A Guide to Apartment Sale in Singapore

Your expert guide to an apartment sale in Singapore. We cover market trends, legal steps, financing, and finding the perfect luxury property for your portfolio.

Buying an apartment in Singapore is an exciting prospect, but let's be honest—it can feel like a maze for anyone, whether you're a first-time buyer or a seasoned investor. This guide is your personal roadmap, designed to make sense of the entire journey, especially for investors and expats looking to plant roots in this incredible city.

Your Guide to Buying a Singapore Apartment

We're going to skip the fluff and get right to what you need to know. We’ll look at what’s happening in the market right now and what it means for your investment. You'll walk away understanding everything from the different types of property to the essential legal hoops and how to lock in the right financing. Think of this as your strategic playbook for acquiring a luxury apartment in one of Asia's most sought-after markets.

Taking the Market's Pulse

Singapore’s property market has a well-earned reputation for being remarkably resilient. It’s this stability and consistent demand that make it a solid choice for a long-term investment. Like any market, it has its natural ups and downs, but recent trends are showing a real return of buyer confidence. Getting a feel for this rhythm is the first step to timing your purchase perfectly.

The latest numbers show a significant jump in activity, a clear sign of the market's underlying strength. In July 2025, new private home sales shot up to 940 units. That's a huge leap from the 272 units sold just a month before in June 2025. This surge comes after a rollercoaster period since 2013, where sales averaged about 802 units a month but swung wildly from a peak of 2,793 units in March 2013 to a low of just 135 in December 2023. This recent recovery tells us that the appetite for private homes is back. For a deeper dive into these trends, you can explore this report on Singapore's new home sales.

Buying an apartment in Singapore isn’t just a transaction; it's a strategic investment in a global financial hub. A clear understanding of the process ensures your purchase is not only a perfect home but a sound financial decision.

