Decoding Luxury Real Estate Market Trends

Explore the key luxury real estate market trends shaping HNWI investments. Our expert guide covers buyer motivations, key markets, and future forecasts.

The global luxury real estate market is showing remarkable strength right now, driven by a clear and strategic pivot toward tangible assets. In a world of economic jitters, affluent buyers are looking for more than just a beautiful home; they want stability, exclusivity, and a solid hedge against uncertainty. This is fueling a surge in demand across the world's most desirable markets.

Decoding The Global Luxury Real Estate Landscape

To really get a handle on high-end property, you have to look past the stunning architecture and prestigious postcodes. It's a complex financial ecosystem. Think of it less as a simple market and more like a global chessboard where high-net-worth individuals (HNWIs) are making strategic moves with their wealth. When other markets get choppy, prime real estate becomes a fortress—a safe harbor for capital that also happens to deliver incredible lifestyle benefits.

This isn't just happening in the usual suspects like London or New York, either. We're seeing a fascinating expansion into new territories. From the sun-soaked coasts of the Mediterranean to the vibrant, fast-growing cities of Southeast Asia, the appetite for premium, secure property investments is growing right alongside global wealth.

The Financial Undercurrents of Luxury Property

At its heart, the luxury real estate market is powered by the ever-growing number of HNWIs and what they look for in an investment. For them, a trophy property is rarely just a place to live. It's a critical piece of a diversified portfolio. This is why the high-end market often marches to the beat of its own drum, largely unbothered by the ups and downs of the general housing market. The focus here is on capital preservation and long-term growth.

The numbers back this up. The global luxury real estate market was valued at roughly USD 289.6 billion in 2023. Projections show it climbing to around USD 515.3 billion by 2032, which is a healthy compound annual growth rate (CAGR) of 6.5%. This growth is being fed by powerful forces like increasing urbanization and rising disposable incomes. You can dig into a complete market analysis to see a full breakdown of these drivers.

