Your Guide to Condo for Sales in Singapore – Find the Best Deals

Explore condo for sales in Singapore with our expert guide. Discover top properties, market insights, and tips to make your investment successful.

Thinking about buying a condo in Singapore? You're looking at one of the world's most impressive real estate markets, known for its stability, luxury, and solid growth potential. It’s a dynamic scene, with everything from sleek city-center pads to quiet, leafy suburban retreats on offer, each fitting a different lifestyle and investment plan.

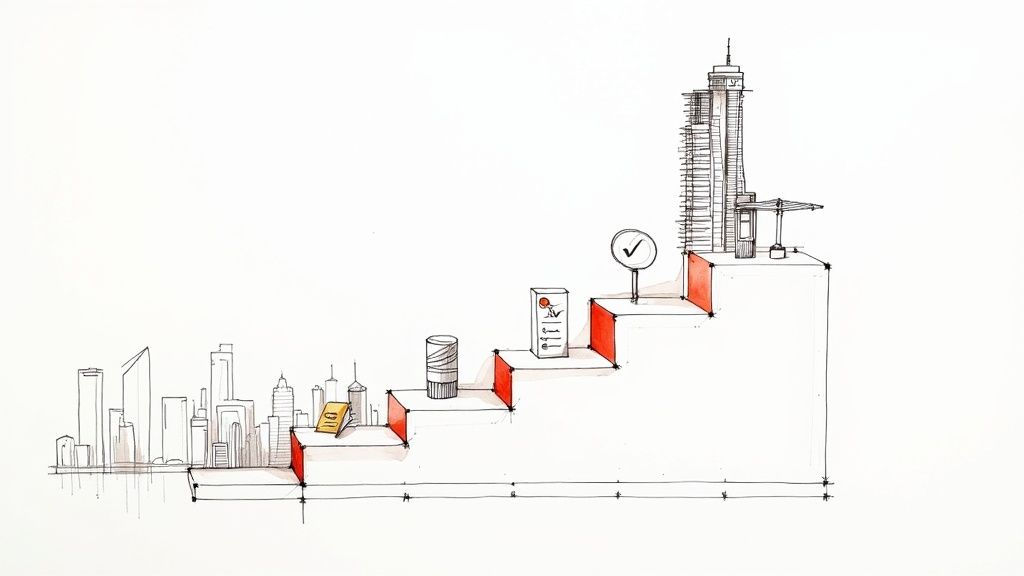

Why Singapore Is Such a Hotspot for Condos

Diving into Singapore's condo market is a unique experience. It's a highly organized, premium ecosystem built on a bedrock of strong economic fundamentals, transparent government oversight, and a global reputation for an incredible quality of life. This powerful combination makes it a magnet for both Singaporeans and international investors seeking a safe-haven asset.

What sets Singapore apart from more unpredictable markets is its long-term stability. The government actively manages the property sector to encourage sustainable growth, which gives buyers a rare sense of confidence that their investment is shielded from wild, speculative swings.

The Forces Driving the Condo Market

So, what keeps the demand for condos in Singapore so consistently high? A few core factors are always at play, and understanding them is the first step to making a smart purchase.

- A Powerhouse Economy: As a global financial hub, Singapore attracts a constant flow of skilled professionals and high-net-worth individuals from around the world—and they all need a place to live.

- Rock-Solid Stability: The country's secure and predictable political environment makes it a safe bet for significant, long-term investments like real estate.

- Supportive Policies: While the government has cooling measures to curb speculation, the overall legal framework is designed to protect property owners' interests.

- Incredible Infrastructure: Think world-class public transport, top-ranked schools, and cutting-edge healthcare. This level of convenience makes condo living exceptionally appealing.

This unique mix ensures that finding a condo for sales in Singapore remains a top priority for many.

What's Happening in the Market Right Now?

