Understanding Additional Buyer Stamp Duty in Singapore

Learn everything about the additional buyer stamp duty, including rates, who pays, and tips to manage this Singapore property tax effectively.

If you're thinking about buying property in Singapore, you've almost certainly heard of Additional Buyer's Stamp Duty, or ABSD. What exactly is it? Think of it as a cooling measure, a targeted tax layered on top of the standard Buyer's Stamp Duty (BSD). Its main job is to keep the property market in check and ensure housing stays within reach for Singaporeans.

For anyone buying residential property here, especially a second home or as a foreign investor, understanding ABSD isn't just helpful—it's absolutely essential.

Why Does Singapore Need ABSD?

The additional buyer stamp duty is much more than just another tax. It's one of the Singaporean government's primary tools for maintaining a stable and sustainable property market. The government uses ABSD like a control valve, adjusting it in response to market heat to prevent speculative bubbles and align property prices with the country's economic health.

When demand from investors and foreign buyers starts pushing prices up too fast, the government can turn the valve by raising ABSD rates. This immediately makes it more expensive to buy multiple properties, which helps to cool demand and level the playing field for genuine homebuyers.

A Powerful Tool for Market Stability

Singapore’s land-scarce reality means the government has to be proactive. Since introducing ABSD back in 2011, they've used it strategically to manage the housing market. The rates have been adjusted upwards several times, with the most significant hikes aimed at foreign buyers and corporate entities to discourage purely speculative buying.

A perfect example of this was on April 27, 2023, when the ABSD rate for foreign buyers was hiked to a staggering 60%. This wasn't a random move; it was a direct and decisive action to counter a sharp rebound in property prices, showcasing the government’s commitment to intervention.