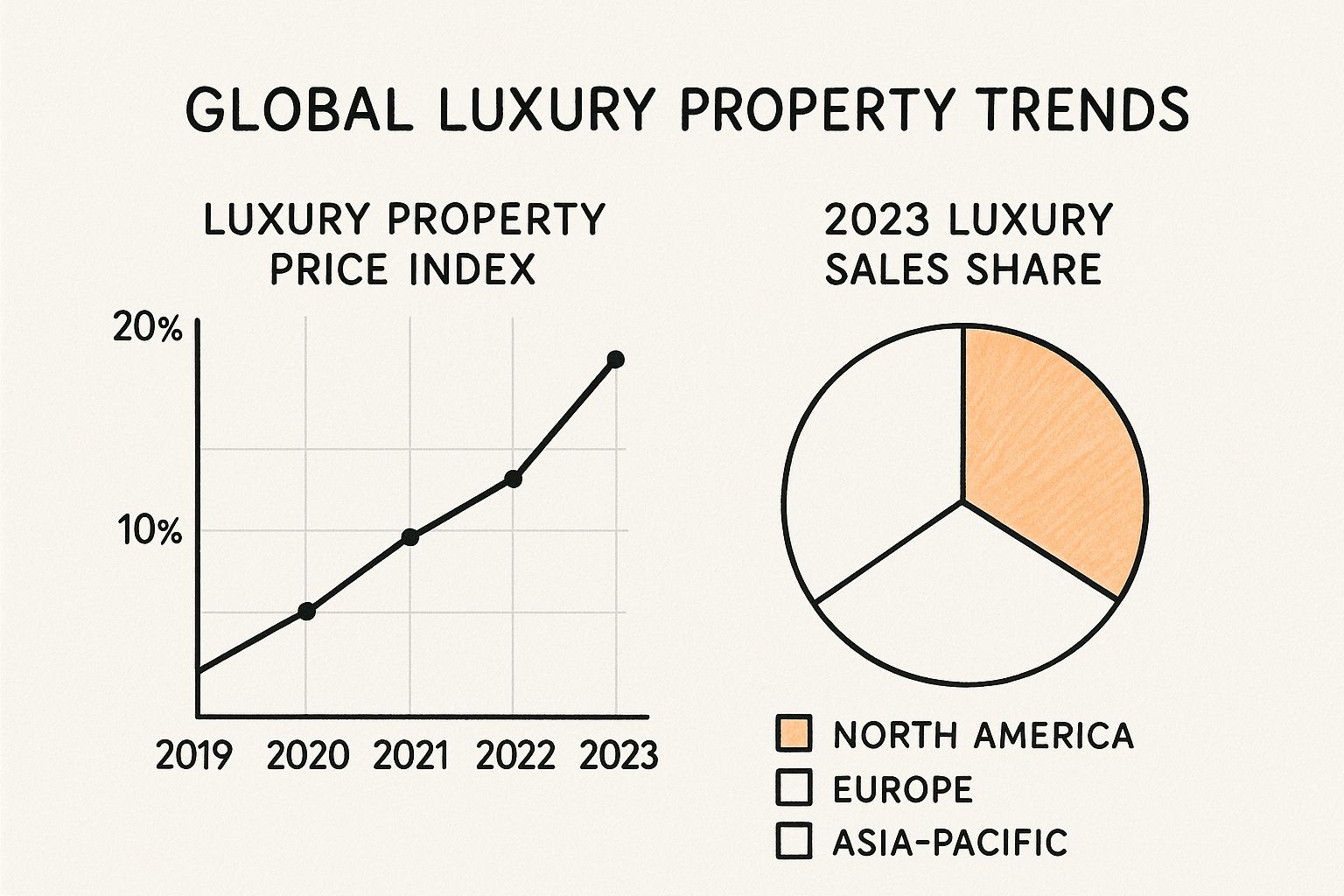

To give you a clearer picture, here's a quick snapshot of the market's key metrics.

Global Luxury Real Estate Market Snapshot

This table summarizes the core financial data and primary forces shaping the high-end property sector worldwide.

| Metric | Value/Forecast | Key Driver |

|---|---|---|

| Market Value (2023) | USD 289.6 Billion | Strong demand from HNWIs seeking stable assets. |

| Projected Value (2032) | USD 515.3 Billion | Continued global wealth creation and urbanization. |

| CAGR (2023-2032) | 6.5% | Increasing preference for tangible, inflation-hedged investments. |

| Key Buyer Segment | High-Net-Worth Individuals (HNWIs) | Focus on portfolio diversification and capital preservation. |

As you can see, the outlook is robust, pointing toward sustained interest and investment in top-tier properties.

This chart offers a great visual of recent price growth in the luxury sector and shows where the sales are happening.

The data clearly illustrates a steady climb in property values, reinforcing just why this market is seen as such a reliable haven for capital.

A Story of Stability and Aspiration

When you boil it all down, the story of today's luxury real estate market is one of confidence. It’s about investors wanting assets they can actually see and touch—properties that serve as both a personal sanctuary and a solid financial anchor. As we'll get into, this powerful mindset is completely reshaping what buyers expect, from the wellness-focused amenities in Singapore developments like UPPERHOUSE at Orchard Boulevard to the eco-conscious designs of modern European villas.

What Modern Luxury Home Buyers Want

To really get a grip on today's luxury real estate market, you have to look past the price tags and understand what makes affluent buyers tick. The very definition of a "trophy" property has changed. It's no longer just about prestige; buyers now expect a home that genuinely improves their quality of life.

The modern luxury home is a sanctuary, a private escape from the hustle of the outside world. This isn't some passing fad. It’s a deep-seated shift in what buyers demand, moving from a nice-to-have feature to an absolute must-have.

This change is pushing developers to get creative, especially in top-tier urban centers like Singapore. They're not just selling square footage anymore. They're selling a complete lifestyle, one that's designed to meet the unspoken needs of a sophisticated, global clientele.

The Rise of Wellness and Sustainability

One of the biggest trends we're seeing is a laser focus on personal wellness built right into the home. Picture a private, five-star spa that you never have to leave. This is worlds away from a spare room with a treadmill in the corner.

High-end buyers are now asking for features that used to be considered niche but are now seen as standard. These in-demand amenities include:

- Spa-Grade Bathrooms: Think expansive rooms with steam showers, hydrotherapy tubs, and finishes that feel like they belong in a world-class wellness retreat.

- Advanced Air and Water Filtration: Cutting-edge systems that guarantee the home's internal environment is pure and healthy.

- Dedicated Wellness Spaces: It's becoming more and more common to see private yoga studios, quiet meditation rooms, and even dedicated massage suites.

Today’s luxury buyer views their home as the ultimate investment in their health. The property must not only be beautiful but also actively contribute to a healthier, more balanced lifestyle. This is a core driver of value in the current market.