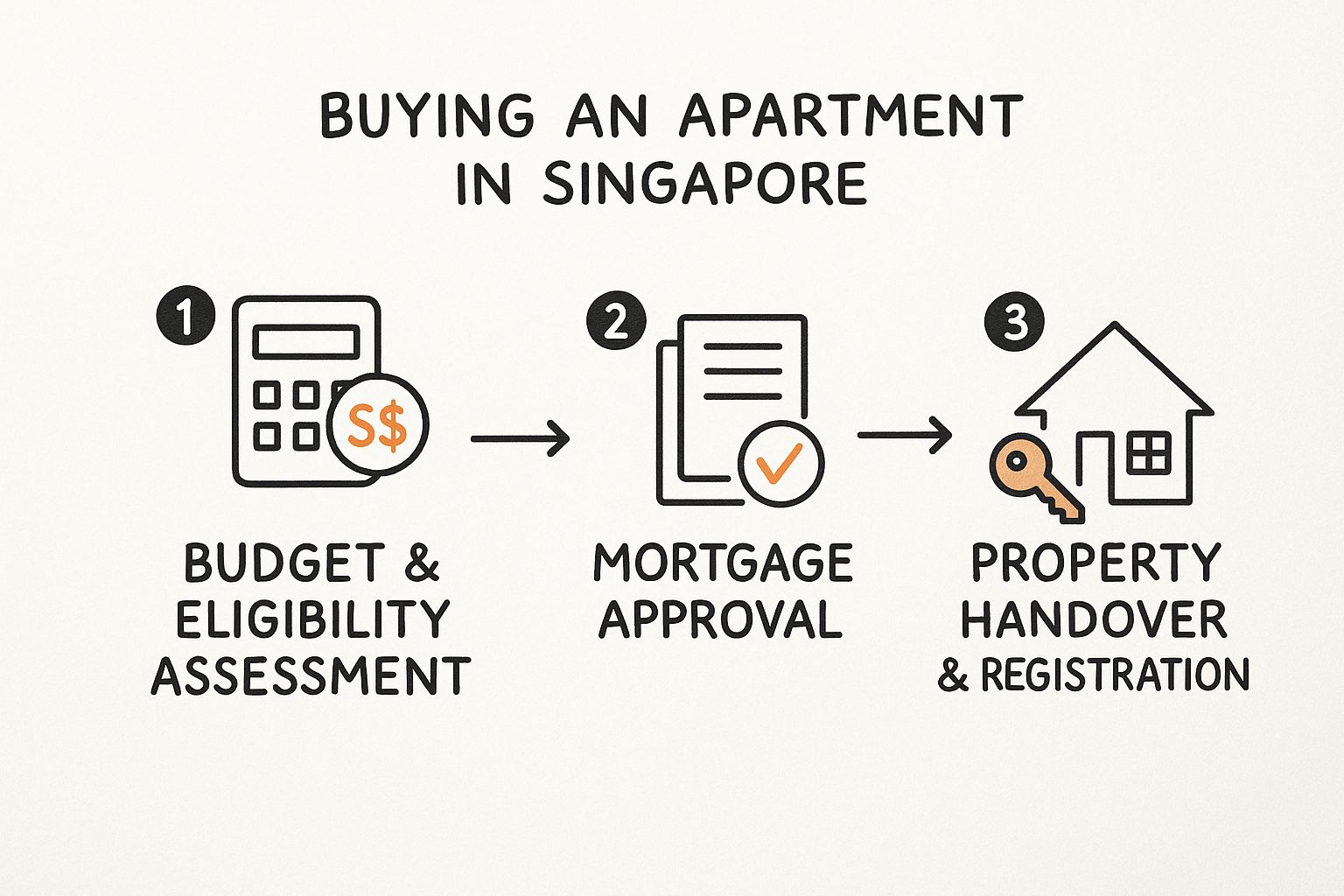

Key Steps in the Purchase Journey

To make things simpler, it helps to think of the buying process as a series of manageable stages. Each step has a clear purpose, moving you closer to getting those keys in your hand with total clarity. The main phases include:

- Planning and Financial Check-In: This is your foundation. You'll nail down your budget, figure out your eligibility as a buyer (which is especially important for foreigners), and get a solid idea of how much you can borrow.

- The Hunt and the Offer: Once your finances are sorted, the fun part begins. You can start exploring top-tier districts and exceptional developments like UPPERHOUSE at Orchard Boulevard, and eventually, make an offer on the one that feels right.

- Legal & Paperwork: This is where things get official. It involves securing an Option to Purchase (OTP), hiring a lawyer to handle the legal transfer (conveyancing), and signing the final Sale and Purchase Agreement.

- Closing and Handover: The home stretch! This final phase is all about settling the remaining payments, doing one last inspection of the property, and finally, receiving the keys to your new apartment.

Breaking down the process into these key stages makes the entire experience far more approachable. Here's a table that lays it all out for you.

Key Steps in the Singapore Apartment Purchase Process

This table summarizes the essential stages you'll navigate when purchasing a private apartment in Singapore, from initial planning to the final handover of your new home.

| Stage | Key Action | Typical Timeline |

|---|---|---|

| 1. Financial Pre-Approval | Assess your budget and secure an Approval-in-Principle (AIP) from a bank. | 1 - 2 weeks |

| 2. Property Search | Engage an agent, view properties, and identify your preferred unit. | 1 - 3 months |

| 3. Option to Purchase (OTP) | Pay a 1% option fee to secure the OTP from the seller. | 1 day |

| 4. Legal & Financing | Appoint a lawyer and secure the formal Letter of Offer from your bank. | Within 14 days of receiving OTP |

| 5. Exercise OTP | Sign the OTP and pay the remaining 4% of the downpayment to exercise the option. | Within 14 days of receiving OTP |

| 6. Stamp Duty Payment | Pay Buyer's Stamp Duty (BSD) and any applicable Additional Buyer's Stamp Duty (ABSD). | Within 14 days of exercising OTP |

| 7. Completion | Pay the remaining purchase price and take legal possession of the property. | 8 - 12 weeks after exercising OTP |

| 8. Key Collection | Conduct a final inspection and collect the keys to your new apartment. | On the completion date |

Following this structured path ensures you cover all your bases, turning a potentially complex process into a clear and confident journey toward ownership.