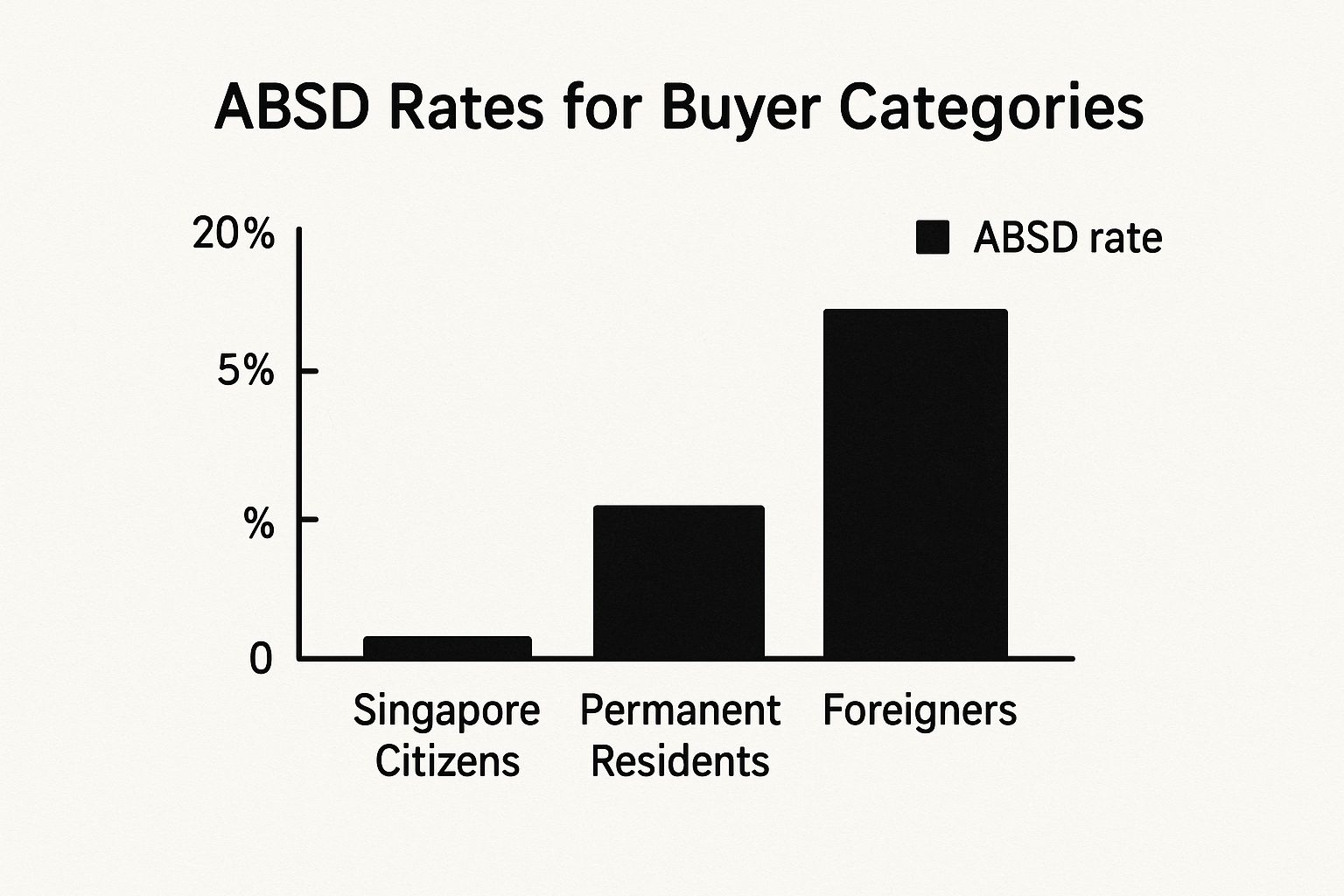

The policy works by creating distinct tiers of tax liability based on the buyer's profile. The central idea is to prioritize owner-occupation over investment. Here’s how it breaks down:

- Singapore Citizens: They get a pass on their first home, paying no ABSD. But for a second or third property, the rates jump significantly.

- Permanent Residents (PRs): They pay ABSD right from their first property purchase, and the rate increases for any subsequent ones.

- Foreigners and Entities: These groups face the highest ABSD rates from the get-go, a clear signal of the policy's intent to curb price inflation driven by foreign capital.

This tiered system is a masterclass in policy design. It carefully places the heaviest financial load on investment-driven purchases, protecting the ability of Singaporeans to buy a home for their families. It’s a delicate balancing act between fostering economic growth and ensuring social stability.

Grasping these fundamentals is non-negotiable, whether you're a local looking to upgrade or an international client considering a luxury https://upperhouse.luxurycondo.sg/blog/orchard-road-condo. To get even deeper into the numbers and analyze specific properties, you might find an AI Agent for Real Estate Property Analysis to be a useful resource for crunching data on investment costs and potential returns.

Who Pays ABSD and What Are the Current Rates?

When you’re buying property in Singapore, one of the first questions you’ll ask is, "How much is the stamp duty?" But the real question is about the Additional Buyer’s Stamp Duty, or ABSD. Who pays it, and just how much will it add to your costs?

There’s no single answer. Your ABSD rate depends entirely on your specific buyer profile. Think of it as a tiered system where your residency status and the number of residential properties you already own are the two deciding factors. This isn't just random taxation; it's a deliberate policy tool designed to keep the property market stable and prioritize Singaporeans buying a home to live in.

As you can see, the financial bar is set at different heights for different people, which gets right to the heart of the policy’s purpose.

Breaking Down the Buyer Profiles

So, how does this actually work in practice? The government uses this tiered structure to guide the market, making it easier for citizens to own their homes.

Here’s a look at the different buyer groups:

Singapore Citizens (SC): If you're a Singapore Citizen buying your first home, you’re in the clear. You pay 0% ABSD. This is a massive advantage and the clearest signal of the government’s pro-homeownership stance. The moment you buy a second property, though, that changes—and the rate is steep.

Singapore Permanent Residents (SPR): For SPRs, the ABSD kicks in right from the very first property. This is the first level of the cooling measures, creating a clear financial advantage for citizens in the property market. Like citizens, the rates for SPRs climb for any subsequent properties.

Foreigners: Anyone who is not a Singapore Citizen or SPR faces the highest ABSD rates by a wide margin. This isn't an accident. It’s a direct measure to cool foreign investment and prevent external capital from driving prices beyond the reach of locals.

Entities (including Companies): When a company or any other entity purchases residential property, it gets hit with a very high ABSD rate. This also includes an additional non-remittable duty for developers to stop them from hoarding residential land and sitting on it.