The market never really sleeps. Even with global economic uncertainties, it has shown remarkable resilience. The latest numbers tell the story: in the first quarter of 2025, developers moved around 3,379 new private homes, holding steady with the previous quarter. Much of this action—about 66% of sales—was in the Outside Central Region (OCR), proving that demand is strong across the board, not just in prime central districts. You can get a deeper analysis of the market's performance from the experts at She Real Estate.

This steady sales volume speaks volumes about the deep-seated confidence people have in Singapore property. It's clear proof of the city-state's lasting appeal as a premier destination to live, work, and invest.

Ultimately, getting a feel for these fundamentals is key to successfully navigating the market. It helps you make sense of price movements, weigh your options, and spot the opportunities that truly match your goals.

Decoding Condo Price Trends and Market Dynamics

Figuring out the true value of a condo for sales in Singapore involves looking at more than just the asking price. Think of the property market as a living, breathing ecosystem. Things like government cooling measures, a wave of new property launches, or a new MRT line are like shifts in the weather—they can all impact the health and growth of the market.

To really get a feel for what's happening, you have to break Singapore down into its three distinct property regions. Each one has its own personality, its own price point, and its own type of buyer.

Unpacking The Three Key Regions

Singapore’s private property market is generally split into three zones, and each one dances to a slightly different economic beat.

- Core Central Region (CCR): This is the top tier. We're talking about prime areas like Orchard, Newton, and Sentosa. Properties here are often seen as luxury assets, attracting high-net-worth individuals and international investors.

- Rest of Central Region (RCR): Think of this as the bridge between the city core and the suburbs. It includes city-fringe neighbourhoods like Queenstown, Bishan, and Paya Lebar. These condos are a huge hit with professionals and families wanting to be close to the action without the CCR price tag.

- Outside Central Region (OCR): This is the largest slice of the market, covering the suburban heartlands—places like Tampines, Jurong, and Woodlands. The OCR is primarily driven by local demand, especially from HDB dwellers looking to upgrade to a larger family home.

Knowing which region a condo sits in is your first step to understanding its price trends and future potential. What drives prices in the OCR is a world away from what moves the needle in the CCR. For a closer look at what makes each region tick, check out our guide to finding the right https://upperhouse.luxurycondo.sg/blog/singapore-condominium-for-sale.

Current Market Pulse And Recent Data

The Singapore condo market has been remarkably resilient, weathering global economic storms with steady, if moderate, growth. The latest figures from the Urban Redevelopment Authority (URA) back this up. In the first quarter of 2025, the overall Property Price Index for private homes edged up by 0.81% from the previous quarter, which translates to a 3.33% rise year-on-year.

Drilling down further, non-landed private condominiums specifically saw a 0.95% price bump. This tells us buyer confidence is still strong, though the market is moving at a more sensible pace than in previous years. You can find more details in these Singapore property price trends on Global Property Guide.

This kind of data points to a market that’s maturing, not overheating—a stable and reassuring environment for anyone looking to buy.

A market showing moderate, sustained growth is often a much healthier sign than one with wild, speculative spikes. It suggests that prices are backed by genuine demand and solid economic fundamentals, which is exactly what a long-term investor wants to see.

To make this data easier to digest, here’s a quick breakdown of the key numbers from the last quarter.

Singapore Private Condo Market Snapshot Q1 2025

The table below provides a quick summary of key price and sales metrics for non-landed private residential properties, illustrating the market's recent performance.

| Metric | Q1 2025 Value | Comparison |

|---|---|---|

| Overall Price Index Change (QoQ) | +0.81% | Slower growth vs. Q4 2024 |

| Non-Landed Condo Price Change (QoQ) | +0.95% | Slower growth vs. Q4 2024 |

| New Private Home Sales (Units) | Approx. 3,379 | Stable compared to Q4 2024 |

| Top Performing Region (Sales Volume) | Outside Central Region (OCR) | Accounted for ~66% of new sales |

| Year-on-Year Price Growth | +3.33% | Indicates solid long-term appreciation |

What this snapshot clearly shows is that while the pace of price growth has cooled a bit, demand is still very much alive, especially in the OCR. This region continues to be the engine of the market, driven by local buyers upgrading their homes and looking for good value. By keeping an eye on these trends, you'll be in a much better position to judge the true value and potential of any condo that catches your eye.