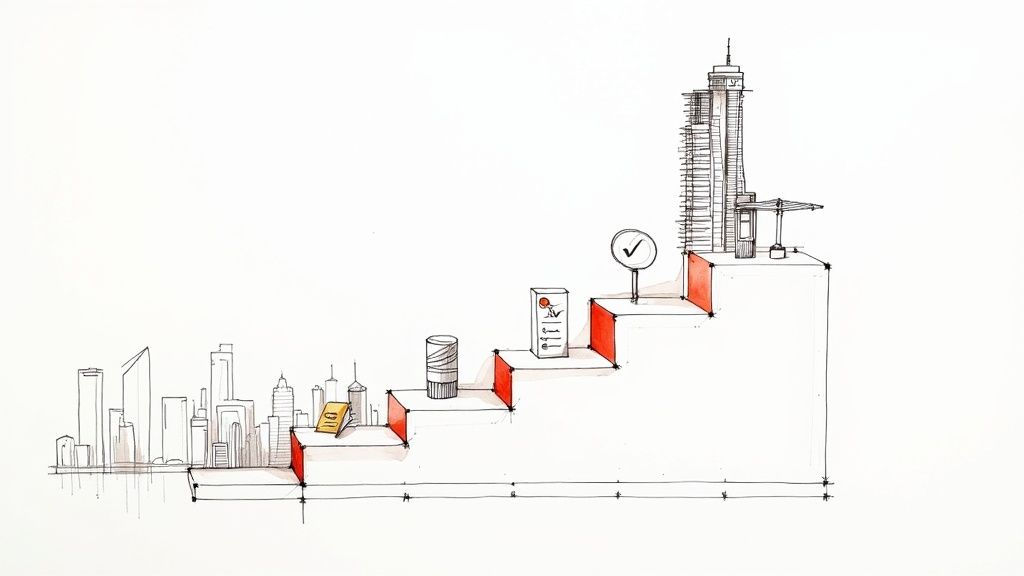

Understanding Singapore Property Market Cycles

Timing is everything in real estate, and nowhere is that truer than in Singapore. The property market here doesn't move randomly; it flows in predictable rhythms, almost like ocean tides, with clear patterns of growth, peaks, stabilization, and eventual correction. Getting a feel for these cycles is the first real step toward making a smart, well-timed investment.

Think of the market as a massive ship influenced by a few powerful currents. These are the economic engines that either push prices up or cause them to cool down. Experienced buyers learn to read these signs to see where the market is headed, not just where it stands today. That's the secret to spotting the right moment to buy for long-term capital appreciation.

Key Drivers of Market Momentum

So, what are these currents? A few key indicators really shape the direction of Singapore's property landscape. Keeping an eye on them gives you valuable clues about future price movements and demand.

- Interest Rates: This one's simple. When borrowing is cheap, more people can afford bigger loans, which naturally fuels demand and nudges prices up. When rates climb, it can put a damper on buying enthusiasm and slow things down.

- Government Policies: Singapore’s government is very hands-on, actively managing the market to prevent wild swings. Policies like the Additional Buyer's Stamp Duty (ABSD) are specifically designed to curb speculative buying and keep the market from overheating.

- Global Economic Health: As a major global hub, Singapore's fortunes are tied to international trade and investment. A booming global economy often means more foreign capital flows into local property, especially in the luxury sector.

If you want to dig a bit deeper into the mechanics of this, learning how to analyze market trends in a broader sense can really sharpen your investment instincts. The same core principles apply.

Interpreting Price Trends and Data

Looking back at historical data gives you the context you need to understand today's property values. The Urban Redevelopment Authority's (URA) Property Price Index is an indispensable tool for this, offering a clear picture of how prices have reacted through different economic climates.

For example, the latest data shows a market that continues to be remarkably resilient. Singapore's residential property price index didn't just grow; it hit an all-time high of 213.20 points in Q2 2025, up from 211.10 points in the previous quarter.

This steady climb points to strong underlying demand. Breaking it down further, the index for private homes rose by 3.33% year-on-year in early 2025. Even more telling for luxury buyers, non-landed private condominiums in prime districts saw a 4.74% annual price increase.