The logic is simple: the more detached a buyer is from being a citizen buying their primary home, the higher the tax. It’s a framework built to give priority to those who are putting down roots in Singapore, rather than those buying purely for investment.

A Clear View of the Current Rates

To get a real handle on this, it's best to see the numbers side-by-side. The rates we’re looking at here came into effect on April 27, 2023, as part of the government's ongoing effort to maintain a stable and sustainable property market. If you're curious about the wider impact of these policies, our analysis of luxury real estate market trends offers some valuable context.

The table below breaks down the current ABSD rates clearly.

Current Additional Buyer's Stamp Duty (ABSD) Rates

| Buyer Profile | First Residential Property | Second Residential Property | Third and Subsequent Residential Property |

|---|---|---|---|

| Singapore Citizens | 0% | 20% | 30% |

| Singapore Permanent Residents | 5% | 30% | 35% |

| Foreigners | 60% | 60% | 60% |

| Entities (including Companies) | 65% | 65% | 65% |

Remember, these percentages are calculated based on either the property's purchase price or its market value, whichever figure is higher. Figuring out which category you fall into is the most critical first step to accurately budgeting for your property purchase.

How to Calculate Your ABSD Payable

It’s one thing to talk about percentages, but it’s another to see what those numbers actually mean for your bank account. This is where we get down to brass tacks. Calculating your additional buyer stamp duty is thankfully straightforward, but the final figure can dramatically shape your budget and investment plans.

The formula itself is simple. You take the property's value and multiply it by your specific ABSD rate. But there’s a small catch you need to be aware of. The Inland Revenue Authority of Singapore (IRAS) always bases the tax on the higher of either the purchase price or the property’s current market value.

So, the calculation looks like this:

ABSD Payable = (Purchase Price or Market Value, whichever is higher) x Your ABSD Rate (%)

This "whichever is higher" clause is a crucial detail. It’s in place to prevent buyers from artificially lowering the declared price to pay less tax, ensuring the duty reflects the property’s true worth.

Putting the Formula into Practice

Let's run through a few scenarios to see how this plays out in the real world. For these examples, we'll use a property with a price and market value of S$2,000,000.

Example 1: A Singapore Citizen Buys a Second Property

Imagine a Singapore Citizen (SC) purchasing their second residential property. The ABSD rate for this profile is 20%.

- Property Value: S$2,000,000

- ABSD Rate: 20%

- Calculation: S$2,000,000 x 0.20

- Total ABSD Payable: S$400,000

That S$400,000 is a significant upfront cost that has to be factored into the purchase price. It’s not a small sum by any measure.

Example 2: A Foreigner Buys Their First Property

Now, let's look at a foreigner buying their first property in Singapore. The government applies a flat 60% ABSD rate to all residential purchases by foreigners, no matter if it's their first or fifth.

- Property Value: S$2,000,000

- ABSD Rate: 60%

- Calculation: S$2,000,000 x 0.60

- Total ABSD Payable: S$1,200,000

The difference between the two examples is staggering. It clearly shows how the system is weighted to favour local buyers.

Untangling Joint Purchases

What if people with different residency statuses buy a property together? This happens all the time, particularly with married couples where one person is a Singapore Citizen and the other is a Permanent Resident or a foreigner.

When it comes to joint purchases, the rule is simple and absolute: the highest ABSD rate among all buyers applies to the entire purchase.

There’s no averaging or splitting the difference. IRAS will look at all the buyers, identify who has the highest rate, and apply that rate to the property's full value.

Let's see this in action.

Example 3: Joint Purchase by a Citizen and a Foreigner

A married couple—one Singapore Citizen, one foreigner—is buying their first home together for S$2,000,000. On their own, the citizen would pay 0% ABSD. But the foreigner's rate is 60%.

- Property Value: S$2,000,000

- Applicable Rate: The foreigner's 60% rate (the highest of the two)

- Calculation: S$2,000,000 x 0.60

- Total ABSD Payable: S$1,200,000

This rule effectively closes any loopholes that might weaken the cooling measures. When budgeting for a property, you need to account for every single cost, and stamp duties are a major one. Using a detailed real estate flip profit estimator can help you get a clearer picture of your total outlay and potential returns. Once you can confidently predict your tax obligations, you're in a much stronger position to make smart moves in Singapore's competitive property market.