Your Step-by-Step Guide to the Purchase Process

So, you're ready to find the perfect condo for sale in Singapore? It's an exciting journey, but it’s less about whirlwind viewings and more about a structured series of financial and legal steps. Think of it as a clear roadmap with checkpoints that protect everyone involved. Knowing this path removes the guesswork and lets you move forward with real confidence.

First Things First: Get Your Finances in Order

Before you even dream of infinity pools and skyline views, your very first stop should be the bank. The single most important first step is getting an Approval-in-Principle (AIP). This is basically a bank’s promise to lend you a specific amount of money, which instantly defines your real-world budget.

An AIP isn't just a number—it’s your ticket to being taken seriously. When you make an offer with an AIP in your back pocket, sellers know you're not just a window shopper. You’re a qualified buyer, ready to act. It also saves you the potential heartbreak of falling in love with a place you can't actually afford.

Locking Down Your Dream Unit

Found the one? Great! Now it's time to make it official with an Option to Purchase (OTP). This is a legally binding agreement that essentially reserves the property for you. It gives you the exclusive right to buy the unit at an agreed price, usually for a period of 14 days.

To get the OTP, you'll need to pay an option fee, which is almost always 1% of the purchase price. Keep in mind, this fee is your skin in the game—if you walk away, you forfeit it.

You can think of the OTP as putting a "reserved" sign on your future home. It takes the property completely off the market, giving you breathing room to sort out your loan and legal work without pressure.

During this two-week window, your lawyer starts their conveyancing work, digging into the property's legal health. At the same time, you'll take the OTP back to your bank to formally lock in your home loan.