Understanding market cycles isn't about having a crystal ball. It’s about making calculated decisions based on evidence, recognizing patterns, and timing your purchase to align with favorable long-term conditions.

This data-driven approach helps take the emotion out of the decision, letting you see if current prices are backed by solid economic fundamentals. To really stay on top of your game, it helps to watch emerging https://upperhouse.luxurycondo.sg/blog/luxury-real-estate-trends, which can signal where buyer tastes—and future value—are heading.

By combining historical data with a sharp eye on today's economic drivers, you can position yourself to buy not just a beautiful home, but a sound financial asset.

Mastering the Purchase Process and Finances

Buying a luxury apartment in Singapore involves a very clear, structured process. While the system is designed for transparency, knowing the steps inside and out is what makes for a smooth, stress-free experience. Let's walk through the entire journey, from figuring out your budget to getting the keys in hand.

We'll cover the key stages, the people you'll need on your team (like your agent and lawyer), and the critical financial milestones you'll need to hit.

This process is a logical progression, starting with your financing and ending with the final property registration.

As you can see, getting your mortgage sorted is the crucial bridge between planning your purchase and making it a reality.

First Things First: Secure Your Financial Footing

Before you even start looking at listings, your very first move should be to get a handle on your finances. The best way to do this is by securing an Approval-in-Principle (AIP) from a bank. Think of an AIP as a bank's preliminary promise to lend you a specific amount, based on a check of your income and credit standing.

Walking into a negotiation with an AIP is a game-changer. It proves to sellers you're a serious, qualified buyer and gives you the confidence to know exactly what you can afford. Best of all, getting an AIP is completely free and comes with no obligations.

In Singapore, your borrowing power is regulated by the Loan-to-Value (LTV) limit. For your first home loan, the LTV is capped at 75% of the property’s price or valuation, whichever is lower. This means you’ll need to prepare a 25% down payment. At least 5% of that must be in cash, while the remaining 20% can come from either cash or your Central Provident Fund (CPF) Ordinary Account.

The Legal Side of the Purchase

Once your finances are lined up and you’ve found the perfect apartment, the legal gears start turning. This part of the process is managed by your real estate agent and a conveyancing lawyer, whose entire job is to ensure the legal transfer of ownership is handled correctly.

Here’s how it typically unfolds:

Making an Offer & Getting the OTP: You make your offer. If the seller accepts, they'll grant you an Option to Purchase (OTP). To secure this, you’ll pay a 1% option fee in cash. This is a big step—it legally prevents the seller from entertaining other offers for a set period, usually 14 days.

Lawyers and Loans: That 14-day window is crucial. You’ll need to officially appoint your conveyancing lawyer and take your AIP back to the bank to get a formal Letter of Offer for your mortgage.

Exercising the Option: Before the 14 days are up, you "exercise" the OTP by signing it and paying the next 4% of the purchase price. At this point, the OTP transforms into a binding Sale and Purchase Agreement. You're officially on your way.

The Option to Purchase (OTP) is more than just a piece of paper; it’s your exclusive right to buy the property. It carves out a vital breathing room for you to get all your legal and financial ducks in a row without pressure from competing buyers.

Understanding Your Tax Obligations

A huge part of budgeting for a property in Singapore is understanding the stamp duties involved. These are essentially taxes on the property transaction documents, and there are two main types to plan for.

First is the Buyer’s Stamp Duty (BSD), which everyone pays on any property purchase. The amount is calculated on a tiered basis depending on the property's price or market value.

The second, and often much larger, tax is the Additional Buyer’s Stamp Duty (ABSD). This applies to specific groups of buyers—namely Singaporeans buying their second property, as well as Permanent Residents and foreigners buying any residential property. The rates for ABSD can be quite steep and depend entirely on your residency status and how many properties you already own. For a clear picture of what you might owe, our in-depth guide to Additional Buyer's Stamp Duty is a must-read.