This mindset naturally extends to sustainability. Eco-friendly design isn't just for a small group anymore; it's become a new kind of status symbol. Buyers are actively looking for properties built with responsibly sourced materials, energy-saving systems, and a lighter environmental footprint. This all points to a larger cultural shift towards more conscious living among the wealthy.

Seamless Technology and Sophisticated Spaces

Right alongside wellness, smart-home technology has become a given. Affluent buyers want to control their entire environment—lighting, climate, security, entertainment—effortlessly, usually from a single, beautifully designed app.

This tech-forward approach is also changing how living spaces are designed. Open-plan layouts are being tweaked to create distinct, multi-purpose zones for both work and play. It's crucial to understand exactly what these buyers want, from integrated tech to sophisticated and spacious areas that include elegant luxury kitchen design ideas.

A chef's kitchen, for instance, isn't just a place to cook. It's the heart of the home for socializing—a showpiece of high-end design and function, often decked out with custom cabinetry and professional-grade appliances.

Why Real Estate Remains A Safe Haven Asset

When the economy gets choppy, you’ll see savvy, affluent buyers start to shift their financial game plan. They’re no longer chasing speculative gains; they’re looking for stability. And that’s where luxury real estate has always stood out. This isn’t just about buying a beautiful home. It’s a deliberate, strategic move to anchor wealth in a tangible asset that has a long history of holding its value, especially when stock markets are volatile and inflation is eating away at cash.

Think of it as a financial anchor in a storm. While stocks and bonds can swing wildly with every news headline, a prime property in a world-class location like Singapore’s Orchard Road provides a very real sense of permanence. This stability is a massive driver behind many of the current luxury real estate market trends, as high-net-worth individuals (HNWIs) double down on preserving their capital.

This thinking is changing how deals get done. Instead of taking on significant debt, we're seeing more and more luxury buyers making all-cash purchases. It’s a direct way to insulate their investment from the risks of fluctuating interest rates. An all-cash deal isn't just a transaction; it's a powerful statement of belief in the property's long-term worth.

The Psychology of Tangible Wealth

There’s something deeply ingrained in us that trusts what we can see and touch, and this absolutely applies to investing. A stock portfolio or a cryptocurrency balance is, at its core, an abstract number on a screen. A luxury residence, on the other hand, is a physical reality. It's a place of comfort and security that you can experience, which also happens to be a very solid financial instrument.

This psychological comfort is a powerful, and often underestimated, factor in the market. It gives owners a sense of control that the financial markets simply can't offer. For many HNWIs, building a portfolio of exceptional properties in key global cities is a cornerstone of their strategy for creating generational wealth. These are assets that are far less likely to be wiped out by the kind of short-term panic that can decimate fortunes elsewhere.

A recent report from luxury property specialists highlighted a fascinating trend: 68% of their affluent clients either held firm or added to their real estate portfolios during recent economic shifts. What’s even more telling is that 96% of these specialists reported that the preference for all-cash deals was either steady or increasing.

These numbers tell a clear story about the enduring faith in property as a safe harbor for capital. Affluent buyers aren't just sitting back and hoping for the best; they are actively using luxury real estate to build a fortress around their financial futures. You can dive into more details on these buyer trends to see just how resilient this segment of the market is.

Real Estate as an Inflation Hedge

Beyond just being stable, prime real estate is also one of the most effective hedges against inflation. It works in a few straightforward ways:

- Rising Rents: As the general cost of living goes up, so does rental income. This creates a cash flow that naturally adjusts and keeps pace with inflation.

- Appreciating Asset Value: Over the long term, property values tend to rise, often outpacing the rate of inflation. This protects the owner’s real purchasing power.

- Fixed Costs: If an owner does have a mortgage, the monthly payment is typically fixed. This means their biggest cost stays the same while the property's value and potential rental income continue to grow.

Seen through this lens, a development like UPPERHOUSE at Orchard Boulevard is far more than just a prestigious address. It represents a shrewd investment in a globally recognized hub, offering a powerful defense against economic uncertainty while delivering an unparalleled quality of life.

A Closer Look at the North American Market

If you want to see these global trends play out in real-time, North America is the perfect case study. Its mature markets are often a bellwether for what's coming next, giving us a clear window into the mindset of today's affluent buyers and sellers. What we’re seeing right now is fascinating: both sales and the number of homes for sale are on the rise.