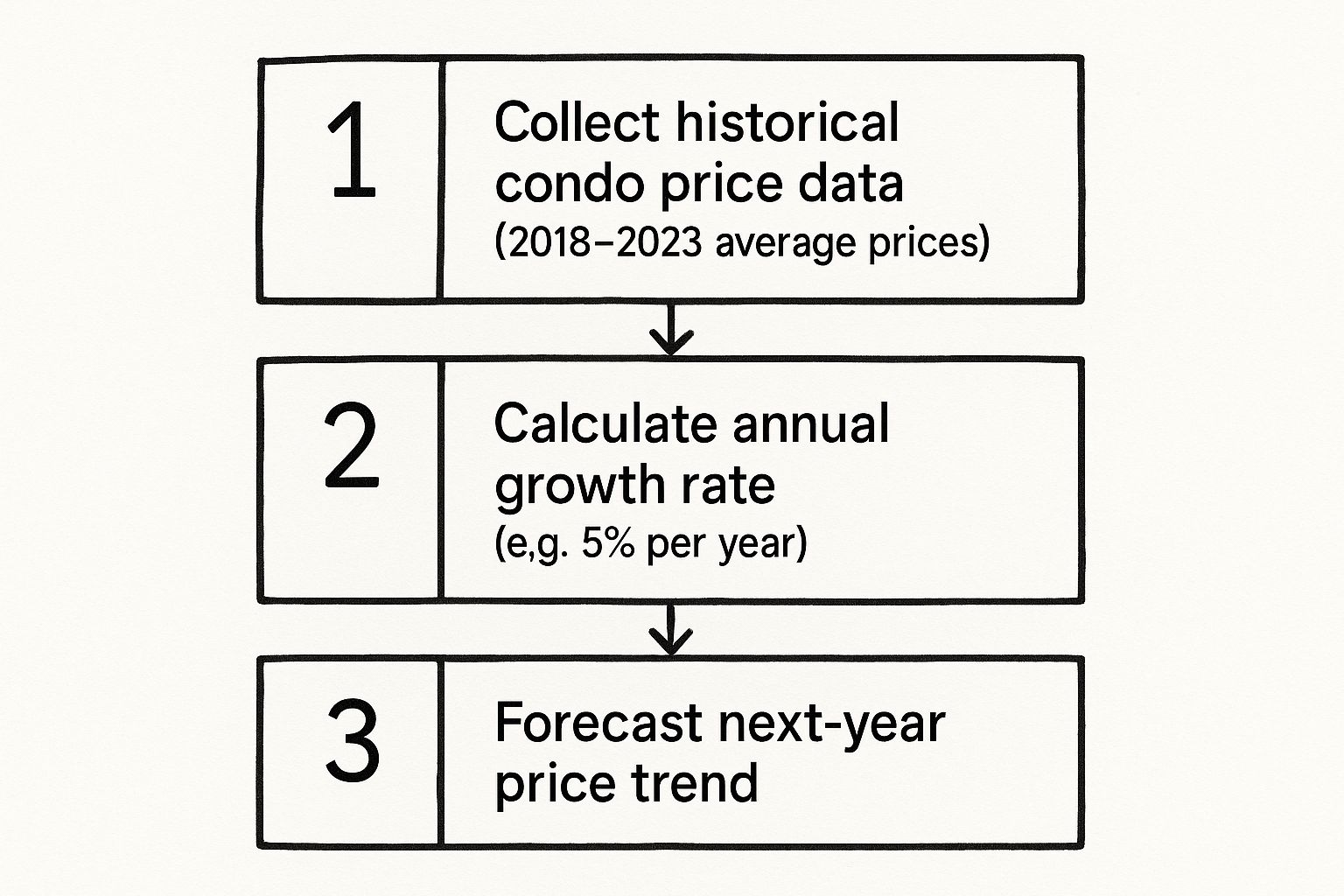

The infographic below shows how historical price trends can be used to analyze the market—something savvy buyers keep an eye on.

This kind of data modeling helps predict future market movements by looking at consistent growth patterns from the past.

Understanding the Financial Guardrails

Before you sign on the dotted line to exercise your option, you need to be crystal clear on two key government regulations that shape every property loan in Singapore.

- Loan-to-Value (LTV) Ratio: This sets the ceiling on how much you can borrow. For your first property loan, the bank can typically only finance up to 75% of its value. The rest is on you.

- Total Debt Servicing Ratio (TDSR): This is a stress test to make sure you're not borrowing more than you can handle. All your monthly debt payments (your new mortgage, car loans, credit cards, etc.) can't add up to more than 55% of your gross monthly income.

These rules aren't there to make life difficult; they're in place to keep the market stable and protect buyers from getting in over their heads.

To finalize the purchase, you’ll exercise the OTP by paying the rest of the down payment, which is usually another 4% of the price. This goes into your lawyer's secure conveyancing account.

Don't Forget the Stamp Duties

A huge chunk of your upfront costs will be government taxes, or "stamp duties." There are two you absolutely must budget for.

The first is the Buyer's Stamp Duty (BSD). Everyone pays this. It's a tax on all property purchases, calculated on a tiered scale based on the home's price.

The second, and potentially much larger, is the Additional Buyer's Stamp Duty (ABSD). This tax applies if you're a Singapore Citizen buying a second property, or if you're a Permanent Resident or foreigner. The rates can be steep and depend entirely on your residency status and how many properties you already own. For a deep dive, check out our comprehensive guide on Additional Buyer's Stamp Duty.

Once the duties are paid and the lawyers have done their thing, the final countdown begins. The entire process typically takes about 8 to 12 weeks to complete. On completion day, funds are transferred, the keys are handed over, and the condo is officially yours. Welcome home.