Keep in mind that these duties are due within 14 days of exercising the OTP. Your lawyer will handle the payment for you, but you absolutely need to factor these costs into your budget from day one to avoid any last-minute surprises.

Finding Your Perfect Neighbourhood

When it comes to Singapore real estate, the old mantra "location, location, location" isn't just a cliché—it's the golden rule. Picking the right neighbourhood is probably the most crucial decision you'll make. It shapes your daily life, your commute, your weekend plans, and, just as importantly, the long-term value of your investment. You're not just buying an apartment; you're buying into a lifestyle.

Think of Singapore’s property market like a tiered wedding cake. Each layer has its own unique flavour and appeal, but the very top is reserved for the most exquisite creations. That top tier is the Core Central Region (CCR), the absolute epicentre of luxury and prestige.

The Prestigious Core Central Region

The CCR is, without a doubt, the pinnacle of Singapore's residential scene. It covers the city's most sought-after postcodes, including the iconic districts of Orchard, Tanglin, and Newton. This is the natural habitat for high-net-worth individuals and top executives who demand the best and want everything right at their fingertips.

Living in the CCR means the very best of Singapore is literally on your doorstep. You're just a stone's throw from the world-class designer boutiques on Orchard Road, a short walk from Michelin-starred restaurants, and close to exclusive private clubs and leading international schools. Developments like UPPERHOUSE at Orchard Boulevard are the perfect embodiment of this lifestyle—effortless connectivity to the city's pulse, combined with the tranquillity of a private, luxurious sanctuary.

The real magic of the CCR is its timeless appeal. There's a limited supply of land here, which gives properties an inherent scarcity and prestige. Owning a piece of the CCR isn't just buying real estate; it's securing a globally recognized standard of living that has proven to hold its value through thick and thin.

This resilience isn't just talk. The numbers back it up. Even amidst global economic headwinds, Singapore's prime property market has shown remarkable strength. Data from the Federal Reserve Economic Data (FRED) shows the real residential property price index climbed from 115.05 in Q3 2023 to 117.89 by Q1 2024. It’s a testament to the market's solid fundamentals. You can dig into the numbers yourself and understand Singapore's property price trends on FRED.

Exploring Beyond The Core

While the CCR is the crown jewel, Singapore offers fantastic opportunities in its other regions, each with its own distinct character.

Rest of Central Region (RCR): This is the city fringe. Think of it as the sweet spot between the vibrant city core and the quieter suburbs. The RCR offers a great mix of easy access to the Central Business District while providing a more relaxed, community-focused vibe with more green spaces.

Outside Central Region (OCR): Known as the heartlands, this is where the majority of Singaporeans live. The OCR delivers incredible value, often with more spacious homes, abundant family-friendly amenities, and rapidly improving infrastructure that points to strong potential for future growth.

Each region caters to a different buyer with different priorities. To help you get a clearer picture, we've broken down the key differences.

Comparing Singapore's Prime Residential Districts

This table offers a quick snapshot of what each region brings to the table, helping you align your lifestyle goals with the right location.

| Region | Key Districts | Primary Appeal | Typical Property Profile |

|---|---|---|---|

| Core Central Region (CCR) | Orchard, Tanglin, Newton, Sentosa | Prestige, luxury amenities, global connectivity, status | High-end condominiums, penthouses, luxury bungalows |

| Rest of Central Region (RCR) | Queenstown, Bishan, Geylang | City-fringe convenience, strong communities, value | Mid-to-high-end condos, well-established HDB estates |

| Outside Central Region (OCR) | Tampines, Punggol, Jurong | Space, family-friendly living, affordability, growth potential | Large condos, executive condominiums, modern HDB towns |

Ultimately, choosing between the vibrant energy of the CCR, the balanced lifestyle of the RCR, or the budding potential of the OCR is the first major step in your property journey. If you want to dive deeper, our detailed guide to Singapore's diverse neighbourhoods provides an insider's look into the unique personality of each area.

Taking the time to understand these distinctions ensures that your new home isn't just a great financial asset but a perfect fit for your life.