That might sound like a contradiction, but it’s actually the sign of a healthy market finding its equilibrium. For months, we saw fierce competition as demand completely overwhelmed the available supply. Now, homeowners are seeing that buyer interest is still strong and prices are holding up, giving them the confidence to finally list their properties. This is injecting much-needed energy and creating a more active, fluid marketplace for everyone.

The numbers really tell the story. In early 2025, the North American luxury market saw an impressive 17.6% jump in single-family home sales compared to last year. High-end condo sales weren't far behind, climbing 12.7%. This surge in demand was met by a 14.4% increase in the inventory of luxury single-family homes, confirming that more sellers are indeed stepping off the sidelines. For a more granular look, you can explore the complete North American market report.

Two-Speed Markets in Major Hubs

This renewed energy isn't spread evenly across all price brackets. In key hubs like Miami, Toronto, and New York, we’re witnessing a distinct market polarization.

Imagine the market as a highway with two separate lanes, each moving at a very different pace.

The Ultra-Luxury Express Lane: This is where the "trophy" properties live—the one-of-a-kind penthouses, sprawling estates, and architecturally iconic homes. This lane is moving fast, fueled by ultra-high-net-worth individuals who often make all-cash offers and are largely insulated from interest rate hikes. For them, it’s about acquiring a rare asset, not just a home.

The Entry-Level Luxury Lane: This segment, filled with beautiful but more conventional high-end properties, is much more attuned to the broader economy. Buyers here are more likely to need financing, so they tend to be more cautious when borrowing costs are high.

This split means that while a unique waterfront mansion in Miami might trigger a bidding war, a standard (yet still luxurious) condo in the same city could sit on the market longer and see more price negotiation.

This divergence creates a complex environment, but one that’s full of opportunity. Local policies add another layer of complexity. Tax incentives in one city can pull buyers from another, just as a zoning change can transform a neighborhood's appeal overnight. It’s a powerful reminder that even in a globally connected world, all real estate is, and always will be, local.

It’s one thing to talk about market trends in the abstract, but it’s another to see them come alive in steel and glass. Let's take a closer look at a real-world example that perfectly captures the new wave of luxury living: UPPERHOUSE at Orchard Boulevard in Singapore. This development isn't just another block of expensive flats; it’s a direct answer to what today’s most discerning buyers are actually looking for.

Think of it as the ultimate urban sanctuary, meticulously planned from the ground up. The developers, UOL Group, clearly get it. They know wealthy buyers aren't just buying square footage or a fancy postcode anymore. They're investing in a lifestyle—one that marries a world-class location with a sense of peace and well-being. This is precisely the kind of thinking that’s shaping luxury real estate market trends all over the globe.

By examining what makes UPPERHOUSE tick, we can see exactly how developers are rising to meet—and even exceed—these new expectations.

The Fusion of Location and Lifestyle

Location has always been the golden rule in real estate, but today's definition of a "prime" spot has evolved. UPPERHOUSE nails this new standard. Nestled in Singapore's most sought-after district, it puts residents on the doorstep of Orchard Road's designer boutiques, exclusive art galleries, and Michelin-starred restaurants. But it’s not just about the buzz. It's also a stone's throw from the lush, tranquil expanse of the Singapore Botanic Gardens, a UNESCO World Heritage Site.

This isn't a happy accident; it's a deliberate strategy. It speaks directly to the modern high-net-worth individual's desire for a life that is both plugged-in and peaceful. This positioning gives residents the best of both worlds:

- Vibrant Urban Access: The city's finest shopping and entertainment are just steps away.

- Tranquil Green Escapes: A natural haven is always within reach for de-stressing and unwinding.

- Effortless Connectivity: The Orchard Boulevard MRT station is a mere 14 metres away, making travel across the city incredibly simple.

This blend of dynamic city life with natural tranquility isn't just a nice-to-have; it's a core part of what defines luxury today. It shows a profound understanding that for the modern elite, the greatest luxuries of all are time and convenience.

Curated Amenities for Holistic Wellbeing

Of course, a great location is just the beginning. UPPERHOUSE truly sets itself apart by embracing the wellness trend, offering a collection of amenities that feel less like a standard condo facility and more like a private, five-star resort.

For example, "The Botanical Villa"—a private wellness hub featuring a hydropool and spa facilities—is a direct response to the growing demand for built-in health and relaxation sanctuaries. Other thoughtful touches, like the stunning infinity pool with sweeping city views and the sophisticated residents' lounge, are designed to build a sense of community while offering exclusive spaces for entertaining or quiet reflection. You can explore how these features come together by learning more about the unique offerings of UPPERHOUSE.