Choosing Between New Launch, Resale, and Sub-Sale Condos

When you start looking for a condo for sale in Singapore, you'll quickly find yourself navigating three main options: new launches, resale units, and sub-sales. Each path is completely different, with its own set of pros and cons when it comes to timing, cost, and what you get for your money. Getting a firm grip on these differences is the first step to making a smart purchase that fits your life and your finances.

A great way to think about it is like buying a car. A new launch is like ordering a brand-new model straight from the factory. You get to pick your specifications, but you have to wait for it to be built. A resale condo is like buying a used car—it has a history, but it’s ready to drive off the lot today. Then you have the sub-sale, which is a unique middle ground. It's like buying a nearly-new car from someone who ordered it but needs to sell before taking delivery.

This decision sets the tone for your entire home-buying journey, from how you'll pay your down payment to the moment you finally hold the keys in your hand.

What Are The Three Condo Categories?

Let's quickly unpack what these terms actually mean on the ground in the Singapore property market.

- New Launch Condos: These are apartments sold directly by the property developer, often before construction has even finished. You're buying based on showflat models, floor plans, and artist's impressions, which means you'll have to wait a few years for the building to be completed.

- Resale Condos: Simply put, these are units in completed buildings that have been lived in before. You buy from the current owner, and once the paperwork is done, you can move in almost immediately.

- Sub-Sale Condos: This one is a bit more specific. It happens when the first buyer of a new launch unit decides to sell their contract to someone else before the project gets its Temporary Occupation Permit (TOP). The new buyer effectively steps into the original buyer’s shoes and takes over the purchase.

Each of these options appeals to a different kind of buyer. It all comes down to whether you prioritize the thrill of a brand-new home, the convenience of a move-in-ready unit, or the opportunity to snag a spot in a sold-out project.

Comparing The Core Considerations

Your decision will almost certainly hinge on a few key things: your budget, how urgently you need a place to live, and your appetite for renovations.

Resale condos, for example, offer the major advantage of being ready for immediate occupancy. But this often comes with a hidden cost—you might need to spend a significant amount of money and time overhauling an older interior.

On the flip side, new launches give you a pristine, untouched home with the latest facilities. The trade-off? A multi-year wait where you're living with floor plans and renders, not a physical space. The second quarter of 2025 saw a dip in new home sales, with the number of transactions falling 66.1% to 1,124 units. However, the market isn't standing still; a pipeline of 15 new private home launches is slated for later in the year. You can dive deeper into these figures in this detailed property market report.

A crucial point for sub-sales is the Seller's Stamp Duty (SSD). If the original owner sells within three years of buying, they get hit with a hefty tax. This cost is almost always passed on to the new buyer in the asking price, so be prepared for it.

Weighing these factors is essential. A side-by-side comparison can really help bring everything into focus.

New Launch vs. Resale vs. Sub-Sale Condo Comparison

To make this decision easier, it helps to see how these three options stack up against the factors that matter most to homebuyers. The table below breaks it down for a clear, head-to-head comparison.

| Factor | New Launch Condo | Resale Condo | Sub-Sale Condo |

|---|---|---|---|

| Move-In Timeline | Long wait (2-4 years) for construction to complete. | Immediate occupancy after the sale is finalized. | Shorter wait than a new launch, but depends on the project's construction stage. |

| Condition | Brand new, with a one-year defects liability period. | Varies greatly; may require extensive renovation. | Brand new upon completion, but without a direct developer warranty for the sub-sale buyer. |

| Pricing | Often includes "early-bird" discounts; prices may rise in later phases. | Based on current market valuation; more room for negotiation. | Price is set by the original owner and can include a premium for desirable units. |

| Payment Schedule | Progressive payment scheme, spreading payments over the construction period. | Upfront down payment and immediate mortgage commencement. | Takes over the original buyer's payment schedule; may require more initial cash. |

So, what's the verdict? It really comes down to your personal situation. If you aren't in a rush and love the idea of a fresh start, a new launch is a fantastic option. If you need a home now and don't mind putting in some work, resale is the way to go. And if you want a new unit without the full waiting period, a sub-sale could be the perfect sweet spot—as long as you understand the unique financial strings attached.