A Case Study in Luxury: UPPERHOUSE at Orchard Boulevard

Theory is great, but let's get our hands dirty with a real-world example. To see how these ideas of location and value play out in the market, we're going to look at a prime example of an apartment sale in singapore—UPPERHOUSE at Orchard Boulevard. Think of this not as a sales pitch, but as a practical benchmark. By dissecting what makes a property like this tick, you'll build a mental checklist for spotting a truly high-value investment.

We'll break down the key pillars of its appeal, from its world-class address to the thoughtful design choices aimed squarely at a sophisticated, global buyer.

The Power of a Prime Address

The location of UPPERHOUSE is a masterclass in "right place, right time." It sits squarely in the heart of the Orchard district, which puts residents at the absolute epicentre of Singapore’s luxury lifestyle belt. This isn't just a matter of convenience; it’s about owning a piece of a neighbourhood with an enduring, global reputation.

Imagine stepping out of your door and being moments away from designer boutiques, world-class art galleries, and Michelin-starred restaurants. This immediate access is a massive value driver. On a practical level, its proximity to the Orchard Boulevard MRT station—a mere 14 meters away—is the icing on the cake, offering seamless connections across the entire island.

Exclusivity and Architectural Intent

Location is one thing, but the building itself has to deliver. The design philosophy behind UPPERHOUSE clearly speaks to its intended audience. By offering a very limited collection of residences, it fosters a sense of privacy and community that you just don't get in massive, sprawling developments. That exclusivity is a core ingredient in the luxury recipe.

The architecture itself is designed to be a sanctuary from the city's hum. Some of the key features that stand out include:

- Bespoke Residences: With layouts ranging from intimate one-bedroom units to sprawling four-bedroom suites—many with private lifts—it caters to everyone from single professionals to families.

- Curated Amenities: The infinity pool with its jaw-dropping city views, a sophisticated residents' lounge, and a private wellness retreat called The Botanical Villa aren't just add-ons. They're designed as genuine extensions of your living space.

- Green Sanctuary: Even in its dense urban setting, the development is just a short walk from the Singapore Botanic Gardens, a UNESCO World Heritage Site. That connection to nature is priceless.

In luxury real estate, the property itself is only half the story. The other half is the lifestyle it unlocks. A development like UPPERHOUSE isn't just designed as a place to live; it's a platform for a life defined by convenience, privacy, and access to the best of everything.

By looking closely at these elements—a top-tier location, intentional exclusivity, and lifestyle-focused amenities—you start to build a clear framework. The next time you look at a potential apartment sale in singapore, you'll know what to ask. Does the location have a truly lasting reputation? Does the design put the resident experience first? Do the amenities genuinely elevate daily life?

Using a development like UPPERHOUSE as your reference point sharpens your investment eye. It helps you cut through the marketing noise and separate fleeting trends from timeless, undeniable value.

Your Final Checklist for a Smooth Handover

You’ve navigated the market, signed the agreements, and the finish line is in sight. This is it—the final leg of your journey to owning a luxury apartment in Singapore. But don't rush these last few steps. Getting the handover right is what turns a signed contract into a home you love, with no nasty surprises down the line.

Think of it as the final, detailed inspection of a bespoke suit before you take it home. You want to make sure every stitch is perfect and it fits exactly as you envisioned. This is your chance to do just that with your new property.

The Final Inspection and Key Collection

This isn't just a casual glance around the apartment. It's a meticulous, top-to-bottom review to ensure everything promised in the Sale and Purchase Agreement is delivered. Come prepared with a checklist, a phone for photos, and a critical eye. Your mission is to identify any defects the developer needs to fix before you officially take possession.

Here's a quick guide on what to scrutinize:

- Fixtures and Fittings: Are the appliances, cabinets, and bathroom fittings the exact models specified? Don't just look—test them. Run the dishwasher, turn on the oven, check every single fixture.

- Utilities: Turn on all the taps and showers. You're checking for water pressure and any signs of leaks. Flick every light switch and plug a phone charger into every power outlet to make sure they all work.

- Surfaces: Look closely at the walls, floors, and ceilings. You're hunting for cracks, chips, scratches, or uneven paintwork. Open every wardrobe and cabinet door to inspect the interior finishes too.