Discovering ABSD Exemptions and Remissions

https://www.youtube.com/embed/A_84Yb4DjYU

Navigating the additional buyer stamp duty can feel like a maze, but paying it isn't always a given. The Inland Revenue Authority of Singapore (IRAS) has created specific pathways for exemption or remission, which can save you a substantial amount of money. Think of these not as loopholes, but as structured relief for people in particular situations.

Understanding these provisions is vital, especially for married couples looking to buy a new home together. For most, this involves getting a refund on the ABSD you've already paid, but only if you meet a strict set of conditions. It turns the ABSD from a permanent tax into a temporary, refundable outlay.

The secret is knowing your eligibility before you commit to a purchase. Finding out about these options after the fact can lead to missed deadlines and a lot of unnecessary financial stress. Let's walk through the main ways you can qualify for an exemption or remission.

ABSD Remission for Married Couples

This is by far the most common route people take, designed specifically to help married couples own a single home together. It's a lifesaver for couples upgrading their property or those with mixed citizenships who would otherwise be hit with a hefty ABSD rate.

To get this remission, your couple must include at least one Singapore Citizen (SC) spouse. The main requirement is simple: you must sell your first home within a set timeframe after buying your second one.

Key Eligibility Requirements:

- Marital Status: You must be legally married when you purchase the new property.

- Citizenship: At least one of you has to be a Singapore Citizen.

- Property Ownership: Besides the first property you're planning to sell, you can't own any other residential properties.

- Sale of First Property: You must sell your first property within six months of either the purchase date of the new property (if it's a resale) or the issue date of its Temporary Occupation Permit (TOP)/Certificate of Statutory Completion (CSC), whichever comes first.

The six-month deadline is ironclad. If you miss it, you lose the entire remission amount. This really highlights how critical it is to have a solid plan in place to sell your current home quickly.

The way it works is you pay the full ABSD upfront. Once you’ve sold your first property and met the conditions, you apply to IRAS for a full refund. This system ensures everyone complies while still giving genuine owner-occupiers a break.

Exemptions Under Free Trade Agreements

Beyond the remission for married couples, Singapore also extends ABSD exemptions to citizens and nationals of a few select countries, thanks to Free Trade Agreements (FTAs). This is a game-changing benefit for eligible foreigners looking to invest or live here.

Under these FTAs, nationals from these countries get the same treatment as Singapore Citizens when buying their first residential property. In simple terms, this means they pay zero ABSD on that purchase.

Countries with this special provision include:

- United States of America: Citizens are eligible.

- Switzerland: Nationals and Permanent Residents are eligible.

- Liechtenstein: Nationals and Permanent Residents are eligible.

- Norway: Nationals and Permanent Residents are eligible.

- Iceland: Nationals and Permanent Residents are eligible.

This exemption puts eligible foreign buyers on the same footing as Singaporeans for their first home purchase—a massive advantage. If you're considering buying in a prime area, our guide to the top neighbourhoods in Singapore can help you find the perfect spot. Just remember, this benefit is strictly for the first property. Any subsequent purchases will attract the full foreigner ABSD rate.

Legal Strategies for Managing Your ABSD

Aside from the standard exemptions, there are a few established legal avenues that experienced buyers use to structure their property ownership and minimise their additional buyer stamp duty liability. These aren't loopholes; they're legitimate strategies that require meticulous planning and solid professional advice. When executed correctly, they can lead to substantial savings, especially if you're aiming to build a property portfolio.

Think of it less like dodging a tax and more like a business structuring its assets for maximum efficiency. It’s all about working within the existing legal framework to achieve the best possible financial outcome.

Two of the most common strategies you'll hear about are "decoupling" and setting up a property trust. Both are quite involved and come with their own set of rules and potential traps, which is why getting professional guidance isn't just recommended—it's essential.

The Decoupling Method

Decoupling is a popular move for married couples who jointly own a property and want to buy another without getting hit with a hefty ABSD bill. The process is straightforward in concept: one spouse legally transfers their share of the current home to the other. This is usually done as a formal sale, not a simple gift.

Once that transaction is finalised, the spouse who sold their share is now, in the eyes of the law, a first-time homebuyer. If they're a Singapore Citizen, they can go out and purchase a new property with zero ABSD. This effectively frees up one person's "first-timer" status to invest in the market again.

