and a huge driver of its value. The amenities aren't just an afterthought either; they are carefully selected to enhance modern living:

- An infinity pool offering breathtaking panoramic views of the city.

- A gourmet pavilion perfect for hosting private dinners and entertaining guests.

- The Botanical Villa, a private wellness sanctuary complete with a hydropool and spa facilities.

The way luxury amenities are woven into green, tranquil spaces here really highlights a key shift in high-end property. It’s no longer just about the four walls of your apartment; it’s about the entire living experience.

Why It Makes Sense as an Investment

As a 99-year leasehold property right in the heart of Orchard, UPPERHOUSE presents a compelling investment case. It offers everything from cozy one-bedroom suites to sprawling four-bedroom residences, attracting a diverse pool of affluent buyers, including professionals, expats, and high-net-worth families.

What really seals the deal is its future-proof connectivity. The Orchard Boulevard MRT station is a mere 14 metres away. For anyone investing in prime property, that kind of effortless accessibility isn't just a bonus—it's a must-have.

Ultimately, UPPERHOUSE shows you exactly what to look for: a strategic location, brilliant design, and a developer you can trust. It’s the complete package for anyone searching for an exceptional apartment in Singapore for sale—a place that serves as both a beautiful home and a smart, long-term investment.

Common Questions About Buying an Apartment

Stepping into the Singapore property market is exciting, but let's be honest, it can also feel like a maze of new terms and rules. To help you find your way, we've tackled some of the most frequent questions buyers ask. Think of this as your quick-start guide to making smart, confident decisions.

Can Foreigners Buy Any Apartment?

The short answer is yes, with a few key conditions. Foreigners and Singapore Permanent Residents (PRs) are welcome to buy private apartments and condominiums. The main thing to be aware of is the Additional Buyer's Stamp Duty (ABSD).

Under the current rules, foreigners pay a 60% ABSD. For PRs, it's 5% on their first property and bumps up to 30% for any additional properties.

It's also good to know that certain property types, like landed homes (bungalows, semi-detached houses), are generally reserved for Singapore Citizens. While exceptions are possible, they're rare and need special government approval.

Is Freehold Always Better Than Leasehold?

This is a classic debate, and the truth is, neither is "better"—it all boils down to what you want to achieve with your property.

A freehold title means you own the property and the land it sits on forever. It's fantastic for building a family legacy and often carries a certain prestige, which is reflected in the price. You're buying permanence.

On the other hand, a 99-year leasehold property is usually more accessible in price and can sometimes offer better rental yields. For an investor focused on generating income, that’s a huge plus. And for most homeowners, a 99-year lease is plenty of time to build a life and a home.

The "better" choice is the one that aligns with your financial strategy. An investor might prioritize the immediate returns of a leasehold, while a family planning to pass down the property might value the permanence of a freehold title.

What Is the Minimum Downpayment Required?

When you’re taking a bank loan for your first property, the bank will typically finance up to 75% of the purchase price. This is known as the Loan-to-Value (LTV) ratio.

That means you'll need to cover the remaining 25% as a downpayment. Here’s how it works:

- At least 5% of the price must be paid in cash.

- The other 20% can be paid with cash or funds from your CPF Ordinary Account.

Don't forget to factor in other upfront costs like the Buyer's Stamp Duty (BSD) and legal fees, which will also need to be paid with cash or CPF.

How Long Does the Entire Buying Process Take?

It’s quicker than you might think! For a resale apartment (one that's already built), the entire journey from making an offer to getting the keys usually takes about 10 to 12 weeks.

This timeline gives enough breathing room for all the important steps: getting your loan approved, having your lawyer handle all the legal checks, and finalizing the ownership transfer. Of course, if you’re buying a brand new launch property, the timeline is much longer and depends on the construction schedule.

Starting your property search is a major milestone. For those who aspire to live at one of Singapore's most prestigious addresses, UPPERHOUSE at Orchard Boulevard represents the height of luxury, design, and convenience.

Discover what your future could look like at https://upperhouse.luxurycondo.sg.

Related Articles

Interested in UPPERHOUSE?

Discover luxury living at UPPERHOUSE at Orchard Boulevard. Get exclusive updates and be the first to know about availability.