A Deep Dive into Luxury Living: UPPERHOUSE Orchard

All this talk about the Core Central Region (CCR) and prime real estate can feel a bit theoretical. So, let's ground these ideas in a real-world example that perfectly captures what "luxury" and "location value" truly mean: UPPERHOUSE at Orchard Boulevard. It’s an ideal case study for understanding what a top-tier condo for sales in singapore delivers.

This isn't just another apartment building; it's a meticulously crafted lifestyle. Located just a stone's throw from the iconic Orchard Road shopping belt, UPPERHOUSE puts its residents right in the heart of Singapore's best dining, shopping, and culture. This is what a "prime location" looks like in reality—absolute convenience with a prestigious postcode.

The Power of a Prime Address

An address on Orchard Boulevard offers so much more than just a convenient place to live. It's a globally recognized benchmark of status and provides a level of connectivity that few other locations can match.

- Unrivaled Accessibility: The Orchard Boulevard MRT station is a mere 14 metres away, putting the entire city at your fingertips.

- A World of Amenities: You're literally surrounded by Michelin-starred restaurants, flagship designer stores, and exclusive art galleries.

- Green Sanctuary: Even with all this urban energy, you’re only a short stroll from the tranquility of the Singapore Botanic Gardens, a UNESCO World Heritage Site. It's the perfect blend of city buzz and natural calm.

This trifecta—connectivity, amenities, and green space—is what makes an address like this so compelling for homeowners and savvy investors alike.

Beyond the Location: Architecture and Amenities

As important as location is, the true feeling of luxury comes from the property itself. UPPERHOUSE was conceived as an exclusive urban retreat, a peaceful haven floating above the city's hustle and bustle. The architecture itself is designed to maximize privacy and elegance, complete with an infinity pool offering sweeping panoramic views of the city.

The interiors are just as thoughtfully designed. Every residence, whether it's a cozy one-bedroom or a sprawling four-bedroom suite with a private lift, is finished with an incredible eye for detail. These aren't just places to sleep; they are spaces designed to enhance your life. To complete such a magnificent space, many owners opt for pieces like custom luxury sofas and other bespoke furnishings that add a personal touch of class.

Living in a place like UPPERHOUSE is a game-changer. It’s the difference between just having a roof over your head and owning a home that actively improves your well-being and simplifies your day-to-day life.

This complete approach to design and lifestyle is what elevates properties like this to the next level. If you're curious to learn more about what makes this area so coveted, you can explore the unique appeal of an Orchard Road condo.

In the end, UPPERHOUSE is a perfect illustration of how all the pieces we've discussed—market trends, location, and what buyers really want—come together. It shows how a masterfully executed development in a prime district creates not just a home, but a legacy asset that represents the very pinnacle of Singapore's property market.

Making Your Final Decision with Confidence

https://www.youtube.com/embed/oHuJ7t7-Y30

Getting to this point in your search for the perfect condo for sales in Singapore is a huge achievement. You’ve navigated market trends, untangled the buying process, and learned the ins and outs of new launches versus resale properties. Now, it's time to bring all that knowledge together and make your final call with complete clarity.

Think of it like the final pre-flight check before taking off. You've already planned your destination and checked the weather; this is the moment to make sure every last detail is squared away. You're shifting from research mode to decision mode.

Your Final Due Diligence Checklist

Before you sign that offer, running through a final checklist is crucial. This isn't just about ticking boxes; it's about safeguarding your investment and making sure there are no unwelcome surprises waiting for you down the line.

- Scrutinize the Management Corporation Strata Title (MCST): Get your hands on the MCST's financial statements and recent meeting minutes. A well-run condo with a healthy sinking fund is a great sign that the property will hold its value and be a pleasant place to live.