In the end, this project is far more than just bricks and mortar. It’s a carefully crafted environment that perfectly aligns with the lifestyle goals of the global elite, turning abstract market trends into something you can see, touch, and experience.

What's Next for Luxury Real Estate Investing?

Looking toward the horizon, the very definition of a prime luxury property is being rewritten. Of course, a prestigious address and stunning design will always be the bedrock of high-end real estate. But a new layer of expectations is emerging, driven by powerful market shifts and evolving investor priorities. It's no longer just about owning a luxury asset; it's about owning the right one for the future.

Two trends, in particular, are reshaping the scene. First is the explosion of branded residences. Think of it as a five-star hotel experience seamlessly integrated into your home, where a world-class brand lends its name, management, and signature services to a residential development. This gives buyers a turnkey lifestyle and a built-in layer of trust that often leads to higher resale values.

At the same time, ESG (Environmental, Social, and Governance) principles have moved from a niche concern to a central pillar of smart investing. Today’s high-net-worth individuals, especially the next generation inheriting wealth, want their portfolios to reflect their values. They're actively looking for homes that are sustainable, energy-efficient, and part of a community that's managed with social responsibility in mind.

How to Read the Current Market Signals

Recent market data paints a fascinating picture that savvy investors should be watching. A mid-year 2025 report revealed a significant jump in the number of high-end properties for sale, hitting a two-year inventory peak. Listings for single-family luxury homes shot up by 40.4%, and attached properties like condos weren't far behind with a 42.6% increase.

You might think that more supply would soften prices, but that's not what happened. Despite the surge in available homes, the median sold price for luxury properties actually climbed 8.0% compared to 2023. You can dig deeper into these inventory and pricing trends in the complete analysis.

This unusual dynamic—rising inventory alongside strengthening prices—tells us the market is maturing, not weakening. More choice might give buyers a bit more room to negotiate, but the fundamental demand is clearly strong enough to keep asset values on an upward trajectory.

Navigating this complex environment requires more than just a surface-level view. To stay ahead of the curve, it’s wise for investors to keep tabs on the full spectrum of emerging trends in real estate investment. Understanding these shifts is what separates a good investment from a great one, helping you pinpoint properties like UPPERHOUSE at Orchard Boulevard that aren't just exceptional today but are also perfectly aligned for what comes next.

Frequently Asked Questions

What Defines A Property As Luxury Today?

It's easy to think a big price tag is all it takes, but true luxury in today's market goes so much deeper. It’s really a blend of several key ingredients: a prime location, world-class design and build quality, genuinely exclusive amenities, and a profound sense of privacy and security.

But the definition has evolved. Now, it's also about a property's contribution to your well-being. Think about features like state-of-the-art air and water filtration systems, fully integrated smart home technology, and the use of sustainable, high-quality materials. It’s less about raw square footage and more about the curated lifestyle experience on offer—a defining trend we're seeing across the luxury real estate market.

How Is Technology Changing Luxury Real Estate?

Technology isn't just a gimmick anymore; it's a fundamental force shaping the high-end property market. For homeowners, this means sophisticated smart home systems that put control of lighting, climate, security, and entertainment right at your fingertips.

For developers and agents, it's about using tools like virtual reality (VR) to create stunningly immersive property tours that you can take from anywhere in the world. Technology is smoothing out the rough edges, making the process of buying and the experience of living more intuitive and personalized for today's discerning buyer.

Branded residences—luxury homes tied to a prestigious hotel or lifestyle brand like the Ritz-Carlton—are widely seen as a solid investment. While they often carry a price premium, they provide a true turnkey lifestyle with access to five-star hotel services and professional management.

This brand association tends to drive higher rental income and more robust resale values. The name itself is a promise of quality and prestige that attracts affluent buyers from all over the globe, making it a trend well worth watching.

Discover a new standard of living that embodies these modern trends. UPPERHOUSE at Orchard Boulevard offers an exclusive urban sanctuary in the heart of Singapore, combining world-class design, wellness-focused amenities, and unmatched connectivity. Explore your future home at https://upperhouse.luxurycondo.sg.

Related Articles

Interested in UPPERHOUSE?

Discover luxury living at UPPERHOUSE at Orchard Boulevard. Get exclusive updates and be the first to know about availability.