Of course, this process isn't free. You have to account for:

- Buyer's Stamp Duty (BSD): The spouse taking over the full ownership will have to pay BSD on the value of the share they are acquiring.

- Seller's Stamp Duty (SSD): If you haven't owned the property for at least three years, SSD might be a factor.

- Legal Fees: Lawyers are needed to handle the ownership transfer, and that comes with its own costs.

Decoupling can be a fantastic tool, but you have to do the math. The real question is whether the costs of the transfer—BSD, legal fees, and possibly SSD—are less than the 20% ABSD you'd otherwise pay on a second property.

Purchasing Property Through a Trust

Another, more advanced strategy is to purchase a property under a trust, often for a child who is a minor. This allows parents to invest in a property specifically for their children's future. When you transfer a residential property into a living trust, you'll have to pay ABSD (Trust) upfront.

The real advantage here is the potential for a refund. You can apply to IRAS for a full remission of the ABSD (Trust) paid, but only if the trust meets very strict conditions. The most important one is having a clearly identifiable beneficial owner who will have the property vested in their name upon creation of the trust. This effectively turns the upfront tax into a refundable deposit, provided you've structured the trust correctly from the start.

When you're dealing with complex purchases involving ABSD and trusts, a reliable real estate closing agent is indispensable for ensuring the transaction proceeds smoothly and all legal requirements are met.

Singapore's aggressive ABSD rates—think 30% for citizens on their third home or a staggering 60% for foreigners—are a world away from global norms. In major hubs like Spain or Thailand, stamp duties are significantly lower. This isn't an accident; it highlights Singapore's unique policy focus. These targeted measures are a fiscal tool designed to manage foreign investment and cool demand in a land-scarce nation, all in an effort to keep the property market stable and housing affordable for citizens. You can find a more detailed breakdown in this global stamp duty comparison.

Even after getting a handle on the rules, real-life situations can throw a wrench in the works and bring up tricky questions about the Additional Buyer Stamp Duty. Let's tackle some of the most common queries that pop up. Think of this as your go-to guide for those "what if" moments.

What If I Inherit a Property? Do I Pay ABSD?

Good news on this front. Inheriting a residential property won't trigger any ABSD. The tax is specifically linked to the act of purchasing a home, not acquiring one through a will or as a gift.

This means if a property is passed down to you, you can breathe a sigh of relief on the ABSD front, though it's always wise to check if other estate duties might apply.

Does ABSD Apply to Commercial or Industrial Properties?

Nope. ABSD is a housing market measure, plain and simple. It only applies to residential properties.

So, if you're looking to buy an office, a shophouse, or an industrial warehouse, you won't have to factor ABSD into your costs. The government’s cooling measures are laser-focused on the residential sector.

Can I Use My CPF to Pay for ABSD?

Yes, but there's a crucial catch. You can't just pay it directly from your Central Provident Fund (CPF) account at the time of purchase.

You must first pay the entire ABSD amount in cash. Only after that can you apply for a reimbursement from your CPF Ordinary Account (OA). This is, of course, subject to your available balance and CPF's own rules and limits.

The key takeaway? You need to have the full cash amount ready upfront, even if you plan to use your CPF funds to replenish your bank account later.

What Happens If I Buy My Second Home Before Selling My First?

This is a classic scenario for upgraders, and the rules are very specific. If you're a married couple and at least one of you is a Singapore Citizen, you can apply to get your ABSD payment back.

To qualify for this refund, you have to sell your first property within a tight timeframe:

- Sell within six months of buying the second property (if it’s already built).

- Sell within six months of the new property receiving its Temporary Occupation Permit (TOP) or Certificate of Statutory Completion (CSC), whichever comes first.

Sticking to this deadline is non-negotiable if you want a full refund of the ABSD you paid.

At UPPERHOUSE, we know that understanding the fine print of property rules is just one part of the journey. The real prize is finding a luxury home that makes all the effort worthwhile. Discover how our prime location and unmatched amenities can be your reward.

Explore your future at UPPERHOUSE.

Related Articles

Interested in UPPERHOUSE?

Discover luxury living at UPPERHOUSE at Orchard Boulevard. Get exclusive updates and be the first to know about availability.