- Conduct a Thorough Final Inspection: This is non-negotiable, whether you're buying a brand-new unit or a resale. Go beyond the surface-level cosmetics—test the water pressure, check every electrical outlet, and keep an eye out for any hints of deeper issues.

- Confirm Your Financing One Last Time: Circle back with your bank or mortgage broker. You want to be 100% sure your Approval-in-Principle (AIP) is still solid and you understand all the terms and conditions of your loan.

- Review the Sale and Purchase Agreement with a Lawyer: This is what lawyers are for! Have yours walk you through every single clause. Make sure you understand your obligations, the payment milestones, and any specific conditions attached to the deal.

Making a confident decision isn't about having a crystal ball—it's about replacing uncertainty with solid information. Every check you complete strengthens the foundation of your investment, ensuring your new home is a source of security and pride.

At the end of the day, buying a condo is a mix of head and heart. You've done the logical work and crunched the numbers. Now, trust the process and listen to that gut feeling. By taking these final steps, you can sign on the dotted line knowing you've made a truly well-informed choice for your new home in Singapore.

Your Condo Buying Questions, Answered

Alright, let's tackle some of the most common questions that pop up when you're on the home stretch of buying a condo. Getting these details straight is often the final step that gives you the clarity and confidence to make your move.

We'll clear up the confusion around eligibility, break down the real costs you'll face after you get the keys, and figure out exactly how much cash you need to have ready.

Who Can Actually Buy a Condo in Singapore?

This is probably the first question on everyone's mind. The good news is, the rules are pretty clear and are based on your residency status.

- Singapore Citizens (SCs): You're good to go. There are no restrictions on buying a private condo.

- Singapore Permanent Residents (PRs): You're in the clear too. PRs can purchase private condos without needing any special government approval.

- Foreigners: You can absolutely buy a condominium unit. The main restriction for foreigners is on landed properties, though an exception is made for the exclusive Sentosa Cove developments.

While almost anyone can buy, the amount of tax you pay—specifically, the stamp duties—varies dramatically depending on which of these categories you fall into.

What Are the Real Ongoing Costs of Owning a Condo?

Your financial commitment doesn't end once you've paid for the property. To avoid any surprises down the line, you need to budget for the regular expenses that come with condo living.

The main one is the monthly maintenance fee, often called MCST (Management Corporation Strata Title) fees. This is your share of the cost for keeping all the common areas—the pool, gym, gardens, and security—in pristine condition. Expect this to be anywhere from $300 to over $800 a month, depending on how luxurious the development is.

On top of that, all homeowners have to pay an annual property tax, which is based on the "Annual Value" (AV) of your unit as determined by the government.

A good way to think about maintenance fees is as your contribution to a collective fund that keeps the entire property running like a well-oiled machine. It not only ensures a great living environment but also directly protects the long-term value of your investment.

How Much Cash Do I Actually Need Upfront?

This is where the rubber meets the road. Knowing the exact cash you need to have on hand is crucial before you even start looking. For your first property loan, a bank will typically finance up to 75% of the condo's value. The other 25% is on you.

Here’s how that 25% down payment breaks down:

- A minimum of 5% must be paid in cash.

- The other 20% can be covered with either cash or funds from your CPF Ordinary Account (OA).

Remember, that's not all. You'll also have to pay for stamp duties (BSD and maybe ABSD) and legal fees. These are usually paid in cash first, though you may be able to get a reimbursement from your CPF later. Having a solid cash buffer is the most important first step in your buying journey.

Ready to see what premier living looks like? Discover the pinnacle of luxury and convenience at UPPERHOUSE at Orchard Boulevard. If a lifestyle defined by elegance and an unbeatable address is what you're after, we invite you to explore our bespoke residences today. Visit our official website at https://upperhouse.luxurycondo.sg.

Related Articles

Interested in UPPERHOUSE?

Discover luxury living at UPPERHOUSE at Orchard Boulevard. Get exclusive updates and be the first to know about availability.