- Doors and Windows: Open and close every single one. Do they move smoothly? Do they lock securely? Look for drafts or gaps in the seals.

Once you’re completely happy with the state of the unit, it’s time to collect the keys. This usually takes place at your lawyer's office. Here, you'll settle any final payments, like the last installment of the purchase price and other administrative fees. With the paperwork signed and payments cleared, the keys are finally yours.

Life as a Singapore Apartment Owner

Getting the keys is a huge milestone, but your responsibilities as an owner are just beginning. In Singapore, when you buy a condominium, you automatically become part of the Management Corporation Strata Title (MCST). This is the legal body that manages the entire development.

You can think of the MCST as the local council for your "vertical village." It's managed by a council of fellow owners and is responsible for everything that keeps the development pristine—from maintaining the swimming pool and gym to paying the security staff.

As an owner, you'll contribute monthly maintenance fees. This money goes towards the day-to-day upkeep of all the shared facilities and also builds a "sinking fund" for major, long-term repairs like repainting the façade or overhauling the lifts years down the road.

The very last step is getting your personal utilities sorted. You’ll need to set up your own accounts for electricity, water, and gas with providers like SP Group. This is usually a simple online process. Once that's done, you can finally move in, unpack, and start enjoying your beautiful new home. Following these steps will ensure your apartment sale in singapore ends on a high note, setting you up for a fantastic ownership experience.

Your Questions Answered: A Guide to Buying an Apartment in Singapore

Jumping into Singapore’s property market can feel a little overwhelming, and it's natural to have questions. Let's break down some of the most common queries buyers have, especially when looking at the luxury segment.

Think of this as your starting point for getting comfortable with the key concepts, from who can buy what to the different types of ownership you'll encounter.

Can Foreigners Buy An Apartment In Singapore?

Yes, they can, and it's a major reason Singapore is such a global property hub. Foreigners are free to purchase condominiums and private apartments without needing prior government approval, making the process straightforward.

The main thing to keep in mind is the distinction between private and public property. Foreign ownership is restricted when it comes to new public housing (HDB flats) and most landed homes like bungalows. You'll also need to factor in the Additional Buyer's Stamp Duty (ABSD)—a tax for foreign buyers that's a critical part of your budget calculations.

The straightforward process for foreign investment in private condos is a cornerstone of Singapore's real estate appeal. While the ABSD is a significant consideration, the system is transparent and secure, giving international buyers peace of mind.

What Is The Difference Between Freehold And Leasehold?

This is all about how long you own the property. It’s a fundamental concept in Singapore real estate, and the two types are freehold and leasehold.

Freehold: This is the big one. Freehold means you own the property and the land it's on forever. There's no expiry date. Because of this permanence and legacy potential, freehold properties are rare and highly prized, particularly in prime districts.

Leasehold: Most properties in Singapore, including almost all new condominiums, are sold on a 99-year lease from the government. Don't let the "lease" part fool you; a 99-year lease on a condo in a fantastic location is still a powerful asset with strong potential for growth over your investment timeline.

What Are The Main Property Types For Sale?

Singapore's housing market is split into two main camps: public and private. If you're looking for a luxury apartment, your focus will be entirely on the private market.

Within that world, condominiums are the go-to choice for international buyers and investors. Why? They offer a complete lifestyle, not just a home. You get access to incredible facilities like swimming pools, top-tier gyms, tennis courts, and the security of a 24-hour concierge.

Apartments are quite similar but usually come from smaller, more boutique developments with fewer shared amenities. Both are great options, but condominiums deliver that full-service, resort-like experience that many luxury buyers are looking for.

At UPPERHOUSE at Orchard Boulevard, we've curated a collection of luxury residences that perfectly suit a global lifestyle. Our prime location, paired with exclusive amenities and stunning architecture, sets a new standard for city living. See what your future could look like and explore our residences today.

Related Articles

Interested in UPPERHOUSE?

Discover luxury living at UPPERHOUSE at Orchard Boulevard. Get exclusive updates and be the first to know about availability.